Airbnb Is at an Inflection Point as Travel Demand Returns

Airbnb Inc. (NASDAQ:ABNB) reported its full-year 2023 earnings last week, and the results were much better than expected. The company divulged that travel demand surpassed expectations and there were indications in its metrics that implied demand would sustain throughout the year.

In addition, the San Francisco-based company announced a $6 billion share buyback program. This is a new buyback program in addition to the $2.25 billion worth of shares it had already repurchased using its own free cash.

With demand returning and the company firing on all of its financial metrics, I believe this travel experience company's stock is now at the turn of the tide with room to grow.

Business model in the post-pandemic world

Founded over a decade ago, Airbnb developed its online platform as a marketplace that allows people to rent out their properties to travelers and other consumers looking for accommodation. Over time, the company also added the Experiences feature, which allows travelers to sign up for activities with local hosts or with other tour guides, allowing travelers to get unique experiences. Since the pandemic, Airbnb has also allowed hosts to offer online-only experiences.

However, in the last few years, the company has been subject to severe criticism from travelers using the platform because Airbnb would allow its hosts to charge exorbitant incremental fees (room cleaning fees, as an example), in addition to the overall cost of a stay. In the last year, management has embarked on a mission to be upfront and transparent with its listing fees and, in some cases, to eliminate incremental fees entirely to build trust with its user base.

Considering the company operates its business model as a marketplace platform, it manages the supply of hosts' properties with the demand from travelers and makes money by charging fees for any transaction that it facilitates on its platform. Hence, I will be reviewing operating metrics such as gross booking value.

Quarterly results show demand coming back to the platform

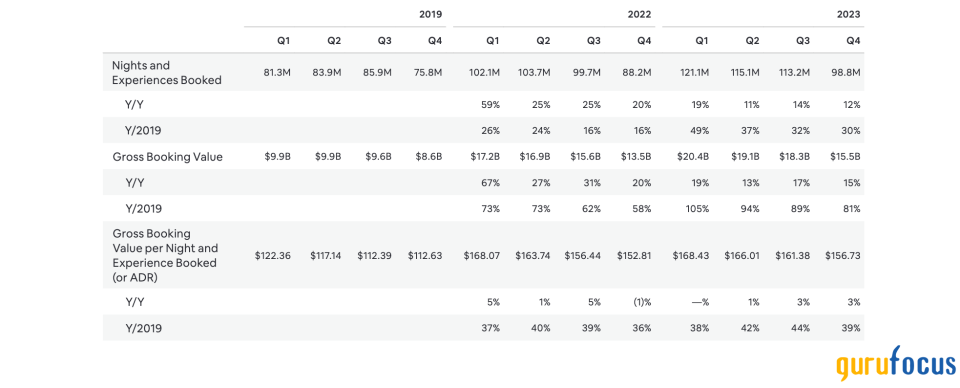

Airbnb's fourth-quarter revenue pleasantly surprised me as it grew by 17% to $2.20 billion, surpassing the $2.17 billion consensus estimates as well as the company's own guidance. Further, gross bookings value increased by 15% to $15.50 billion, as can be seen in the chart below, as the number of Nights and Experiences booked on the platform grew 12% to 98.80 million.

This news was a positive development from what management guided for in in the third quarter, when they expected Nights and Experiences booked to moderate in the fourth quarter due to slower travel demand as geopolitical tensions took center stage in October of last year.

While reviewing the underlying metrics, I noticed many indicators that looked a lot healthier. Longer-term stays of 28 days on the platform accounted for 19% of gross nights booked sequentially, increasing from the 18% level seen in the prior quarter. Even better, nights booked for trips over three months advanced approximately 20% compared to the year-ago quarter. Moreover, average daily rates increased by 3% from last year, suggesting travelers did not mind paying the marginal increase in rates.

Demand dynamics on the platform also helped the company slightly increase its take rates to 14.30% from 14.10%. All these developments appeared to have an immediate positive effect on Airbnb's revenue, in my opinion, which increased 17% year over year to $9.90 billion, beating expectations. In addition to observing these trends, I also found some of the commentary from management to be very encouraging, as they noted they were seeing particular demand strength from first-time bookers who were booking more Nights on the platform.

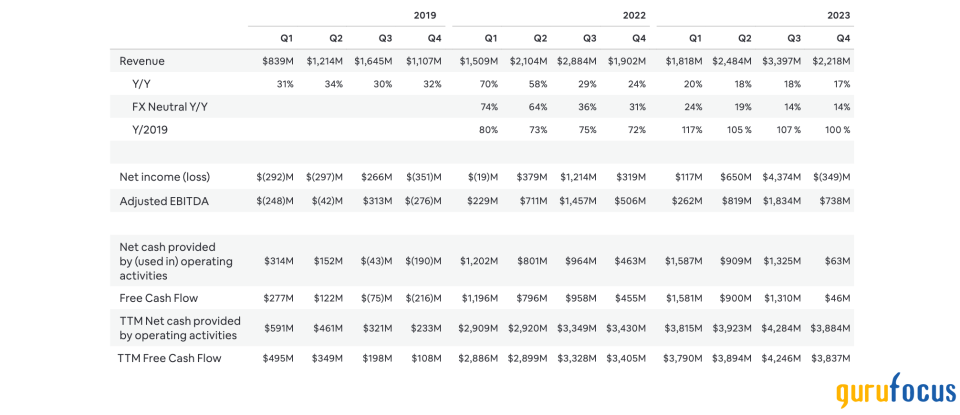

On the earnings front, Airbnb reported a loss of $349 million, or 55 cents a share, in the fourth quarter vs. a profit of $319 million, or 48 cents a share, a year earlier. The latest quarterly results included a charge of about $1 billion related to tax expenses. Excluding the tax charge and other adjustments, management reported net income of $489 million, an increase of 53%. I believe this was a strong show of earnings, minus the one-time tax charge, leading Airbnb to report record free cash of $3.8 billion, an increase of 12.70% year over year.

The company holds about $2.20 billion in debt. It carries about $2 billion of that debt in the form of 2026 convertible senior notes, while the rest is operating lease liabilities.

Outlook

In the previous section, I noted how some net positive developments were increasing the prospects for Airbnb's outlook in 2024. When answering a question about the macroenvironment moving forward on the earnings call, Chief Business Officer Dave Stephenson said:

"I think that we continue to see a very robust demand for people staying on Airbnbs versus just necessarily kind of buying other things. So the experiences over things continues to be a big trend. And we're excited to see the growth that we're continuing to see in our established businesses in North America and Europe and even greater growth in Latin America and Asia Pacific. As I said on the last question about doubling down and making sure that we invest in these expansion countries where we're underpenetrated, I think, that's going to continue to drive growth for us for the rest of the year."

Per the above commentary, management also revealed their intentions to focus on newer and underpenetrated markets, giving the company considerable upside to scale the gross bookings value on the platform.

For the first quarter, management projects revenue to grow 13% to $2.05 billion, ahead of consensus expectations of $2.03 billion. While management expects adjusted Ebitda to grow on a nominal basis, it anticipates adjusted Ebitda to contract to at least 35% versus the 37.40% seen in 2023. I believe the company will slightly expand its marketing budget this year to further expand just when demand is returning to the platform. Management spoke of investing in marketing initiatives such as full-funnel marketing. Moreover, I agree with management's view of expanding marketing budgets this year as Airbnb expands into newer markets.

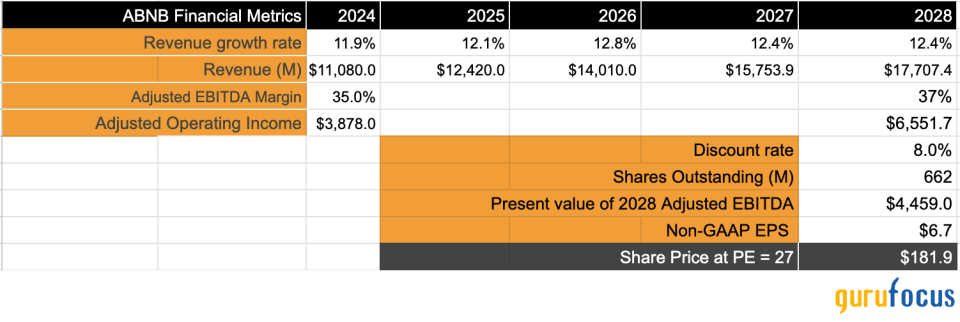

Assuming Airbnb's revenue grows at a compounded annual rate of 12.20% through 2028, I expect the company to expand its margins back to at least 37%, implying Ebitda will grow by a 14% rate on an adjusted basis. With these growth rates, a forward price-earnings ratio of 27 would be justified, implying upside from current levels.

Risks and other factors to consider

One of the key strengths of Airbnb is the supply of property listings that are available on its booking platform. If hosts on its platform do not see additional incentives in listing their properties on the platform, it would affect the supply of properties which, in the long run, would deter travelers from booking on Airbnb and moving to competitors. Competitors such as Expedia-owned (NASDAQ:EXPE) Vrbo and Booking.com (NASDAQ:BKNG) compete with Airbnb directly in the vacation rentals market, but Airbnb prides itself by differentiating its rentals platform from others on the strength of its supply. Per the earnings report, active listings on the platform exceeded 7.70 million in 2023, over three times more than the 2 million listings that Vrbo mentioned it had for the same period, per Expedia's recent 10-K report. So far, Airbnb has managed the hosts' supply of its platform economics well, but were hosts to move over their properties to competitors such as Vrbo, it would impact the company.

Additionally, travel aggregator sites such as Expedia and Booking.com also work with hotel chains and other large lodging companies to list their hotel rooms on their websites. If Airbnb ceases to offer day rates at comparative value to hotel chains, it may severely impact its bookings and revenue prospects. Many travelers may directly book with hotel chains as well, which represents a lost opportunity for Airbnb.

Finally, regulation is another gray area that poses some headwind for the company. In September, New York's short-term rental law went into effect, impacting many Airbnb hosts' ability to lease rentals for less than 30 days. While the company says the impact is not material, it would become a significant headwind if other jurisdictions drafted similar bills.

Takeaways

For now, the changes that Airbnb has made to its business model is working well and the company looks set to reap the benefits of its cost initiatives and investments. The company is demonstrating acuity in managing platform dynamics by inviting more hosts and giving travelers compelling reasons to use its platform. With these trends persisting throughout the year, I expect Airbnb's stock to move higher.

This article first appeared on GuruFocus.