Air Products & Chemicals Inc (APD) Reports Solid Earnings Growth Amid Economic Headwinds

GAAP EPS: Increased to $2.73, up 6% year-over-year.

Net Income: Grew to $622 million, a 6% rise from the previous year.

Adjusted EBITDA: Improved by 8% to $1.2 billion, with margins expanding significantly.

Dividend: Quarterly dividend increased to $1.77 per share, marking the 42nd consecutive year of dividend growth.

Guidance: Fiscal 2024 full-year adjusted EPS guidance set at $12.20 to $12.50, anticipating a 6-9% increase.

Capital Expenditures: Expected to be between $5.0 billion and $5.5 billion for fiscal year 2024.

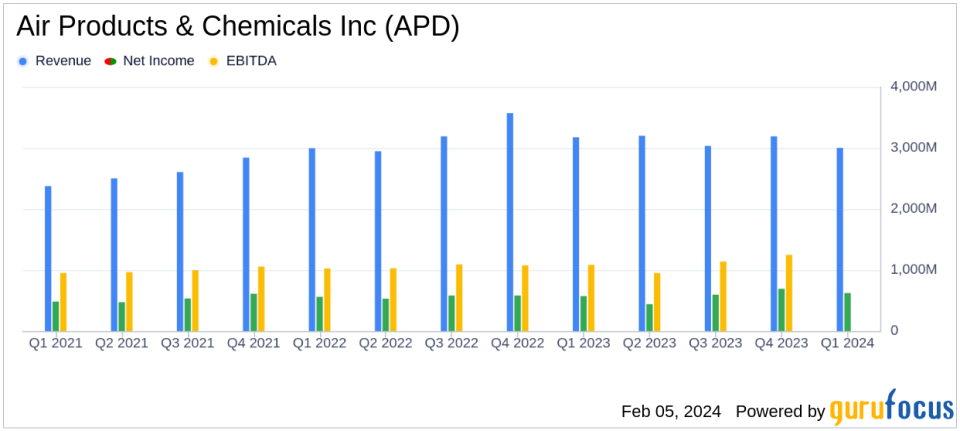

Air Products & Chemicals Inc (NYSE:APD) released its 8-K filing on February 5, 2024, detailing its financial performance for the first quarter of fiscal year 2024. The company, a global leader in industrial gases with operations in 50 countries and a workforce of 19,000, reported a GAAP EPS of $2.73, a 6% increase from the previous year. Adjusted EPS also saw a rise, reaching $2.82, up 7% year-over-year. Despite facing significant geopolitical and economic challenges, including a manufacturing slowdown in Asia, particularly China, and lower helium demand, the company managed to improve its net income to $622 million, marking a 6% increase.

Financial Highlights and Challenges

Air Products' adjusted EBITDA grew to $1.2 billion, an 8% improvement from the prior year, with a notable adjusted EBITDA margin expansion of 510 basis points to 39.2%. This margin improvement included a positive impact of about 400 basis points from lower energy cost pass-through. However, the company's overall sales decreased by 6% to $3.0 billion, primarily due to an 11% lower energy cost pass-through, which negatively affected sales but had no impact on net income.

Despite these challenges, Air Products' financial achievements are significant within the chemicals industry. The company's ability to increase pricing and volumes in a tough economic climate demonstrates its strong market position and operational efficiency. The increased dividend also reflects a commitment to shareholder returns, reinforcing the company's financial stability and confidence in its long-term growth strategy.

Segment Performance and Outlook

The Americas segment saw a 10% decrease in sales but improved operating income and adjusted EBITDA, driven by higher pricing and volumes, particularly in hydrogen demand. Asia's sales increased by 2%, although operating income and adjusted EBITDA faced declines due to unfavorable volume mix and higher costs. Europe experienced an 8% decrease in sales but saw significant increases in operating income and adjusted EBITDA, benefiting from higher volumes, lower power costs, and favorable currency movements.

Looking ahead, Air Products has updated its fiscal 2024 full-year adjusted EPS guidance to $12.20 to $12.50, representing a 6 to 9% increase over the previous year's adjusted EPS. The company also continues to expect capital expenditures of $5.0 billion to $5.5 billion for the full year, reflecting its commitment to growth and investment in its core industrial gases business and low-carbon intensity hydrogen projects.

Comprehensive Financial Analysis

The company's balance sheet remains robust, with total assets increasing to $34.1 billion as of December 31, 2023, from $32.0 billion at the end of the previous fiscal year. Long-term debt increased to $11.7 billion, reflecting ongoing investments in growth initiatives. Cash provided by operating activities was $626.6 million for the quarter, while cash used for investing activities was significantly higher at $1.7 billion, primarily due to additions to plant and equipment.

Air Products' Chairman, President, and CEO Seifi Ghasemi commented on the results, stating:

"Despite significant geopolitical and economic headwinds, the team at Air Products performed well, increasing our adjusted EPS by seven percent over last year. Our reported results were lower than our expectations, mainly due to a slowdown in manufacturing in Asia, particularly in China; lower helium demand; cost headwinds from a sale of equipment project; and currency devaluation in Argentina. We are moving forward to successfully implement our ambitious, long-term growth strategy through our core industrial gases business and as a leader in low-carbon intensity hydrogen to generate a cleaner future for the world.

In conclusion, Air Products & Chemicals Inc (NYSE:APD) has demonstrated resilience and strategic growth in a challenging economic environment. The company's focus on operational efficiency, pricing power, and strategic investments positions it well for continued success in the industrial gases sector. Investors and stakeholders can look forward to a company that is not only weathering economic storms but also paving the way for a sustainable future.

Explore the complete 8-K earnings release (here) from Air Products & Chemicals Inc for further details.

This article first appeared on GuruFocus.