Akamai (AKAM) Q3 Earnings Beat Estimates, Revenues Surge Y/Y

Akamai Technologies, Inc. AKAM reported impressive third-quarter 2023 results, with the bottom and the top line surpassing the respective Zacks Consensus Estimate. The company recorded higher revenues year over year, driven by healthy demand trends in multiple end markets. Strength in API security solutions was a positive factor. The introduction of enticing features in Security solutions, such as additional security configurations and more advanced rate control policies, have been driving more value to the customers and boosting the top line.

Net Income

GAAP net income rose to $160.5 million or $1.04 per share from $123.7 million or 78 cents per share in the year-ago quarter. Solid net sales growth positively affected the bottom line during the quarter.

Non-GAAP net income was $251.1 million or $1.63 per share, up from $200 million or $1.26 per share a year ago. The bottom line beat the Zacks Consensus Estimate by 12 cents.

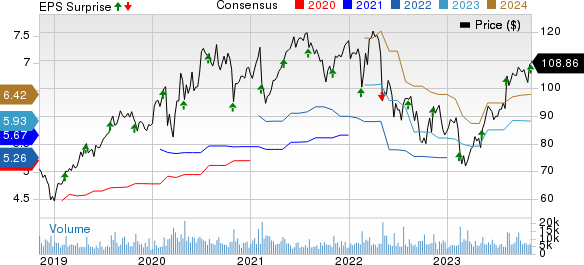

Akamai Technologies, Inc. Price, Consensus and EPS Surprise

Akamai Technologies, Inc. price-consensus-eps-surprise-chart | Akamai Technologies, Inc. Quote

Revenues

The company generated $965.5 million in revenues compared with $881.9 million reported in the year-ago quarter. Solid momentum in the Security and Compute vertical drove the top line during the quarter. Revenues beat the Zacks Consensus Estimate of $945 million.

By product groups, revenues from Security Technology Group were $455.8 million compared with $379.5 million in the year-ago quarter. The 20% year-over-year growth was primarily driven by strength in segmentation products. The company also witnessed a healthy demand for Web Application Firewall solutions. Net sales surpassed our estimate of $442.3 million.

The Delivery segment contributed $379.3 million, down from $393.2 million in the year-earlier quarter. Despite the decline, few CDN clients acquired from StackPath partially cushioned the top line in this segment. The segment’s revenues surpassed our estimate of $370.4 million.

The Compute segment registered $130.4 million in revenues, up from $109.1 million in the prior-year quarter. The company expanded its cloud computing partner ecosystem during the quarter. It also secured multiple deals with prominent enterprises worldwide in various end markets, including financial institutions, media companies, e-commerce, digital advertising and more. The top line beat our estimate of $129.3 million.

Region-wise, net sales from the United States came in at $498.5 million, up 8% year over year. International revenues stood at $466.9 million, up from $420.8 million in the year-earlier quarter.

Other Details

In the September quarter, total operation expenses rose to $789.4 million from $721.5 million. Non-GAAP income from operations improved to $295.9 million from $242.6 million, with respective margins of 31% and 28%. Top-line growth, combined with cost-optimization actions, boosted the operating income. Adjusted EBITDA was $417.6 million, up from $368.5 million in the year-ago quarter.

Cash Flow & Liquidity

In the third quarter of 2023, Akamai generated $359.4 million in cash from operating activities compared with $369.3 million in the prior-year quarter. As of Sep 30, 2023, the company had $459.9 million in cash and cash equivalents with $760.7 million of operating lease liabilities. During the quarter, it repurchased approximately 1.1 million shares for around $113 million.

Outlook

For the fourth quarter of 2023, Akamai estimates revenues in the range of $985-$1,005 million. Non-GAAP operating margin is projected at 29%. Non-GAAP earnings are forecasted in the range of $1.57-$1.62 per share. Capital expenditure is anticipated to be 15% of revenues.

For 2023, Akamai upgraded its revenue guidance to $3,802-$3,822 million from $3,765-$3,795 million estimated previously. It expects a non-GAAP operating margin of 29%. Non-GAAP earnings are now expected in the range of $6.08-6.13 per share, up from $5.87-$5.95 per share. Capital expenditure is likely to be around 19% of total revenues.

Zacks Rank & Stocks to Consider

Akamai currently has a Zacks Rank #3 (Hold).

Model N Inc MODN, sporting a Zacks Rank #1 (Strong Buy) at present, delivered an earnings surprise of 21.26%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 45.83%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MODN provides revenue management solutions for life sciences and technology companies, including applications for configuration, price, quote, rebate management and regulatory compliance.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, presently carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12%, on average, in the trailing four quarters.

ANET holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gigabit high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report