Aker Solutions (OB:AKSO) Shareholders Have Enjoyed A 35% Share Price Gain

While Aker Solutions ASA (OB:AKSO) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 10% in the last quarter. In contrast the stock is up over the last three years. In that time, it is up 35%, which isn't bad, but not amazing either.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for Aker Solutions

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

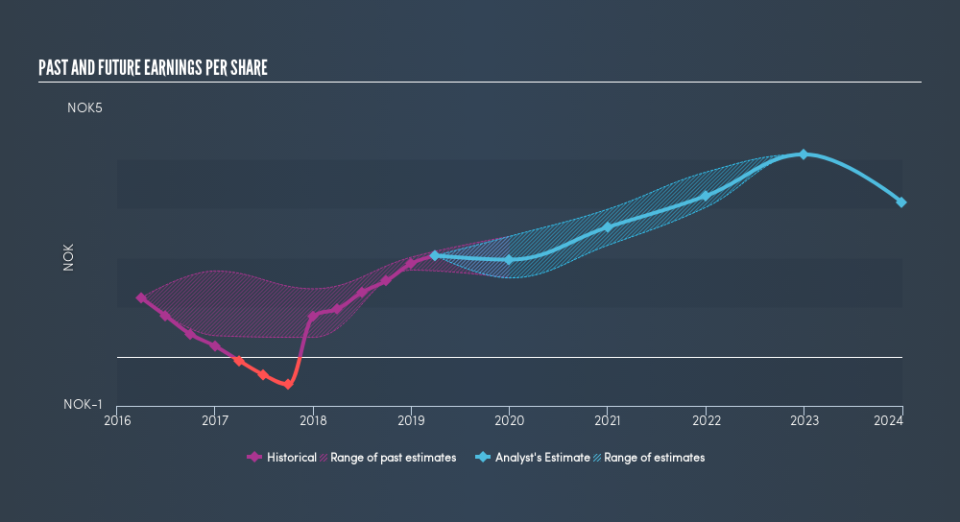

During three years of share price growth, Aker Solutions achieved compound earnings per share growth of 20% per year. This EPS growth is higher than the 10% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Aker Solutions has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

The last twelve months weren't great for Aker Solutions shares, which performed worse than the market, costing holders 30%. Meanwhile, the broader market slid about 2.0%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 10% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before forming an opinion on Aker Solutions you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.