Airbnb (ABNB) to Report Q4 Earnings: What's in the Cards?

Airbnb ABNB is scheduled to report fourth-quarter 2023 results on Feb 13.

For the fourth quarter, Airbnb expects revenues between $2.13 billion and $2.17 billion, implying year-over-year growth in the band of 12-14% on a reported basis.

The Zacks Consensus Estimate for the same is pegged at $2.16 billion, indicating growth of 13.7% from the year-ago quarter’s reported value.

The Zacks Consensus Estimate for earnings is pegged at 67 cents per share, suggesting growth of 39.6% from the year-ago reported figure.

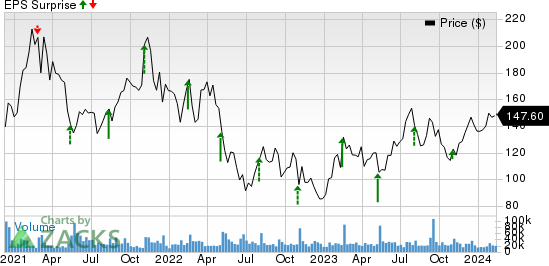

Airbnb’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 49.99%.

Let’s see how things have shaped up for this announcement.

Airbnb, Inc. Price and EPS Surprise

Airbnb, Inc. price-eps-surprise | Airbnb, Inc. Quote

Key Factors to Note

Airbnb’s fourth-quarter 2023 results are expected to have benefited from the solid momentum in Nights and Experiences booked across all geographies, owing to growing demand among first-time bookers.

The Zacks Consensus Estimate for fourth-quarter Nights and Experiences Booked is pegged at 97.85 million, indicating growth of 10.9% from the year-ago reported figure.

Further, the growing Average Daily Rate, driven by a mix shift across EMEA and Asia Pacific regions, is expected to have impacted the to-be-reported quarter’s performance.

Growing momentum across international expansion markets, particularly in the Asia-Pacific region, is likely to have aided cross-border travel growth during the fourth quarter.

All these factors are expected to have driven growth in gross booking value (GBV) in the fourth quarter. The Zacks Consensus Estimate for GBV is pegged at $15.12 billion, indicating growth of 12% from the reported figure in the year-ago quarter.

The company’s growing awareness around hosting and new features introduced for hosts are likely to have acted as tailwinds for the company in the to-be-reported quarter.

Strong momentum in active listings, owing to supply growth across all regions, is expected to have bolstered the company’s top-line performance during the quarter under review.

However, intense competition in the online travel market is anticipated to have remained an overhang in the to-be-reported quarter.

Also, growing macroeconomic challenges and the impacts of geopolitical conflicts may have been major concerns.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Airbnb this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Airbnb has an Earnings ESP of -0.82% and a Zacks Rank #2 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some companies worth considering from the same space, as our model shows that these have the right combination of elements to beat on earnings in their soon-to-be-reported quarterly results.

Shopify SHOP has an Earnings ESP of +1.02% and a Zacks Rank #1 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Shopify is set to announce fourth-quarter 2023 results on Feb 13. The Zacks Consensus Estimate for SHOP’s earnings is pinned at 31 cents per share, suggesting growth from the year-ago quarter’s figure of 7 cents per share.

Duolingo DUOL has an Earnings ESP of +22.09% and a Zacks Rank #1 at present.

Duolingo is set to announce fourth-quarter 2023 results on Feb 28. The Zacks Consensus Estimate for DUOL’s earnings is pinned at 17 cents per share, indicating growth from the year-ago quarter’s loss of 35 cents per share.

Akamai Technologies AKAM has an Earnings ESP of +1.61% and a Zacks Rank #3 at present.

Akamai Technologies is scheduled to release fourth-quarter 2023 results on Feb 13. The Zacks Consensus Estimate for AKAM’s earnings is pegged at $1.59 per share, suggesting a jump of 16.1% from the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report