Airbnb Is Redefining Travel Economics

Airbnb Inc. (NASDAQ:ABNB) is one of those ultra-rare phenomenal growth stories that started as a little incubated startup in San Francisco and has now mushroomed into a powerful force in the holiday home rental industry.

The company has disrupted the travel industry, injecting an idea of a property-sharing economy, redefining multiples of spaces and, at the same time, generating money in hotels.

How does Airbnb make money?

Founded in 2008 and headquartered in California, Airbnb is an online marketplace for travel bookings. The platform connects those with spaces to rent out and those looking for places to stay. Consequently, it has grown into a global powerhouse in the multibillion-dollar hospitality industry because of its ability to offer travelers alternative accommodations away from hotels.

By offering a platform that connects hosts and guests, the company is able to generate fees on any transaction that takes place. Most of its revenues come from the 14% fee it charges guests who reserve accommodations on the platform. In addition, it generates some revenue from hosts by imposing a 3% fee on the booking fee. Therefore, the company profits from both the hosts and guests.

Airbnb's double-sided network means the more guests and hosts the company has on its platform, the more money it can make in booking fees. Its other revenue sources are experience, customer support and payment processing fees.

Airbnb soars to new heights as global travel rebounds

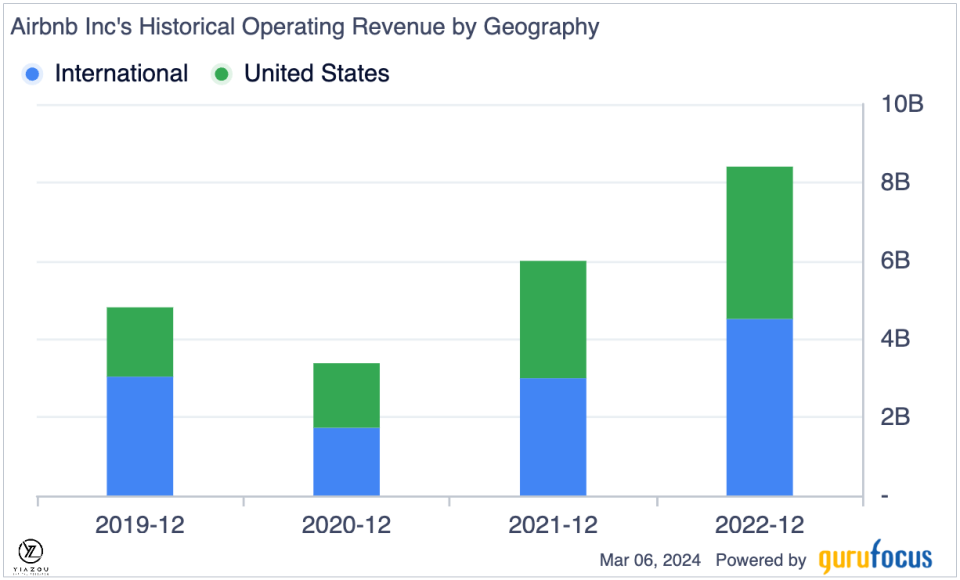

With the opening of the global economy following the easing of Covid-19 travel restrictions, the company has bounced back to profitability amid booming business. As more people travel to various destinations around the globe, Airbnb continues to record booming business on its platform, translating to more transaction fees and, thus, revenue.

Its revenue increased 18% to $9.90 billion in 2023, out of $73.30 billion in gross bookings. The company turned a profit of $4.80 billion in the year, representing a robust increase from $1.90 billion in 2022.

Despite the dip in 2020 that stemmed from the pandemic shutdowns that nearly destroyed the travel industry, revenue has been increasing consistently since 2018. Thus, the company's quick comeback to growth shows a resilient business model.

Apart from its strong revenue growth, Airbnb also maintains a solid balance sheet. The company exited 2023 with more than $10 billion in cash and short-term investments, and it has less than $2 billion in long-term debt.

Lastly, the company is using its cash prudently. In addition to investing the cash in the market and production expansion efforts, Airbnb is returning money to its investors through share repurchases.

Since announcing its first repurchase program in 2022, Airbnb has returned $3.80 billion to investors. It recently added $6 billion to its share repurchase program. The company had $750 million under its previous plan at the end of 2023.

Massive addressable market and expansion ffforts

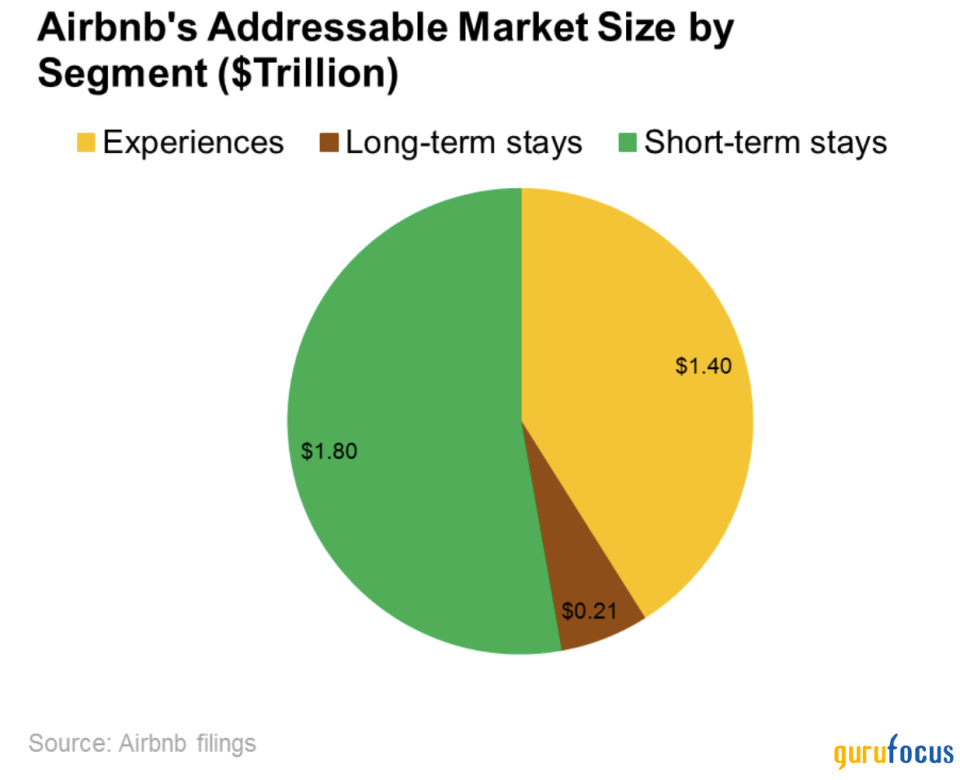

While it already pulls in considerable revenue, Airbnb sees more room to grow ahead. The company classifies its target markets into short-term stays, long-term stays and experiences.

Across these market segments, Airbnb estimates its addressable market opportunity to be $3.40 trillion. The short-term stay is the company's largest market segment, accounting for $1.80 trillion of the market opportunity.

Therefore, the company has a $1.40 trillion opportunity in the experience market and a $210 billion opportunity in the long-term stays market.

The experience market segment consists of activities that guests can participate in during their stays in a location. These include tours of the host's city and culture and activities like hiking in the local communities.

While it has already built a significant footprint in North America, Airbnb still has a limited presence overseas. The company has embarked on an international expansion drive to fuel revenue growth.

Airbnb is building a footprint in underpenetrated international markets like Germany, Brazil, Korea, Switzerland, the Netherlands and Belgium. In the international expansion drive, the company is focusing on brand awareness and localized services.

Huge untapped opportunities for Airbnb still exist in regions like Europe, Latin America and Asia-Pacific.

Expanding and diversifying the business

The company is expanding both its geographic footprint and its service scope.

Going into more countries and deepening its presence in existing markets allows the company to expand its host community and increase rental choices and variety for its guests. These initiatives help the company stay competitive and maximize the addressable market opportunities.

In addition to widening its geographic market, Airbnb is also expanding its service scope. The experience market segment is particularly promising since it remains a less-explored opportunity with vast revenue potential.

As the company's host and guest communities grow, it can also build adjacent businesses around them. For example, payment processing and other financial services present a huge business opportunity for the company.

Moreover, diversifying its services beyond home-sharinginto experiences, long-term accommodations, boutique hotels and transport serviceshas, according to Bailey Moran, transformed Airbnb into a multifaceted travel company.

Finally, Airbnb has developed a great business model with an enormous market opportunity. Therefore, expanding into additional countries and launching additional services put the company in a great position to continue driving strong revenue growth.

A leading market share in a competitive industry

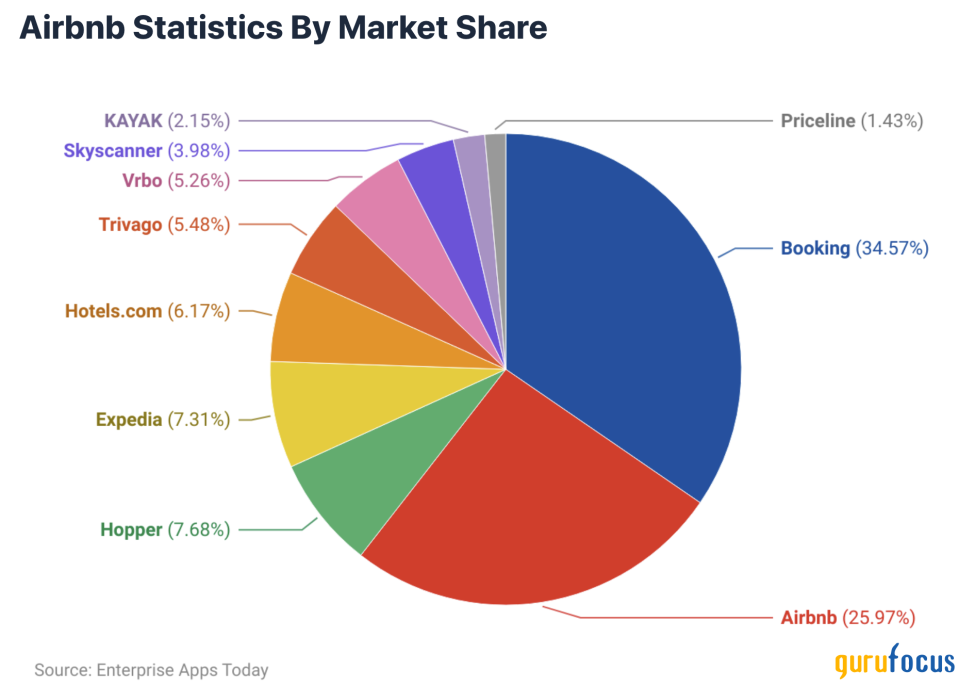

Though lucrative, the vacation rental market is fiercely competitive with many established participants.

However, Airbnb has disrupted the scene and captured a substantial market share of 26%, being among the top three players in the market.

The company's double-sided networkhosts on one side and guests on the otheris a great advantage. For example, as the number of hosts increases on the platform, rental space options and variety increases for guests.

Therefore, that incentivizes more guests to come to the platform, expanding the booking fee revenue opportunity for the company.

Source: enterpriseappstoday.com

Valuation

Airbnb went public in 2020 for $68 a share and started trading at $146 after a 112% price gain. Three years down the line, the stock has underperformed despite taking over the accommodation sector on the back of significant innovations.

The stock has gained less than 10% over the past three years. The biggest beneficiaries have been investors who bought the stock before it started trading.

Amid the underperformance, Airbnb looks undervalued while trading with a forward price-earnings multiple of 35 compared to the industry average, considering it is a growth stock. Its price-sales ratio of 11 is close to record lows at a time when the company is recording booming business, depicted by robust revenue growth.

While trading for just $159 a share, Airbnb seems fairly valued, as per the GF Score. However, the booming travel outlook and the company's improving fundamentals with growth and profitability from 2021 with the opening of the global economy support a favorable outlook for the stock.

U.S. market dependence and rising hotel competition threaten growth

One of the biggest risk factors associated with Airbnb is its dependence on the U.S. market. The company has always relied on American consumers' high travel demand. While travel has climbed significantly since the pandemic, the high interest rates could affect the ability of most Americans to travel.

With most companies slashing spending to conserve cash as economic growth stalls out, American travelers are also following suit. U.S. consumers going slow on travel could significantly impact Airbnb's ability to generate money.

On the other hand, Airbnb is also staring at resurgent competition from hotels that are also finding ways to stay competitive in the hospitality industry. Thus, offering affordable accommodations could pose significant competition that could affect Airbnb travel volumes.

Bottom line

Airbnb has maintained strong travel volumes above 2019 levels amid deteriorating economic conditions fuelled by runaway inflation. Likewise, the company remains well positioned for further growth in 2024 on the basis of improving consumer sentiment and economic conditions, supported by falling inflation and interest rates.

The company's growing market share and expansion into emerging markets, coupled with diversified offerings such as hotels and cruises, affirm its long-term prospects. The company has also started leveraging artificial intelligence to determine property pricing for photo arrangements that enhance the user experience and unlock new opportunities.

Finally, Airbnb's unique approach, growing market share and client base and rising revenue affirm why the stock is a long-term play.

This article first appeared on GuruFocus.