Akebia Therapeutics Inc (AKBA) Reports Steady Revenue and a Profitable Quarter

Revenue: Auryxia net product revenue reached $170.3 million in 2023.

Net Income: Transitioned from a net loss in Q4 2022 to a net income of $0.6 million in Q4 2023.

Research and Development: R&D expenses decreased to $9.9 million in Q4 2023 from $32.1 million in Q4 2022.

Selling, General and Administrative Expenses: SG&A expenses were reduced to $25.4 million in Q4 2023.

Cash Position: Cash and cash equivalents stood at approximately $42.9 million as of December 31, 2023.

Debt Financing: Secured $55.0 million term loan financing and raised $26.0 million from ATM offerings.

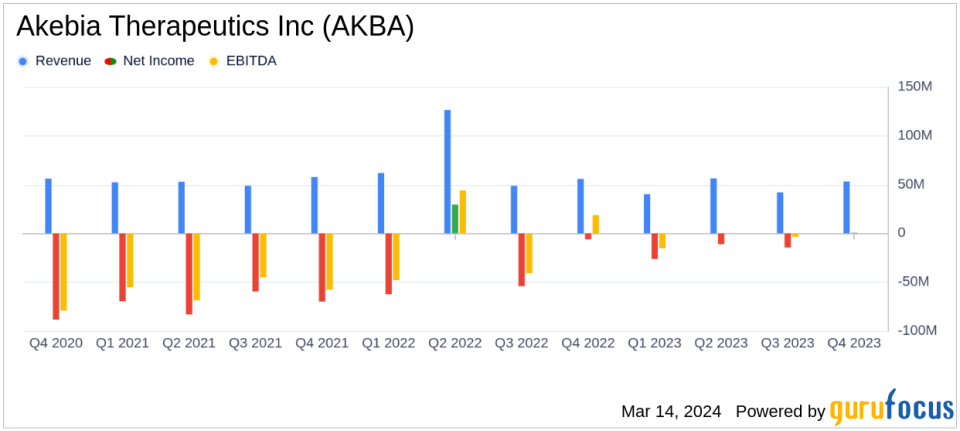

On March 14, 2024, Akebia Therapeutics Inc (NASDAQ:AKBA) released its 8-K filing, detailing the fourth quarter and full-year financial results for 2023, along with recent business highlights. Akebia Therapeutics, a biopharmaceutical company focused on kidney disease, is on the cusp of a potential transformation with the upcoming PDUFA date for vadadustat on March 27, 2024.

Company Overview

Akebia Therapeutics Inc operates in the biopharmaceutical industry, dedicated to developing and commercializing novel therapeutics for individuals suffering from kidney disease. Its portfolio includes Auryxia for controlling serum phosphorus levels and treating iron deficiency anemia in adults with chronic kidney disease, and vadadustat, an oral treatment for anemia due to chronic kidney disease in adults, approved in Japan and awaiting approval in the U.S.

Financial Performance and Challenges

The company reported a slight increase in total revenues for the fourth quarter of 2023, amounting to $56.2 million compared to $55.8 million in the same quarter of the previous year. Full-year revenues, however, saw a decline from $292.5 million in 2022 to $194.6 million in 2023. This decrease is primarily attributed to lower license, collaboration, and other revenues, which dropped significantly from $115.5 million in 2022 to $24.3 million in 2023.

Despite the overall decrease in annual revenue, Akebia Therapeutics managed to report a net income of $0.6 million in the fourth quarter of 2023, a notable improvement from a net loss of $6.1 million in the fourth quarter of 2022. This performance is crucial as it demonstrates the company's ability to achieve profitability despite revenue challenges, which is particularly important in the biotechnology industry where research and development costs can be substantial.

Financial Achievements and Importance

Akebia's financial achievements in 2023 include managing its expenses effectively, with a significant reduction in research and development expenses from $130.0 million in 2022 to $63.1 million in 2023, and a decrease in selling, general, and administrative expenses from $138.6 million in 2022 to $100.2 million in 2023. These reductions reflect the company's strategic focus on managing costs while preparing for the potential launch of vadadustat.

Additionally, the company strengthened its balance sheet through a new debt facility with BlackRock, providing access to $55.0 million in borrowing capacity, and raised approximately $26.0 million in gross proceeds from its ATM offering. These financial strategies are important for Akebia as they provide the necessary capital to support operations and invest in the potential launch of vadadustat, which could be a significant growth driver for the company.

Key Financial Metrics

Important metrics from Akebia's financial statements include:

"Net product revenues were $53.2 million for the fourth quarter of 2023 compared to $50.3 million for the fourth quarter of 2022, and $170.3 million for the full-year 2023 compared to $176.9 million for the full-year 2022."

These metrics are essential as they provide insight into the company's core revenue-generating capabilities and its ability to sustain and grow its product sales over time.

Analysis of Performance

Akebia's performance in 2023 reflects a company in transition, with a focus on cost management and preparation for potential product launches. The company's ability to turn a profit in the fourth quarter, despite a decrease in annual revenue, indicates a disciplined approach to expense control and strategic financial planning. The upcoming PDUFA date for vadadustat represents a critical milestone that could significantly impact the company's future trajectory.

Akebia's current cash position and financing arrangements suggest that it has sufficient resources to fund operations for at least two years if vadadustat is approved. This financial stability is vital for the company's continued research and development efforts and for maintaining investor confidence.

For value investors and potential GuruFocus.com members, Akebia Therapeutics Inc (NASDAQ:AKBA) presents a case of a biopharmaceutical company navigating the complexities of product development and commercialization, with a keen eye on financial health and strategic growth opportunities.

Explore the complete 8-K earnings release (here) from Akebia Therapeutics Inc for further details.

This article first appeared on GuruFocus.