Al Gore's Generation Investment Management Boosts Stake in Trimble Inc by 1.4%

Insights from the Latest 13F Filing Reveal Key Portfolio Adjustments

Al Gore (Trades, Portfolio), through his investment firm Generation Investment Management, has made notable changes to its portfolio in the fourth quarter of 2023. The firm, co-founded by Gore and David Blood in 2004, is renowned for its commitment to long-term, sustainable investing. With a team that speaks over 25 languages and represents more than 20 countries, Generation Investment Management serves a diverse clientele, including pension plans and charitable organizations. The firm's investment strategy is deeply rooted in sustainability, focusing on companies that effectively manage their economic, social, and environmental impacts. By identifying key drivers of global change, such as climate change and resource scarcity, Generation seeks to capitalize on both the risks and opportunities these issues present.

Summary of New Buys

Al Gore (Trades, Portfolio)'s firm has introduced new positions into its portfolio, with the most significant addition being:

Accenture PLC (NYSE:ACN), purchasing 815,650 shares, which now represent 1.3% of the portfolio and are valued at approximately $286.22 million.

Key Position Increases

Generation Investment Management has also increased its stakes in several companies, with the most noteworthy being:

Trimble Inc (NASDAQ:TRMB), where an additional 5,796,030 shares were acquired, bringing the total to 12,270,440 shares. This move marks an 89.52% increase in shares held and has a 1.4% impact on the current portfolio, with a total value of $652.79 million.

Danaher Corp (NYSE:DHR), with an additional 313,891 shares, increasing the total to 3,026,053 shares. This represents an 11.57% increase in share count, with a total value of $700.05 million.

Summary of Sold Out Positions

Al Gore (Trades, Portfolio)'s firm has completely divested from certain holdings in the last quarter, including:

S&P 500 ETF TRUST ETF (SPY), where all 51,603 shares were sold, impacting the portfolio by -0.12%.

Key Position Reductions

Significant reductions were made in several stocks, with the most substantial being:

Palo Alto Networks Inc (NASDAQ:PANW), which saw a reduction of 882,171 shares, equating to a 66.27% decrease and a -1.09% portfolio impact. The stock traded at an average price of $267.41 during the quarter and has seen a 42.99% return over the past three months and a 26.64% year-to-date return.

Trane Technologies PLC (NYSE:TT), reduced by 943,549 shares, resulting in a 23.76% decrease and a -1.01% impact on the portfolio. The stock's average trading price was $218.78 for the quarter, with a 19.26% return over the past three months and an 11.62% year-to-date return.

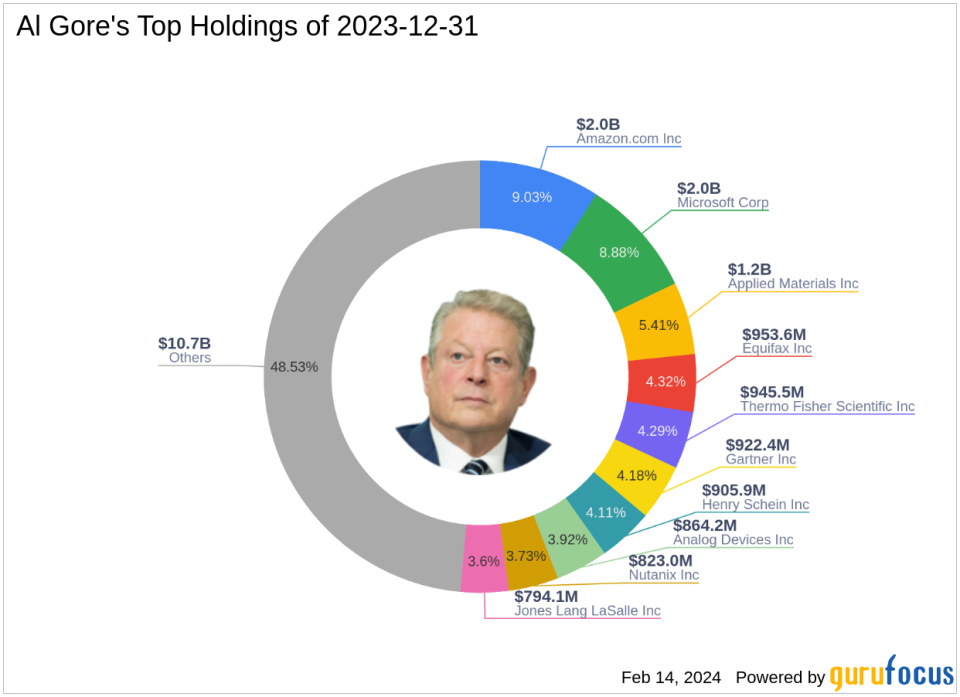

Portfolio Overview

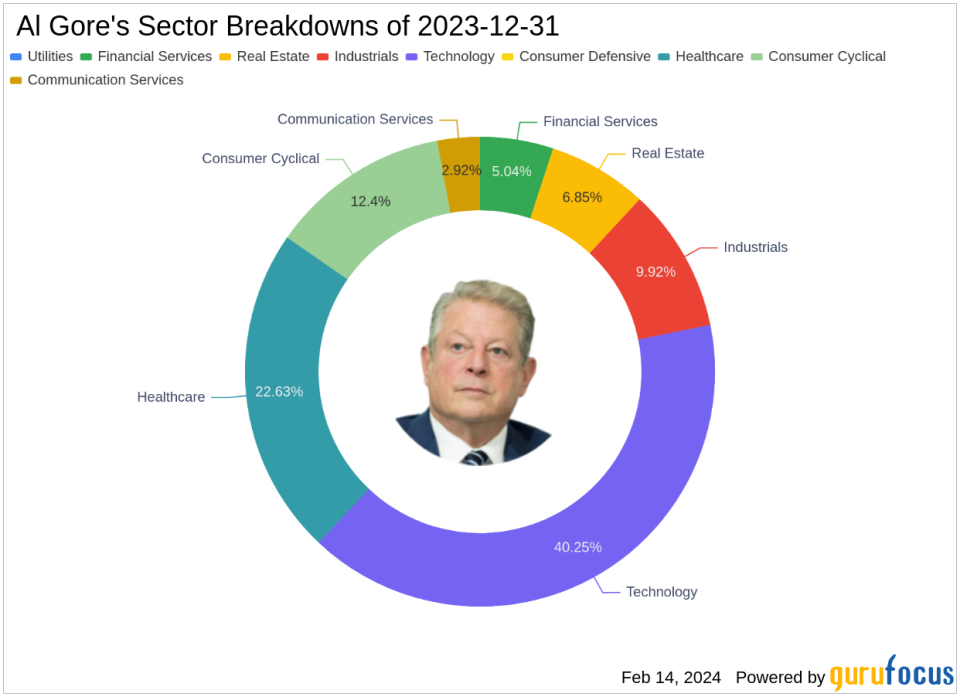

As of the fourth quarter of 2023, Al Gore (Trades, Portfolio)'s portfolio consists of 44 stocks. The top holdings include 9.03% in Amazon.com Inc (NASDAQ:AMZN), 8.88% in Microsoft Corp (NASDAQ:MSFT), 5.41% in Applied Materials Inc (NASDAQ:AMAT), 4.32% in Equifax Inc (NYSE:EFX), and 4.29% in Thermo Fisher Scientific Inc (NYSE:TMO). The investments are primarily concentrated across seven industries: Technology, Healthcare, Consumer Cyclical, Industrials, Real Estate, Financial Services, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.