Air cargo market: From ‘doom mongering’ to stability

The air cargo market is experiencing an unexpected bounce during the traditional peak shipping season culminating the year, fueled by e-commerce exports from China, but revenues for air logistics companies could be lower even if strengthening demand carries over into 2024, according to industry experts.

Still, the vibe in industry circles is that the worst of the freight recession is in the rearview mirror, with next year bringing welcome stability even if it takes until late summer for a full-throated recovery to take hold.

“There’s overall shipper confidence that the market will be more predictable and more consistent. There’s more trust going into next year and as a result I think you’ll see more semiannual or annual contracts. That’s a really good signal that the market is starting to stabilize and shippers have confidence that supply and demand are going to be more balanced,” said Zeid Houssami, global head of airfreight at Flexport, in a webinar on Wednesday for the logistics firm’s customers.

The International Air Transport Association (IATA) recently forecast that airfreight volume will grow 4.5% in 2024, building on this year’s second-half momentum. Shipment traffic will contract 3.8% in 2023 after declining 8.2% last year, it said, as global supply chains stabilize and there is less need for fast delivery.

Other analysts anticipate air cargo volumes will increase 1% to 3%, in line with economic projections.

But continued growth in cargo capacity from passenger aircraft reentering service after the pandemic to meet travel demand, stagnating international trade and competition from ultra-low maritime cargo rates will continue to put downward pressure on rates, offsetting the demand gain. That translates into less revenue for airlines and logistics providers, the industry group said.

About half of global cargo volume — not including shipments transported by integrated express carriers — is being carried in the lower hold of passenger aircraft, as it was before the pandemic forced a shift to freighters.

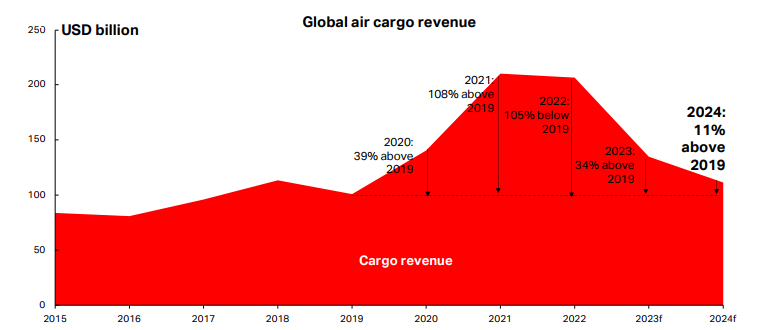

IATA estimates airline cargo revenues will fall 35% in 2023 to $134.7 billion, about $8 billion less than in its outlook presented last June, and slide to $111 billion next year as average unit pricing for air cargo deteriorates further. Yields fell more than 32% this year and will drop another 21% in 2024, it said.

Despite yield erosion, global cargo revenues will still be 11% higher than in 2019.

With combination airlines in full recovery mode and focused on their primary business, the cargo share of total airline revenues will revert to 12% after more than doubling during the pandemic because of the supply shortage, said IATA.

Fourth-quarter surge

Current market conditions have buoyed hopes that the air cargo industry will finally begin a full recovery from the freight recession that began in early 2022, although ongoing economic uncertainty suggests progress may not be sustainable.

Peak-season demand is still lower than usual, but weather disruptions and temporary decreases in passenger flights have constrained cargo capacity as demand from online shoppers surges, driving up rates on key routes.

Global volumes jumped 5% year over year (y/y) in November on the strength of low-cost e-commerce exports from China to Europe and the United States, marking the fourth consecutive — and most robust — month of growth after more than a year of tightening, according to freight data providers Xeneta and World ACD. IATA, which reports on a lagging basis, said cargo traffic measured in distance traveled increased 3.8% in October.

High-frequency data from several market intelligence firms indicates the market has stayed in positive territory through early December, with growth up 3% y/y.

The trend line is tempered somewhat by the fact that current growth figures look good compared to the third and fourth quarters of 2022, when the air cargo market began its steeper dive.

Meanwhile, cargo capacity is running 15% ahead of last year and is back to 2019 levels, with Asia accounting for 40% of the overall capacity growth after its delayed opening from the pandemic.

In the past four weeks, capacity rose nearly 2%, with a 5% increase in freighter capacity and an 18% surge on China-U.S. routes as all-cargo operators relocated equipment to take advantage of the hot market, according to consulting firm Accenture Cargo.

Higher demand helped to push the global fill rate for aircraft to 60%, based on volume and weight metrics, which is on a par with last year’s level, Xeneta said.

Some of the largest quantities of airfreight are coming from fast-fashion house Shein and online marketplace Temu. Fulfillment of direct-to-consumer orders is the primary reason aircraft out of Hong Kong and southern China are mostly full and rates have taken off. Consumer electronics are also moving extensively by air in recent weeks, air logistics companies say.

The first positive shift in load factors since May 2021 is reflected in rates out of Chinese gateways to North America, which have outperformed historical peak season activity by low single digits, with rates having risen 40% during the past three months.

According to the TAC Index, global airfreight rates have surged 21.2% in the past five weeks, cutting the y/y deficit to 10%. As recently as the end of August, rates were still about 40% lower than in 2022. The price to ship by air out of Hong Kong is 12% above the level a year ago, with rates out of Shanghai up 18% y/y, as of last week as producers and U.S. importers fight for space on the trans-Pacific lane.

Rates are now 43% higher than pre-pandemic levels in 2019.

“There was a lot of doom mongering heading into the fourth quarter. We’re not seeing that,” said IAG Cargo CEO David Shepherd on the STAT Media podcast Cargo Masterminds. “The market has gotten tighter, load factors have improved, and yields have stabilized and increased, which is what you’d expect.”

IAG is the umbrella company for several airlines, including British Airways and Iberia.

But shipping prices have started to cool in recent days, indicating that the e-commerce-driven increase in demand may be starting to subside as holiday shopping wraps up. Some observers, however, expect the e-commerce boom to last until the Lunar New Year holiday in early February.

And while trunk lanes out of China have been booming, air exports from North America continue to be softer than last year in early December.

“Seasonality means volumes are up, admittedly slightly more than we expected, but the figures also look better than they really are because November last year was disappointing for airlines and forwarders alike. More than anything else, what we saw this November was air cargo’s growing dependency on e-commerce,” said Niall van de Wouw, Xeneta’s chief airfreight officer, in the monthly report.

He questioned whether Shein and Temu will be able to generate similar volumes in the future if they eventually raise shipping prices to levels necessary to make a profit, which could undercut quantities of goods moved by air.

Stifel equity analyst Bruce Chan also cautioned about reading too much into this year’s spike in e-commerce activity, much of it aimed at Black Friday and Cyber Week sales.

“We think it is too early to extrapolate this trend to a broader economic recovery. For one thing, we believe some of the cyber activity, at least in the U.S, was a product of attractive ‘door buster’ deals. Moreover, broader retail sales performance was much more muted and, net of inflation, were likely even slightly more negative year over year,” Chan wrote in a monthly column for the Baltic Air Freight Index.

Xeneta’s analysis of spot rates versus seasonal rates also shows that the general cargo market, aside from e-commerce, still faces weak demand. Volumes for specialized commodities such as high-tech, valuables, pharmaceuticals and perishables are actually up 3% to 4%.

Forecast: Partially cloudy but stable

Consensus thinking within the logistics sector is that air and ocean volumes are poised for substantial growth in 2024 because the global economy has defied expectations of a recession, inflation is receding and retailers have drawn down excess inventories, clearing the way for new factory orders.

The International Monetary Fund forecasts global trade, which includes services, will grow 3.5% next year.

But there are signs that global economic resilience is fading. Many experts now believe strong economic conditions won’t appear until the third quarter.

Surveys of manufacturing output and export orders for major economics remain below the threshold indicating growth. Manufacturing orders in the U.S. remained in contraction territory during November, according to the Institute for Supply Management.

U.S. consumers are acting more cautious in the face of higher interest rates and dwindling household savings, according to retailers. And they’ve become more value-oriented, limiting discretionary purchases unless there is a promotion or discount. The National Retail Federation forecasts core holiday retail sales – excluding autos, gasoline and restaurants – will increase between 3% to 4% from Nov. 1 through Dec. 31, but some economists predict weak consumer spending in the first half of 2024.

The economic outlook from Oxford Economics is for global GDP of 2% in 2024 versus a consensus estimate of 2.3% and down from 2.6% growth this year. U.S. economic output is expected to fall from 2.4% to 1%. Among the potential drags on growth are a sputtering Chinese economy, U.S. consumers using up excess savings, protectionism and the lag effects of higher interest rates pushed by the U.S. Federal Reserve that are designed to cool growth by making borrowing more expensive. U.S. consumer confidence is rising, but consumers are feeling negative in the European Union, surveys show.

Jason Miller, a professor of supply chain management at Michigan State University, recently noted on LinkedIn that apparel and commercial equipment wholesalers have still not fully rebalanced inventory levels, which will continue to limit the recovery of airfreight for the time being.

Many experts predict most of the global economic slowdown will occur in the first half of 2024, with activity heating up in the following months. IHS Markit is calling for growth to start the year at 2.1% and rise to 2.7% by the end. Exports, industrial production and retail sales are expected to tick up in 2024.

Analysts say global airfreight capacity will likely continue to outpace market demand next year with growth of 3% to 5%, especially in Asia. International airlines operating to China at the end of October, for example, only offered half the number of seats they did during the same month in 2019. A temporary visa exemption for citizens of five European countries may also spur passenger travel to China, as the U.S. and China work to resolve diplomatic differences over further access for their respective airlines. Shipping rates could dip if capacity increases and demand softens at the same time.

If an influx of passenger flights to China materializes, a portion of the freighter fleet will likely shift to underserved markets such as Vietnam and India, which have limited direct capacity into North America and Europe.

A sign the air cargo market is gradually returning to health is the increased reliance on longer-term contracts. When consumers concentrated spending on goods during the pandemic, many logistics companies reserved large blocks of aircraft space or even leased their own freighters to guarantee capacity. Demand plummeted last year as economies reopened and people could spend on services again, which left logistics providers with dead space that they heavily discounted to attract business and contributed to the sharp downturn in rates earlier this year.

Flexport’s Houssami said the market should be much less volatile next year because the pendulum shifted from 70% procurement in the fixed market, or block space agreements, during the pandemic to 30% fixed and 70% spot transactions in 2023.

“Next year we’ll see more of a normalized market environment. I think most forwarders will look to leverage a more stable procurement portfolio of about 50% fixed, or BSA, and about 50% spot. So as a risk-mitigation strategy, forwarders are going to continue to balance both,” he said. But van de Wouw warned in Xeneta’s 2024 outlook that forwarders are selling long-term contracts and buying volume on the short-term spot market, which incentivizes them to not honor the contracted service if rates spike. He said the parties need a mechanism to adjust the contract rates when circumstances dictate.

January could be fairly strong for air cargo leading up to the Chinese New Year as companies look to push out inventory before the market slows down for a few weeks before picking up in March and transitioning to a traditional seasonal pattern for the remainder of the year, Houssami added.

Alex Fuller, UPS’ director of marketing for international airfreight, anticipates a strong rebound for air cargo, with rates dipping in the first quarter and staying relatively flat through June before rising substantially in the back half of the year.

There is “a strong possibility” of big peak season surcharges and rate hikes in the fourth quarter of 2024, he said during a company webinar in November.

RECOMMENDED READING:

Air cargo’s anemic peak season nothing to celebrate

Cargo revenues to fall $65B in 2023, airline group says

The post Air cargo market: From ‘doom mongering’ to stability appeared first on FreightWaves.