Akamai Technologies Inc (AKAM) Reports Solid Q4 and Full-Year 2023 Financial Results

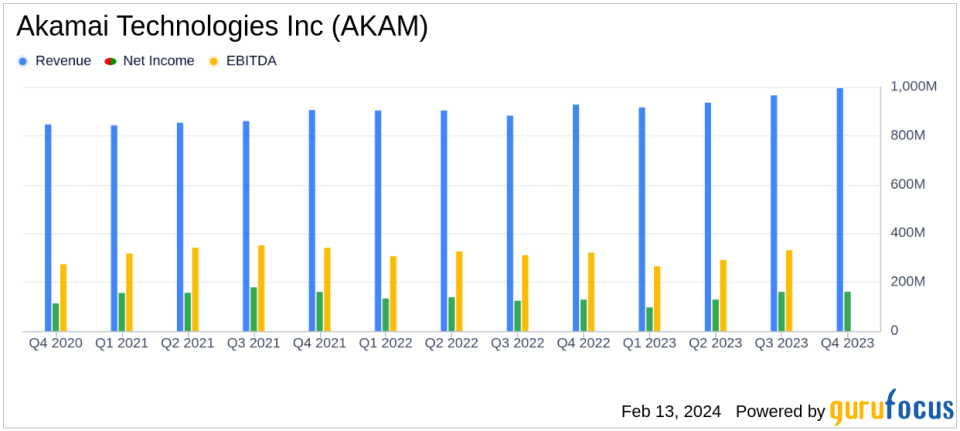

Revenue: Q4 revenue increased by 7% year-over-year to $995 million; full-year revenue up 5% to $3.812 billion.

Net Income: GAAP net income per diluted share for Q4 up 26% year-over-year; full-year GAAP net income per diluted share increased by 8%.

Security and Compute Revenue: Security revenue grew by 18% in Q4; compute revenue up 20%, both contributing significantly to the overall revenue mix.

International Growth: International revenue for Q4 increased by 8% year-over-year, showing strong global performance.

Share Repurchases: In 2023, AKAM repurchased 7.8 million shares of its common stock, reflecting confidence in its financial health.

Financial Guidance: Positive outlook for Q1 2024 with revenue expected between $980 million to $1 billion and continued growth projected for the full year.

Akamai Technologies Inc (NASDAQ:AKAM) released its 8-K filing on February 13, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its content delivery network (CDN) and cybersecurity services, reported a 7% increase in Q4 revenue year-over-year, reaching $995 million. This growth was bolstered by its security and compute segments, which now represent 61% of total revenue. For the full year, revenue rose by 5% to $3.812 billion, with security and compute revenue growing by 17%.

Performance Highlights and Challenges

Akamai's performance in the fourth quarter and throughout 2023 was marked by significant achievements, particularly in its security and compute businesses. The security segment's revenue for Q4 was $471 million, marking an 18% increase year-over-year, while the compute segment saw a 20% rise to $135 million. This growth is critical as it demonstrates the company's successful pivot towards high-demand cloud services and cybersecurity solutions, areas that are increasingly important in the digital economy.

Despite these successes, Akamai faced challenges in its delivery segment, which experienced a 6% decline in Q4 revenue and an 8% decrease for the full year. This downturn reflects the highly competitive nature of the CDN market and potential shifts in customer preferences or industry dynamics. As the delivery segment still constitutes a significant portion of Akamai's business, continued declines could pose future risks.

Financial Achievements and Importance

The company's financial achievements in 2023 underscore its operational efficiency and strategic focus. GAAP net income per diluted share for the fourth quarter increased by 26% year-over-year to $1.03, and non-GAAP net income per diluted share rose by 23% to $1.69. For the full year, GAAP net income per diluted share was $3.52, an 8% increase, with non-GAAP net income per diluted share at $6.20, up by 15%. These metrics are vital as they reflect the company's profitability and ability to deliver shareholder value in a competitive software industry.

Key Financial Metrics and Commentary

Dr. Tom Leighton, Akamai's CEO, commented on the results, stating:

"Akamais fourth quarter financial performance capped off an excellent year for the company highlighted by very strong profitability. We were very pleased with our Security and Cloud Computing results in 2023 which now represent 60% of total revenue. Looking to 2024, we plan to continue driving profitability in delivery, expanding our market leading security offerings, and extending our cloud computing platform to the edge to provide customers with better performance at a lower cost."

Other key financial details include:

Financial Metrics | Q4 2023 | Full-Year 2023 |

|---|---|---|

Adjusted EBITDA | $426 million | $1.608 billion |

Cash from Operations | $389 million | $1.348 billion |

Share Repurchases | $55 million | $654 million |

Adjusted EBITDA for Q4 increased by 12% to $426 million, and cash from operations was $389 million, representing 39% of revenue. These metrics highlight the company's strong cash generation capabilities and operational efficiency.

Analysis and Outlook

Looking ahead, Akamai provided positive financial guidance for Q1 2024, with revenue expected to be between $980 million and $1 billion and a non-GAAP operating margin between 29% and 30%. The company also anticipates continued growth throughout 2024, with security and compute segments expected to maintain their upward trajectory.

Akamai's balance sheet remains robust, with $2.3 billion in cash, cash equivalents, and marketable securities as of December 31, 2023. The company's strategic investments in security and cloud computing are paying off, positioning it well for future growth in these critical areas. However, the decline in delivery revenue will be an area to monitor in the coming quarters.

For value investors and potential GuruFocus.com members, Akamai Technologies Inc (NASDAQ:AKAM) presents a compelling case of a company successfully navigating the transition towards high-growth segments in the software industry while maintaining strong financial health.

Explore the complete 8-K earnings release (here) from Akamai Technologies Inc for further details.

This article first appeared on GuruFocus.