AkzoNobel (AKZOY) New Investments to Fuel North American Growth

AkzoNobel N.V. AKZOY, a leading global paints and coatings company, is taking steps to improve its North America industrial operations and deliver innovative solutions to customers in the region. The company's latest investments include a state-of-the-art pilot manufacturing plant in Huron, OH, and a new regional research and development center in High Point, NC. With a focus on advanced technologies, AkzoNobel aims to create groundbreaking advancements in its industrial operations and enhance its product offerings.

By harnessing the power of data analytics, AkzoNobel aims to transform its manufacturing processes, ensuring agility in response to market changes and customer demands. This approach enables seamless information flow from the laboratory to the factory floor, resulting in improved efficiency and customer satisfaction.

The new R&D center in High Point will primarily serve AkzoNobel's Wood Coatings business. By bringing together multidisciplinary teams of researchers, the company aims to drive innovation and develop cutting-edge solutions for its customers. Moreover, the R&D center will expedite the process of transferring new discoveries from the laboratory to manufacturing production plants, ensuring a swift response to market demands.

The pilot manufacturing plant in Huron will join AkzoNobel's global network of pilot plants and support its Packaging, Marine and Automotive businesses. Ohio, with its strategic location and existing AkzoNobel facilities in Huron, Strongsville, Springfield, and Columbus, has the company's largest footprint in North America. This expansion reinforces AkzoNobel's commitment to the region and positions it for continued success.

In addition to the new R&D center in High Point, AkzoNobel maintains a network of R&D centers across North America, supporting its Performance Coatings businesses. These centers, located in Troy, MI, Strongsville, OH, Houston, TX, Flying Hills, PA and Lancaster, SC, enable the company to invest in science and technology while providing direct access to sustainable product development for its customers.

AkzoNobel's investments in advanced technologies, including the new pilot plant in Huron and the R&D center in High Point, signify the company's dedication to delivering innovative solutions and driving step-change improvements in its North America operations. These strategic moves ensure AkzoNobel's position as a frontrunner in the industry and set the stage for transformative growth.

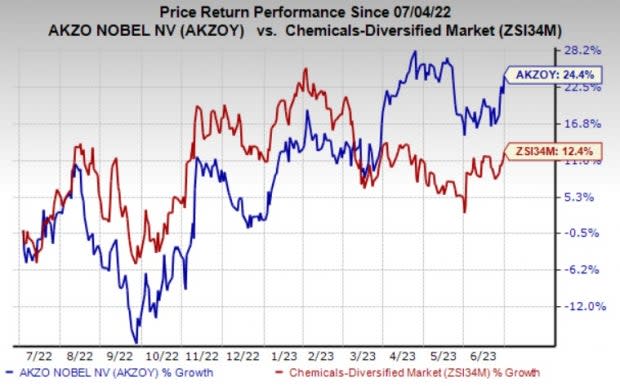

AKZOY’s shares have rallied 24.4% in the past year compared with the 12.4% rise of its industry. The Zacks Consensus Estimate for the company’s current-year earnings has been revised 1.4% upward in the past 60 days.

Image Source: Zacks Investment Research

AkzoNobel expects its organic volume growth to be impacted by the ongoing macro-economic uncertainties. It is taking actions to manage margins, reduce costs, normalize working capital and de-leverage its balance sheet. Its cost-cutting actions are expected to mitigate the sustained pressure from inflation in operating costs this year. AKZOY sees decreasing raw material costs to favorably impact its profitability in 2023.

Akzo Nobel NV Price and Consensus

Akzo Nobel NV price-consensus-chart | Akzo Nobel NV Quote

Zacks Rank & Key Picks

AKZOY currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include L.B. Foster Company FSTR, Koppers Holdings Inc. KOP and Linde plc LIN.

L.B. Foster currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for FSTR's current-year earnings has been stable over the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

L.B. Foster’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 140.5%, on average. FSTR shares have gained around 11% in a year.

Koppers currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for KOP’s current-year earnings has been stable over the past 60 days.

The consensus estimate for current-year earnings for KOP is currently pegged at $4.40, reflecting an expected year-over-year growth of 6.3%. Koppers’ shares have rallied roughly 48% in the past year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 1% upward in the past 60 days.

Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN shares have risen roughly 33% in the past year.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report