Air Liquide (AIQUY) and Sasol Ink New Long-Term Contracts

Air Liquide AIQUY and Sasol have signed new Power Purchase Agreements (PPAs) with the global wind and solar company Mainstream Renewable Power for the long-term supply of renewable power with a capacity of 97.5 MW to Sasol's Secunda site in South Africa, where Air Liquide operates the world's largest oxygen production site.

This is Air Liquide and Sasol's third set of PPAs, following those announced in the first quarter of 2023 with Enel Green Power and TotalEnergies with its partner Mulilo. These PPAs reflect a total renewable power capacity of approximately 580 MW. The contracts will help Air Liquide achieve its goal of reducing CO2 emissions linked with oxygen production in Secunda by 30% to 40%.

Mainstream will establish a local firm with strong socioeconomic development commitments to build a solar farm in the Free State province under the terms of these PPAs with Air Liquide and Sasol. This renewable energy generation facility is set to open in 2025.

Air Liquide purchased Sasol's 16 oxygen production units at Secunda and has been operating them on a long-term supply contract with its partner since June 2021. Air Liquide runs 17 Air Separation Units (ASUs) in Secunda, with a total capacity of 47,000 tons/day of oxygen, including another ASU it already operated for Sasol.

Air Liquide employs roughly 67,100 people in 73 countries and services more than 3.9 million clients and patients. Oxygen, nitrogen and hydrogen are critical molecules that are required for life, matter and energy. They represent Air Liquide's scientific domain and have been at the heart of the company's operations since its inception in 1902.

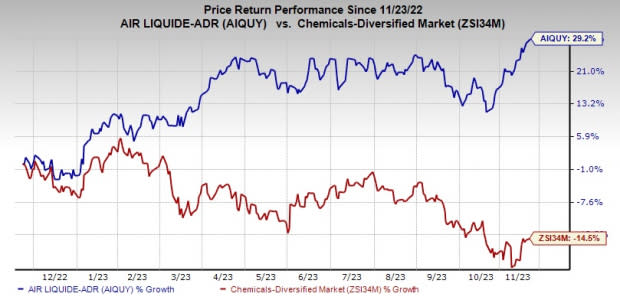

Shares of Air Liquide have gained 29.2% over the past year against a 14.5% decline of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Air Liquide currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). DNN delivered a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 50.9% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently carries a Zacks Rank #1. AXTA delivered a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 17.4% in a year.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 36.6% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Air Liquide (AIQUY) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report