AIM Top Tech Dividend Paying Stocks

Mission Marketing Group, Oxford Metrics, and NAHL Group are technology companies which share a common feature – they’re also great dividend stocks. The tech sector is known to be highly cyclical and volatile since companies tend to find it difficult to create sustainable competitive advantage. However, those that build successful economic moats are exceptionally profitable and some pay strong dividends as a result. Today I will share with you my list of high-dividend tech stocks you should consider for your portfolio.

The Mission Marketing Group plc (AIM:TMMG)

TMMG has a sizeable dividend yield of 3.70% and their current payout ratio is 29.98% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from £0.0072 to £0.015.

Oxford Metrics plc (AIM:OMG)

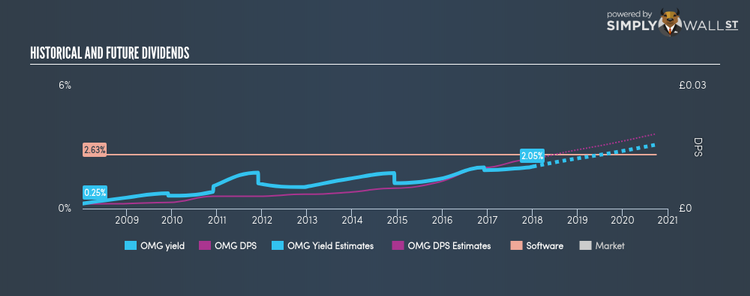

OMG has a good-sized dividend yield of 2.05% and the company currently pays out 46.98% of its profits as dividends . Over the past 10 years, OMG has increased its dividends from £0.00115 to £0.012. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Oxford Metrics is also reasonably priced, with a PE ratio of 22.9 that compares favorably with the GB Software average of 30.6.

NAHL Group plc (AIM:NAH)

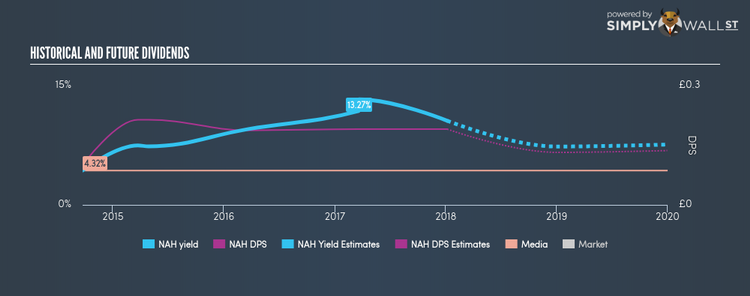

NAH has a substantial dividend yield of 10.58% and has a payout ratio of 78.81% . NAH’s 10.58% yield puts it in the top quartile of GB payers. The company has a lower PE ratio than the GB Media industry, which interested investors would be happy to see. The company’s PE is currently 7.9 while the industry is sitting higher at 23.8.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.