Air Products & Chemicals Is Poised for a Transition

Air Products & Chemicals Inc. (NYSE:APD) is a leading industrial gas company. Founded in 1940, the Pennsylvania-based company operates in over 50 countries and employs 19,000 people.

The company produces and sells atmospheric gases such as oxygen, nitrogen and argon; process gases such as hydrogen, helium, carbon dioxide, carbon monoxide and syngas (a mixture of hydrogen and carbon monoxide); and specialty gases.

It has a two-pillar growth strategy to expand its core gas business and to build own and operate clean hydrogen projects that will support the energy transition in the heavy-duty transportation and industrial sectors.

Investment thesis

While Air Products has been around for decades operating in the industrial gases industry, our core investment thesis is based on the growth it is expected to achieve through its production of hydrogen that contributes to global decarbonization goals.

Transitioning to clean hydrogen has become an important part of achieving climate goals. The current production of hydrogen, called grey hydrogen, involves a large amount of carbon dioxide emissions. What Air Products aims to focus on is blue and green hydrogen.

Blue hydrogen involves the regular production of hydrogen, but with carbon capture and storage limiting emissions. Air Products is one of the few companies that claims to be able to capture 95% of the carbon emissions.

Green hydrogen, on the other hand, uses electricity from renewable sources to split water and release hydrogen. Air Products has several green hydrogen projects, including in New York, Texas, Arizona and Saudi Arabia, in partnership with NEOM, which is backed by the government.

The other catalyst for growth is the recent policy changes in the U.S. that incentivize the production of clean hydrogen.

According to the U.S. Department of Energy, the Inflation Reduction Act and the Bipartisan Infrastructure Bill have introduced clean hydrogen production tax credits that have created a new 10-year incentive for clean hydrogen production of up to $3 per kilogram, depending on the extent of carbon intensity.

Air Products CEO Seifi Ghasemi spoke at the JP Morgan Industrial Conference on March 13, where he illustrated the impact of the change. In Louisiana, the incentive to sequester carbon from hydrogen production had an incentive of $45 per ton. After the Inflation Reduction Act, the incentive is now $85 per ton. As a result, the company is increasing its capacity in Louisiana because it is now far more economical to capture carbon and produce blue hydrogen. This is a good example of why Air Products is increasing investments and how its net margin will improve.

The company has set aside about $15 billion for international hydrogen-related projects, setting it up for a significant upside in earnings should all the investments materialize. Below is a list of its projects from its first-quarter 2024 earnings presentation, the majority of which are related to the energy transition.

Financial position

Revenue growth reported in the first quarter of 2024 showed a decline of about 6% year over year to $2.99 billion. However, net income was reported at $609.3 million, up almost 6.50%.

A major reason for the decline in revenue came from China, which comprises almost 16% of its business. Operating income from the Asia division was down 10%. There was also lower helium demand across the electronics end market in China. The company, however, does not believe there is an issue with its supply, but there may be illegal supplies entering the market that hurt its performance. Furthermore, onsite assets are still expected to contribute positively to performance.

The other issues were cost headwinds from the sale of equipment projects and currency devaluation in Argentina.

These issues have certainly impacted the company's margins as well, although Air Products continues to maintain margins that are solid compared to industry standards.

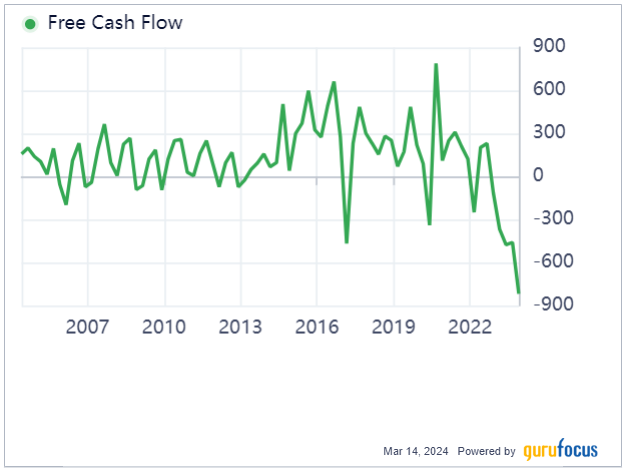

One of the major issues with the company's financial performance is that its free cash flow margin has fallen off a cliff. Free cash flow turned negative last year at -$1.4 billion because of its aggressive expansion and investment policies.

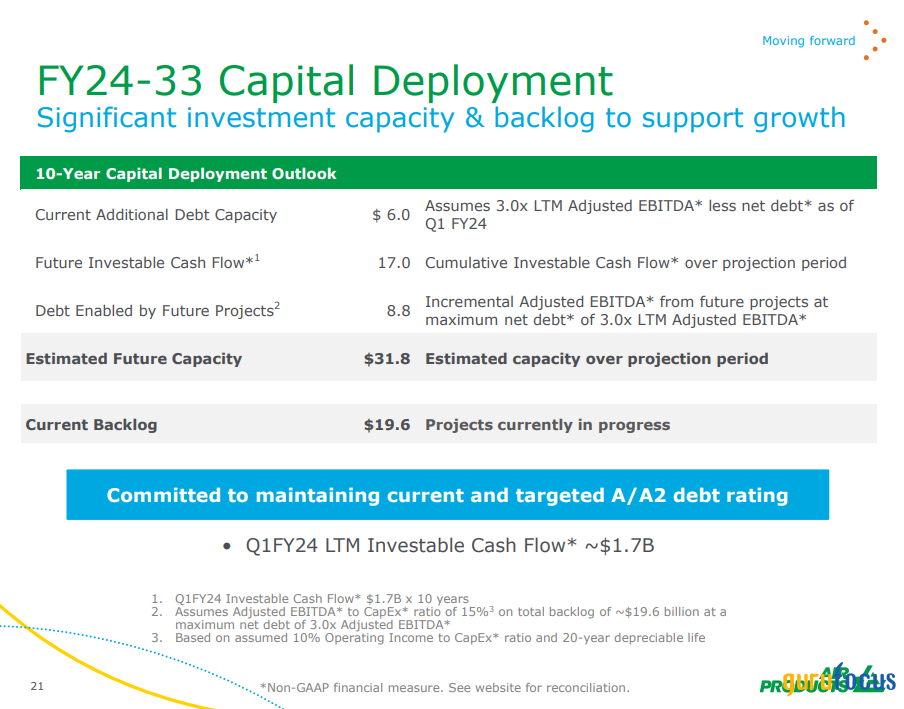

Air Products remains well aware of this, however, and it has charted a course of funding these projects through a mix of equity and debt, which it can raise because of its A rating from Moody's and S&P Global. Below is a snapshot of its capital deployment plans from the most recent earnings report.

This, of course, has led to higher debt levels, with the debt-to-equity ratio increasing to 0.86 in the first quarter from 0.62 in the prior-year period. The company is determined, however, to retain its current debt rating and, therefore, has committed to ensure the balance sheet is not overleveraged.

On the positive side, Air Products is a dividend aristocrat with a history of consecutively raising its dividend for 42 years. The company raised its quarterly dividend to $1.77 per share from $1.75 in the first quarter. The dividend yield is still quite low at 2.84%, and with all the cash being deployed for expansion, we will not be surprised if it makes minimal increases in the next two years just to retain the aristocrat title. Once the projects materialize and add to the income, however, we are likely to see an improvement in that trend.

Valuation

The GF Value Line suggests a value of $287.14 for 2024, which presents an upside of about 16% as of the time of writing.

According to GuruFocus, analysts estimate revenue of $13.22 billion for 2024 and $14.14 billion for 2025, which represent year-over-year increases of 4.92% and 6.96%. The earnings per share estimate for 2024 is $12.49, while the company is guiding for $12.20 to $12.50, which represents an increase of 6% to 9%.

The current enterprise value/Ebitda ratio is at 16.61 and the forward EV/Ebitda ratio is 12.48, which is higher than the industry average, mainly because of the debt burden the company is now carrying.

Now, as I have mentioned, several projects are coming online in the next few years which should add incremental Ebitda to the company and, for some, the IRA tax credits will improve the profitability. However, these projects are expected to materialize between the second half of 2025 and early 2027, so we are looking at this company as a longer-term investment of at least four to five years.

Risks

China continues to pose a risk for Air Products, and this could intensify if further tariffs are imposed after the U.S. presidential election later this year. Ghasemi warned on the last earnings call that conditions in China remain far more dire than what is being reported in the news.

Another potential risk is a change in U.S. government policies. The Inflation Reduction Act, which has been driven by the Biden administration, could come under scrutiny if there is a change in leadership. This could result in a change to the tax credit structure for hydrogen and weigh on the industrial gas companies.

Project cost overruns and high leverage are another concer. Along with revenue and earnings targets, the company puts out yearly capital expenditure estimates. For 2024, the estimate is $5 billion to $5.50 billion. For 2025, the capex estimate is $5.20 billion. I would be worried if the company keeps increasing its estimates significantly as a sign of cost overruns. The company may run out of cash and may not be able to raise financing to complete projects in time. This could lead a significant hit to earnings.

Conclusion

The recent sell-off in the stock has reset the valuation and made the current price levels attractive and somewhat undervalued.

While Air Products has ambitious growth plans that could lead to reduced free cash flow and higher levels of leverage over the next two to three years, I expect that these will yield returns as the projects materialize over the next five years.

Solid, diversified growth prospects and a central role in the future of the energy transition make Air Products an appealing option. Its position in the clean energy movement offers a unique opportunity for diversification.

This article first appeared on GuruFocus.