Akamai (NASDAQ:AKAM) Posts Q4 Sales In Line With Estimates But Stock Drops

Web content delivery and security company Akamai (NASDAQ:AKAM) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 7.2% year on year to $995 million. On the other hand, the company expects next quarter's revenue to be around $990 million, slightly below analysts' estimates. It made a non-GAAP profit of $1.69 per share, improving from its profit of $1.37 per share in the same quarter last year.

Is now the time to buy Akamai? Find out by accessing our full research report, it's free.

Akamai (AKAM) Q4 FY2023 Highlights:

Revenue: $995 million vs analyst estimates of $999.7 million (small miss)

EPS (non-GAAP): $1.69 vs analyst estimates of $1.61 (4.7% beat)

Revenue Guidance for Q1 2024 is $990 million at the midpoint, below analyst estimates of $995.4 million

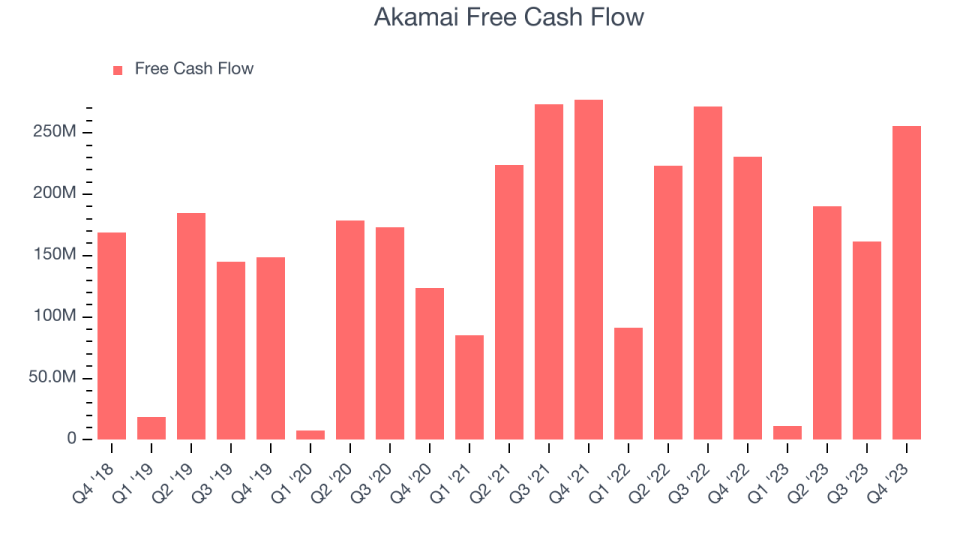

Free Cash Flow of $255.3 million, up 57.8% from the previous quarter

Gross Margin (GAAP): 60.5%, down from 61.6% in the same quarter last year

Market Capitalization: $19.33 billion

"Akamai's fourth quarter financial performance capped off an excellent year for the company highlighted by very strong profitability," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

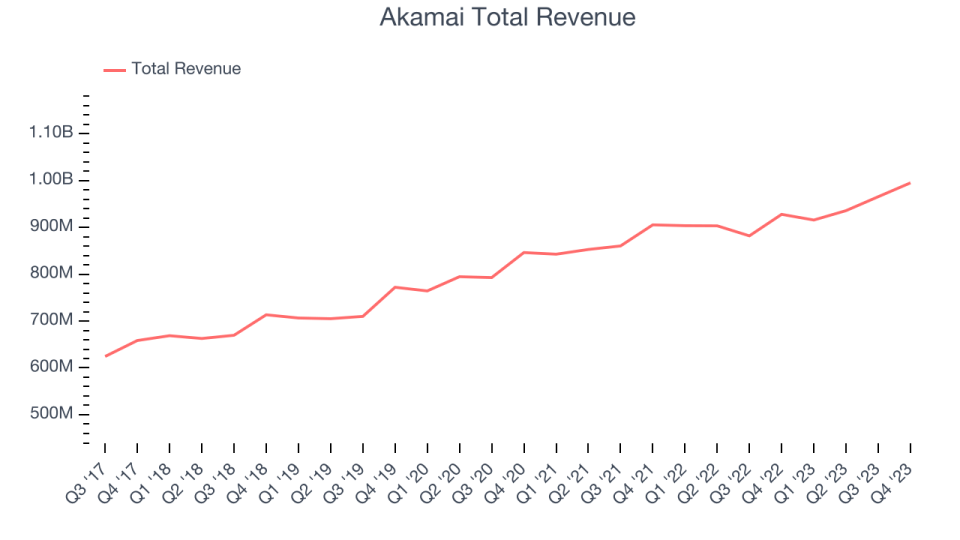

Sales Growth

As you can see below, Akamai's revenue growth has been unimpressive over the last two years, growing from $905.4 million in Q4 FY2021 to $995 million this quarter.

Akamai's quarterly revenue was only up 7.2% year on year, which might disappoint some shareholders. We can see that revenue increased by $29.53 million in Q4, which was roughly the same as in Q3 2023.

Next quarter's guidance suggests that Akamai is expecting revenue to grow 8.1% year on year to $990 million, improving on the 1.3% year-on-year increase it recorded in the same quarter last year.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Akamai's free cash flow came in at $255.3 million in Q4, up 10.7% year on year.

Akamai has generated $618.4 million in free cash flow over the last 12 months, a solid 16% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Akamai's Q4 Results

We struggled to find many strong positives in these results. Akamai missed Wall Street's revenue estimates and guidance for next quarter also came in weaker than expected. The company is down 5.6% on the results and currently trades at $118.2 per share.

Akamai may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.