AirIQ Inc.'s (CVE:IQ) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

AirIQ (CVE:IQ) has had a rough three months with its share price down 23%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Specifically, we decided to study AirIQ's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for AirIQ

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AirIQ is:

49% = CA$3.7m ÷ CA$7.6m (Based on the trailing twelve months to September 2023).

The 'return' is the profit over the last twelve months. So, this means that for every CA$1 of its shareholder's investments, the company generates a profit of CA$0.49.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

AirIQ's Earnings Growth And 49% ROE

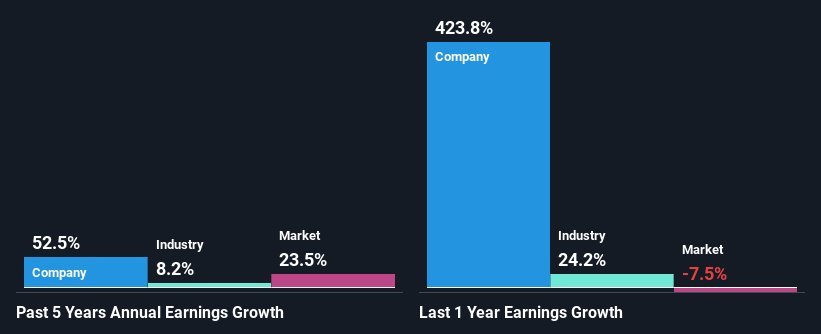

To begin with, AirIQ has a pretty high ROE which is interesting. Second, a comparison with the average ROE reported by the industry of 15% also doesn't go unnoticed by us. As a result, AirIQ's exceptional 52% net income growth seen over the past five years, doesn't come as a surprise.

We then compared AirIQ's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 8.2% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about AirIQ's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is AirIQ Using Its Retained Earnings Effectively?

AirIQ doesn't pay any dividend currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Conclusion

On the whole, we feel that AirIQ's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. Our risks dashboard would have the 3 risks we have identified for AirIQ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.