Air Lease (AL) Rides on Fleet Growth, Rising Expenses Ail

Air Lease Corporation’s (AL) top line isbenefiting from continuous growth in its fleet. Total revenues jumped 6% year over year in the first quarter of 2023, owing to the continuous growth in Air Lease’s fleet. As of Mar 31, 2023, Air Lease owned 437 aircraft with a net book value of $25.7 billion. The total fleet size at the first-quarter end was 899 (including the owned fleet of 437) compared with 900 at December 2022-end.

The company’s efforts to reward its shareholders are encouraging. Air Lease has an impressive dividend payment history. In November 2022, the company’s board approved a dividend hike of approximately 8.1% to 20 cents per share (annually: 80 cents). This marks the company’s 10th dividend increase since February 2013, when it began distributing dividends. On Apr 28, 2023, Air Lease’s board of directors declared a quarterly cash dividend of 20 cents per share, payable on Jul 7, 2023, to shareholders of record as of Jun 6, 2023.

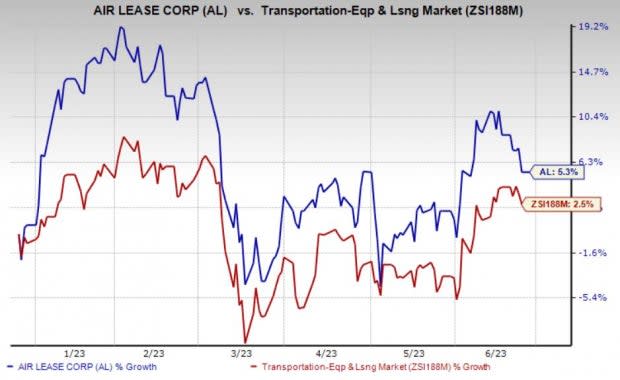

Notably, shares of Air Lease have gained 5.3% over the past six months compared with 2.5% growth of the industry it belongs to.

Image Source: Zacks Investment Research

On the flip side, rising operating expenses pose a threat to the company's bottom line. In first-quarter 2023, operating expenses rose 20.7% to $477.9 million.

Air Lease’s liquidity position is a concern. Cash and cash equivalents of $690.41 million at the first quarter of 2023-end was lower than $19.4 billion of debt financing and net of discount and issuance costs. This implies that the company does not have enough cash to meet its debt burden.

Zacks Rank and Stocks to Consider

Air Lease currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks for investors interested in the Zacks Transportation sector are Copa Holdings CPA and Allegiant Travel Company ALGT. Each of these companies presently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of 75.42% for the current year. CPA delivered a trailing four-quarter earnings surprise of 14.60%, on average.

The Zacks Consensus Estimate for CPA’s current-year earnings has improved 25.5% over the past 90 days. Shares of CPA have soared 32.6% over the past six months.

Allegiant has an expected earnings growth rate of more than 100% for the current year. ALGT delivered a trailing four-quarter earnings surprise of 79.78%, on average.

The Zacks Consensus Estimate for ALGT’s current-year earnings has improved 46.5% over the past 90 days. Shares of ALGT have surged 82.8% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report