Air Products (APD) to Feature Latest Developments at LNG2023

Air Products and Chemicals, Inc. APD will exhibit its latest developments in LNG liquefaction technology at LNG2023, the 20th International Conference & Exhibition on liquefied natural gas, which will be held from Jul 10-13 at the Vancouver Convention Centre in British Columbia, Canada.

Air Products' LNG experts will present the company's unparalleled LNG process technologies and equipment utilized by big export, small and mid-sized, and floating LNG plants at the conference. The team will additionally demonstrate how it helps customers to maximize the overall operation of an LNG facility by providing safe and sustainable solutions that minimize the total cost of ownership.

Air Products plays a significant part in the LNG industry, providing a wide range of products and services for the successful design, construction, start-up and operation of LNG facilities, having successfully shipped more than 150 large coil-wound heat exchangers to plants in 20 countries globally.

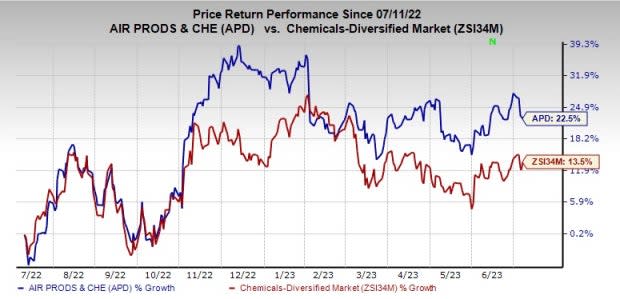

Shares of APD have gained 22.5% over the past year compared with the 13.5% rise of the industry.

Image Source: Zacks Investment Research

Air Products expects fiscal 2023 adjusted earnings per share of $11.30-$11.50, indicating 10-12% year-over-year growth. For the third quarter of fiscal 2023, the company expects adjusted earnings per share in the range of $2.85-$2.95, suggesting a rise of 10-14% from the year-ago quarter.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Zacks Rank & Key Picks

Air Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks to consider in the basic materials space are Carpenter Technology Corporation CRS, Silvercorp Metals Inc. SVM and Linde plc LIN.

CRS currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for the company’s current-year earnings is pegged at $1.04, implying year-over-year growth of 6.3%. It has a trailing four-quarter earnings surprise of 198.1%, on average. The stock has gained 107.8% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Silvercorp Metals also sports a Zacks Rank #1 at present. The consensus estimate for the company’s current fiscal-year earnings is pegged at 27 cents, suggesting year-over-year growth of 28.6%. The stock has jumped 19.9% in the past year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days. The company’s earnings beat the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9%, on average. The stock has gained 31.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report