Airline Stock Roundup: Q3 Earnings Reports of LUV, ALK, SAVE & Others

In the past week, sector heavyweights like Alaska Air Group ALK and Southwest Airlines LUV reported third-quarter 2023 earnings. While air travel demand remained upbeat, high costs hurt results.

Meanwhile, Hawaiian Holdings’ HA loss widened in third-quarter 2023, owing to below-par revenues. Spirit Airlines’ SAVE revenues declined year over year due to the slowdown in domestic travel.

.More earnings-related updates are available in the previous week’s write-up.

Recap of the Past Week’s Most Important Stories

1. Southwest Airlines reported third-quarter 2023 earnings per share of 38 cents, which came in line with the Zacks Consensus Estimate but declined 24% on a year-over-year basis. Revenues of $6,525 million lagged the Zacks Consensus Estimate of $6,570.3 million but improved 4.9% year over year. Total adjusted operating expenses (excluding profit sharing, special items, fuel and oil expenses) increased 17.3%.

For 2023, Southwest Airlines continues to expect capacity to improve 14-15% from the 2022 level. Economic fuel costs per gallon are now estimated to be between $2.85 and $2.95 (prior view: $2.70 and $2.80). CASM, excluding fuel, oil and profit-sharing expenses, and special items, is still anticipated to decrease 1-2% in 2023 from 2022.

2. Alaska Air reported third-quarter 2023 earnings per share of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year. Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line inched up 0.4% year over year. For the fourth quarter of 2023, Alaska Air expects capacity to improve 11-14% from the year-ago reported figure.

Cost per available seat mile, excluding fuel and special items, is expected to decline 3-5% year over year. Total revenues are anticipated to grow 1-4% year over year. ALK, currently carrying a Zacks Rank #3 (Hold), forecasts economic fuel cost per gallon in the $3.30-$3.40 band. Adjusted pre-tax margin is anticipated between 0% and 2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3. Hawaiian Holdings posted third-quarter 2023 loss (excluding 12 cents from non-recurring items) of $1.06 per share, wider than the Zacks Consensus Estimate of a loss of 76 cents. In the year-ago quarter, HA had incurred a loss of 15 cents.

Quarterly revenues of $727.7 million fell 1.8% year over year and missed the Zacks Consensus Estimate of $743.1 million. Quarterly revenues were hurt by a devastating wildfire in Lahaina in West Maui. Management now expects the current-year fuel price per gallon to be $2.89 (prior view: $2.78).

4. Spirit Airlines’ third-quarter 2023 loss (excluding 7 cents from non-recurring items) of $1.37 per share was narrower than the Zacks Consensus Estimate of a loss of $1.47. In the year-ago quarter, SAVE reported earnings of 3 cents per share. Revenues of $1,258.5 million edged past the Zacks Consensus Estimate of $1,251 million. However, the top line declined 6.3% year over year. In third-quarter 2023, passenger revenues, which accounted for the bulk of the top line (98%), decreased 6.7% year over year to $1,233.9 million, highlighting the slowdown in domestic travel. Other revenues increased 16.7% year over year to $24.7 million.

For fourth-quarter 2023, management expects total revenues in the $1.28-$1.32 billion range. Management believes that SAVE will experience discounted fares for the off-peak travel periods throughout the fourth quarter of 2023. Adjusted operating margin is expected to be between -15% and -19%. Fuel gallons consumed are expected to be $156 million. Fuel price per gallon is anticipated to be $3.15. The effective tax rate is projected to be 22.6%. Available seat miles are anticipated to increase 14.7% from fourth-quarter 2022 actuals. Available seat miles are anticipated to increase 7% in first-quarter 2024 from first-quarter 2023 actuals.

Price Performance

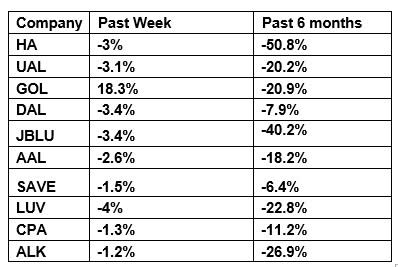

The following table shows the price movement of the major airline players over the past week and during the past six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the red in the past week. As a result, the NYSE ARCA Airline Index declined 1.3% over the period to $48.57. Over the course of the past six months, the sector tracker declined 13.3%.

What's Next in the Airline Space?

JetBlue Airways JBLU is scheduled to report its third-quarter earnings on Oct 31. While passenger revenues are likely to have been impressive, high costs are likely to have dented the bottom-line performance in the to-be-reported quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report