Airbnb: Strong Market Position Despite Earnings Miss

Airbnb (NASDAQ:ABNB) may be one of the best investments in the technology industry as it relates to travel and leisure at this time. I think that based on its software quality and diverse demographic reach, it has a significant advantage over its main competitors, Booking Holdings (NASDAQ:BKNG) and Expedia (NASDAQ:EXPE). I also consider it fairly valued, but there are risks related to the effective maintenance of its platform and associated reputation.

Future operations & market outlook

Airbnb is introducing four new property types: Vacation Home, Unique Space, B&B, and Boutique. It is also launching Collections, which are homes perfectly suited to specific occasions, like a family trip, a honeymoon, or a work stay. By expanding its scope of offerings in this way, the company is aiming to cater to the diverse needs of its users, potentially also attracting new customers.

It has also added two new tiers called Airbnb Plus and Beyond by Airbnb, which come under its luxury segment and will offer custom-designed trips, including the finest homes, unique experiences, and world-class hospitality.

The company is planning to use AI, most notably through its acquisition of the AI firm GamePlanner, creating its ultimate concierge' service. This intends to create a deeper level of personalization for users on the Airbnb app and website and marks the beginning of what should be an adaptive period of transforming its digital footprint.

Deloitte reports that the leisure travel industry may face a correction as it could have hit the peak of pent-up demand following lock-down restrictions during the pandemic. Despite a slower economic environment across the world at the moment, travel seems to remain a priority for many, including a desire for more diverse locations. The rise of hybrid and remote working options is also facilitating growth in leisure travel and accommodation options like those provided by Airbnb. On the flip side, there is less business travel, and so any income Airbnb was receiving from corporate customers could be negatively affected over the long term. This is a result primarily of the adoption of digital meetings like those provided by Zoom (ZOOM) and Microsoft (MSFT) Teams.

Profitability

Airbnb's last earnings results were announced on 2/13/2024, and it missed EPS GAAP expectations by $1.10, reporting negative $0.55. That's somewhat of a shock, considering the last year has been instrumental in providing evidence that the company will be able to retain profitability from here on out. Next quarter estimates are positive on consensus, but at the lowest part of the year in its earnings cycle.

However, investors will be pleased by its aggregate net margin of 48%, as provided by GuruFocus. This is in the top 5% of companies in the travel and leisure industry, and evidence of how strong profitability for Airbnb could become over the long term.

I've compared Airbnb to two of its major and older competitors to represent the power of income it could generate in the future:

Booking Holdings - net margin of 25.7%

Expedia - net margin of 6.21%

Both of these firms are utilizing AI, including machine learning and data analytics, and have a high digital footprint. Airbnb may have an advantage over Booking.com and Expedia, as it has user-friendliness and a higher focus on cutting-edge design and technology, as well as a wider range of properties on offer.

Financial stability & shareholder value

Airbnb's balance sheet is stable enough to make the stock investable, in my opinion. Its equity-to-asset ratio is 0.4, which is moderately lower than the industry median of 0.47. Consider how strong this is in comparison to Booking Holdings' equity-to-asset ratio of -0.02 and Expedia's of 0.07.

Shareholder returns have also been improved through the repurchase of common stock over the last two years, totaling $3,752 million. It also has not issued debt since 2021.

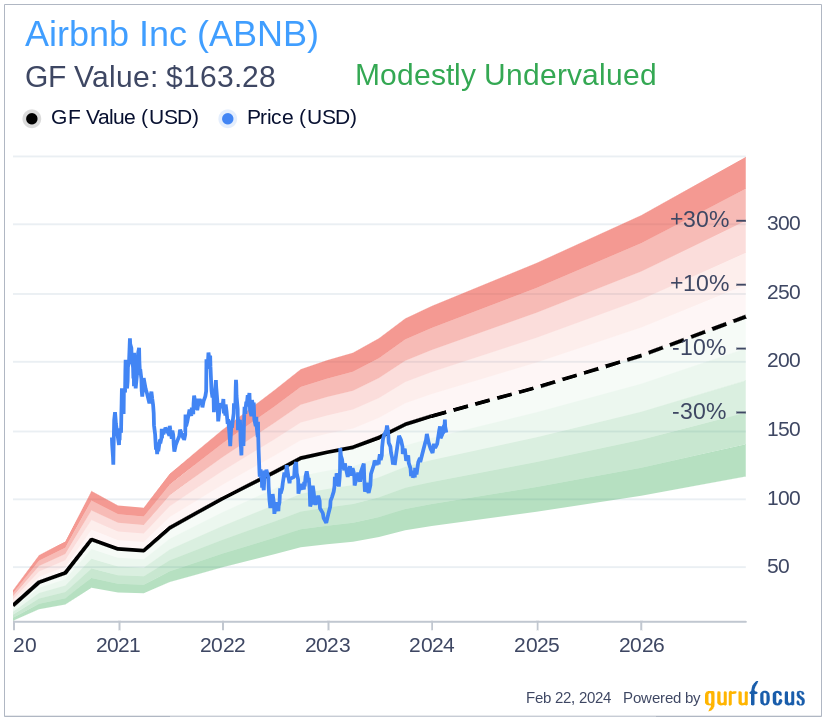

No margin of safety

The GF Value chart presents Airbnb stock as modestly undervalued at this time:

Investors might consider some present risk from its forward PE ratio of 32.7, much higher than the industry median of 16. However, its present PE ratio of 20.6 is equal to the industry median.

On analysis of the consensus EPS YoY growth estimates over the next decade, I have considered a 12.5% EPS without NRI growth rate as an annual average for my discounted cash flow analysis. I used the standard GuruFocus 4% terminal stage annual growth rate and a typical discount rate of 11%. My fair value estimate, when adding the company's tangible book value per share of $11.56, is $148.26, a -0.66% margin of safety on a stock price of $149.24. Therefore, I consider it reasonable to propose that Airbnb stock is fairly valued.

Notable risks

Heimdal Security reports that Airbnb faces reputational risks related to how it manages its platform, and it must ensure that it does not allow users that are on regulatory, terrorist, or sanctions watchlists. To prevent this, the firm is utilizing predictive analytics, behavioral analysis, and machine learning to assess the risk of each host, guest, and listing.

The company also faces cybersecurity threats, such as fake renting offers and infected Wi-Fi networks, which can seriously negatively impact the user experience and reviews of Airbnb's platform if significant issues occur. The organization has faced phishing campaigns and data privacy concerns in the past, and threats related to its cybersecurity are likely to proliferate with the advent of AI used by criminal enterprises. Therefore, it is paramount that the company invests heavily in advanced cybersecurity technologies for risk mitigation.

Conclusion

I think Airbnb could be an excellent long-term holding, and this may be the time to buy the company at the advent of it reporting profitability. There are risks, including significant competitors and reputational hazards in relation to how it manages its technology operations, but my analysis reveals that Airbnb may be one of the best investments in software travel & leisure. I estimate that the company is currently fairly valued, and my analyst rating for Airbnb stock is a moderate buy.

This article first appeared on GuruFocus.