Airbnb Sees Demand Moderating as Chesky Readies for Pivot

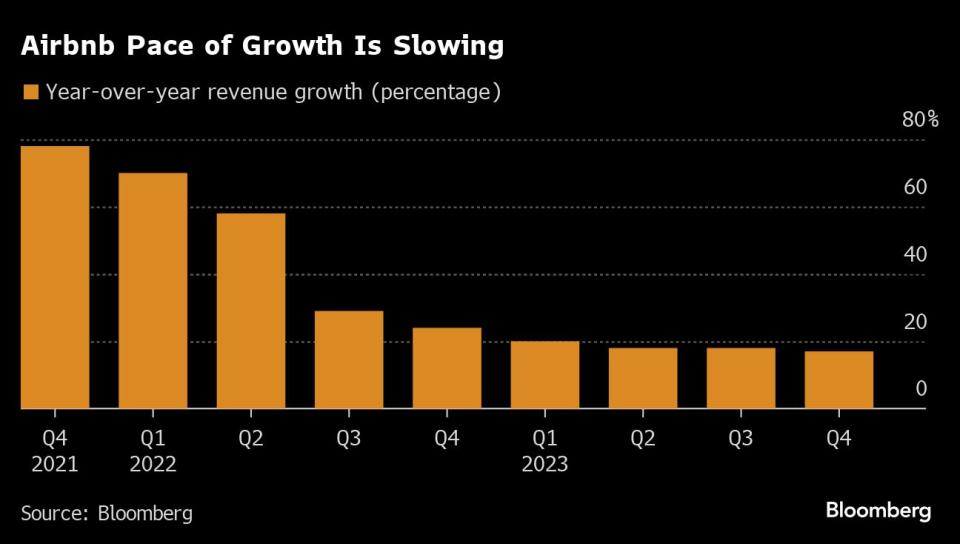

(Bloomberg) -- Airbnb Inc. ended 2023 stronger than analysts’ had expected but suggested that demand in the current quarter wouldn’t be as robust as the last.

Most Read from Bloomberg

Trump Keeps NY Empire Intact as Judge Rescinds Asset-Sale Order

Record US Stock Rally Is Under Threat From a World in Turmoil

Systemic Risk Concerns Grow Among Money Managers as Real Estate Woes Cause Turmoil

Revenue for the three months ending in March will be $2.03 billion to $2.07 billion, surpassing analysts’ average estimate of $2.02 billion. The number of nights and experiences booked is expected to moderate compared with the fourth quarter, however, due to a particularly strong growth rate a year ago, the home-sharing company said Tuesday in a letter to shareholders.

Travel was especially strong last year after the Omicron wave of Covid-19 but the company is starting to see overall demand normalizing coming out of the pandemic, Chief Business Officer Dave Stephenson told analysts on a call.

The shares were down 4% in premarket trading in New York Wednesday, after initially rising as much as 11% on the results. The stock has gained 30% in the past 12 months and hit its highest price in almost two years on Monday. The home-sharing platform also reported a surprise net loss in the quarter, due to a one-time tax charge related to a long-running dispute with the Italian authorities.

Still, Airbnb’s quarterly results beat analysts’ estimates on many metrics and Chief Executive Officer Brian Chesky was optimistic about where the company is headed, especially in international markets.

“There are massive opportunities in front of us,” Chesky said on the call. After spending the past few years adjusting to shifts in travel trends from the pandemic, the CEO said he’s ready now to “expand beyond our core business and reinvent Airbnb.” It will be a “gradual, multi-year journey,” and he pledged to share more towards the end of this year.

Chesky has hinted that the new ventures would include further integrations of artificial intelligence and third-party services into its products, which would allow more personalized travel recommendations for guests and better user experience for hosts.

The company had warned in November that it was seeing “greater volatility” globally early in the last quarter, due to economic and geopolitical issues. But then, bookings accelerated throughout the rest of the year. “Guest demand remains strong — especially among first-time bookers,” Airbnb said in the letter.

Airbnb’s results suggest there is still pent-up travel demand, especially in regions that were slower to return to normal life after Covid-era lockdowns. Airlines, hotels and and other travel companies, including Airbnb, saw record demand over the summer, a phenomenon dubbed “revenge travel,” as people proved willing to swallow high fares for flights and lodging to fulfill their lost pandemic itineraries.

Wall Street analysts were largely positive about Airbnb’s results, and saw broad based upside for the stock.

Revenue in the fourth quarter jumped 17% to $2.22 billion, ahead of the average analyst estimate of $2.16 billion, according to data compiled by Bloomberg. Nights and experiences booked increased 12% to 98.8 million, also ahead of expectations for about 11% growth. Airbnb said the results were boosted by a “modest increase” in the average daily rate and a favorable foreign exchange rate.

Chesky sees markets outside the US one of Airbnb’s biggest growth opportunities and the San Francisco-based company is planning to boost its presence in about a dozen countries such as Switzerland, Belgium and the Netherlands in the coming years. Airbnb has been working to adapt its app to the local market and raise awareness to drive traffic and is starting to see the effort pay off.

Gross nights booked in Brazil nearly doubled compared with the same pre-pandemic period in 2019, the company said. The Asia Pacific region was one of the last globally to emerge from Covid lockdowns and cross-border travel is continuing to recover there. Nights and experiences booked increased 22% in the area from a year earlier and Latin America saw similar growth.

Airbnb said it’s “particularly excited for the upcoming Paris 2024 Olympic Games.” It’s already seen an increase in supply and demand and the current backlog of nights in Paris during the summer is more than double a year ago. The company has said it expects to host half a million people in the City of Lights.

The company posted a net loss of $349 million in the fourth quarter, due to non-recurring tax withholding expenses and lodging tax reserves of about $1 billion as a result of a 2017 Italian tax law that it fought and later settled last December. Excluding that, adjusted net income was $489 million.

Airbnb, which went public in 2020, also announced a new share repurchase program to buy back as much as $6 billion of the company’s stock.

Airbnb’s results contrast with Expedia Group Inc., which owns the Vrbo vacation-rental site. Last week Expedia gave an outlook for gross bookings in the current quarter that disappointed investors, sending its shares tumbling the most in almost four years.

(Updates with premarket share trading)

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.