AIG Q4 Earnings Beat Estimates on General Insurance Strength

American International Group, Inc. AIG reported fourth-quarter 2023 adjusted earnings per share of $1.79, which outpaced the Zacks Consensus Estimate by 12.6%. The bottom line jumped 31.6% year over year.

Operating revenues inched up 4.6% year over year to $12.7 billion in the quarter under review. The top line beat the consensus mark by 9.7%.

The strong quarterly results were aided by strong underwriting results in the International business and North America Personal Insurance business of the General Insurance unit and higher net investment income. However, the upside was partly offset by higher expenses as well as reduced sales of Variable Annuities in the Life and Retirement unit and lower financial lines premiums in the General Insurance.

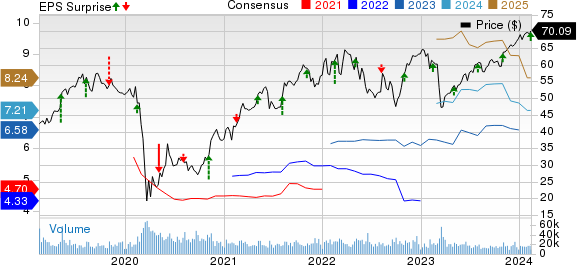

American International Group, Inc. Price, Consensus and EPS Surprise

American International Group, Inc. price-consensus-eps-surprise-chart | American International Group, Inc. Quote

Quarterly Operational Update

Premiums fell 9.9% year over year to $8.5 billion in the fourth quarter. Total net investment income of $3.9 billion climbed 20.7% year over year and beat the consensus mark by 11.7% and our estimate by 8.9%. The metric benefited on the back of improved reinvestment rates partially offset by lower alternative investment income.

Total benefits, losses and expenses of American International inched up 0.7% year over year to $11.2 billion. The increase was due to a rise in policyholder benefits and losses incurred.

Adjusted return on common equity of 9.4% improved 190 basis points (bps) year over year in the quarter under review.

AIG completed two secondary offerings of Corebridge in the fourth quarter of 2023, reducing its stake to 52.2%. AIG expects to complete the deconsolidation of Corebridge in 2024.

Segmental Performances

General Insurance

Net premiums written amounted to $5.8 billion in the fourth quarter, which grew 2.6% year over year. The metric was aided by rate increases, strong retention rates and new business growth in Lexington and Global Specialty. However, the metric lagged the Zacks Consensus Estimate by 16.7%.

Underwriting income increased 1.1% year over year to $642 million in the quarter under review, attributable to strength in International Commercial lines and Personal insurance. Catastrophe losses totaled $122 million, down from $248 million a year ago. The unit’s combined ratio of 89.1% improved 80 bps year over year due to an improvement in the loss ratio.

Adjusted pre-tax income was $1.4 billion, which soared 18.6% year over year and surpassed the consensus mark by 8.8% and our estimate by 10.2%. The metric was driven by improved underwriting income, lower catastrophe-related charges and higher net investment income.

Life and Retirement

The segment’s premiums and fees were recorded at $3.2 billion in the fourth quarter, which increased 13.6% year over year. Premiums improved due to improved pension risk transfer volumes. Premiums and deposits advanced 20.3% year over year to $10.6 billion.

Adjusted revenues of the unit were $6 billion, which improved 13.9% year over year in the quarter under review and surpassed the Zacks Consensus Estimate by 24.2%.

The unit reported an adjusted pre-tax income of $957 million, which rose 12.3% year over year on the back of higher base portfolio yields, partially offset by higher mortality in life insurance and reduced alternative asset income. The metric beat the consensus mark by 1.1%.

Financial Position (as of Dec 31, 2023)

American International exited the fourth quarter with a cash balance of $2.2 billion, which improved from $2 billion at 2022-end. Total assets of $539.3 billion improved from $522.2 billion at 2022-end.

Short and long-term debt amounted to $19.8 billion, down from $21.3 billion at 2022-end.

Total equity of $51.3 billion increased from $43.5 billion at 2022-end. Total debt and preferred stock to total capital was 28.5% at the fourth-quarter end.

Adjusted book value per share was $76.65, which grew 1% year over year in the quarter under review.

Capital Deployment Update

American International rewarded shareholders with $1 billion in repurchases and dividends worth $256 million.

Full-Year Update

American International’s 2023 total revenues of $46.8 billion decreased from $54.5 billion in 2022. However, adjusted earnings of $6.79 per share improved from $5.12 a year ago. Total benefits, losses and expenses increased to $42.9 billion in 2023 from $40.2 billion in 2022. Net income declined to $3.9 billion from $11.3 billion a year ago.

Zacks Rank

American International presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported fourth-quarter 2023 results so far, the bottom-line results of CNO Financial Group, Inc. CNO, Radian Group Inc. RDN and Assurant, Inc. AIZ beat the Zacks Consensus Estimate.

CNO Financial reported fourth-quarter 2023 adjusted earnings per share of $1.18, which beat the Zacks Consensus Estimate by 38.8%. Also, the bottom line jumped 66% year over year. Total revenues increased 20.2% year over year to $1.2 billion in the fourth quarter. The top line beat the consensus mark by 25.3%. Total insurance policy income of $625.7 million fell marginally year over year.

CNO’s net investment income increased 47% year over year to $465.2 million in the fourth quarter. General account assets grew 10.3% year over year to $325.1 million. Also, the policyholder and other special-purpose portfolios jumped nearly seven times to $140.1 million. Annuity collected premiums of $438.3 million increased 2% year over year. Annuity, Health and Life products accounted for 23%, 53% and 24%, respectively, of CNO’s insurance margin.

Radian Group’s fourth-quarter 2023 adjusted operating income of 96 cents per share beat the Zacks Consensus Estimate by 15.6%. The bottom line decreased 8.5% year over year. Operating revenues increased 4.4% year over year to $329 million. Net premiums earned of RDN were $232.6 million, which decreased 0.07% year over year.

Net investment income jumped 16.5% year over year to $68.8 million. Primary mortgage insurance in force totaled $270 billion as of Dec 31, 2023, up 3% year over year. Persistency — the percentage of mortgage insurance in force that remains in the company’s books after a 12-month period — was 84% as of Dec 31, 2023, up 400 basis points year over year. The Mortgage segment’s total revenues of $282.9 million remained almost unchanged year over year.

Assurant reported fourth-quarter 2023 net operating income of $4.58 per share, which beat the Zacks Consensus Estimate by 23.4%. The bottom line surged 41.8% year over year. Total revenues increased 12.4% year over year to $3 billion due to higher net earned premiums, fees and other income and net investment income. The top line beat the consensus estimate by 7.9%.

Adjusted EBITDA, excluding reportable catastrophes, increased 29% to $382.4 million. Net earned premiums, fees and other income at the Global Housing segment of AIZ increased 7% to $545.8 million. Net earned premiums, fees and other income at the Global Lifestyle unit increased 13% to $2.3 billion. The segment’s adjusted EBITDA of $204.6 million increased 12% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report