Al Gore's Generation Investment Management Q2 2023 Portfolio Update

Generation Investment Management, a London-based investment management firm, recently filed its 13F report for the second quarter of 2023. The firm, co-founded by Al Gore (Trades, Portfolio) and David Blood in 2004, is dedicated to long-term investing, integrated sustainability research, and client alignment. With additional locations in New York, Washington D.C., and Sydney, the firm represents over 20 countries and 25 languages. Catering to a diverse client base, including pooled investment vehicles, pension and profit sharing plans, and charitable organizations, Generation Investment Management offers a range of strategies in its product lineup.

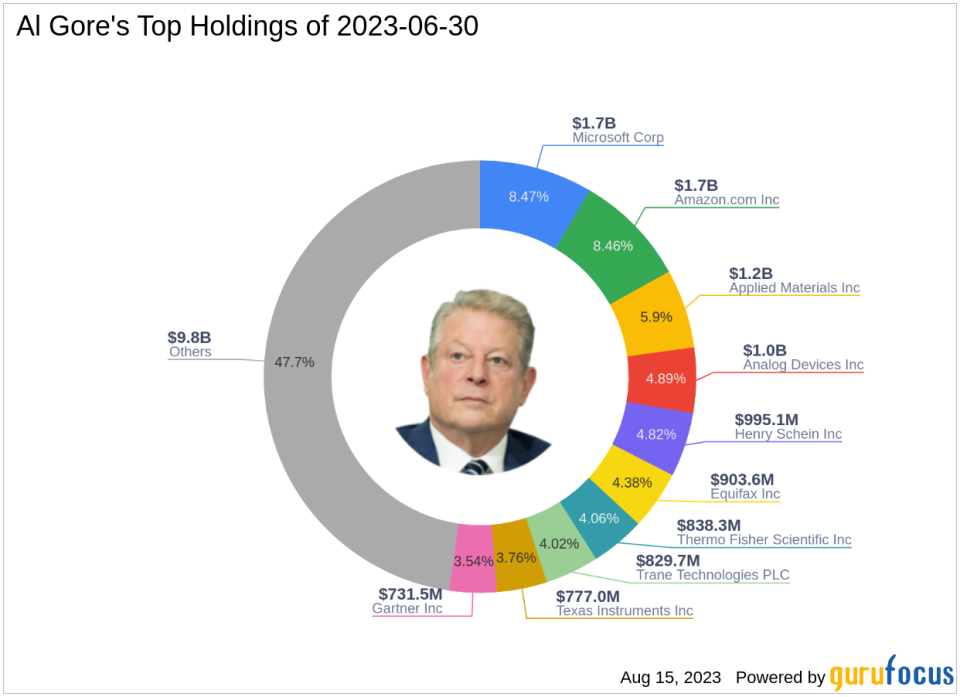

Portfolio Overview

The firm's portfolio for Q2 2023 contained 44 stocks with a total value of $20.65 billion. The top holdings were Microsoft (MSFT) at 8.47%, Amazon (AMZN) at 8.46%, and Applied Materials (AMAT) at 5.90%.

Top Three Trades of the Quarter

The firm's top three trades of the quarter included new positions in Waters Corp (NYSE:WAT) and Danaher Corp (NYSE:DHR), and a reduction in The Cooper Companies Inc (NYSE:COO).

Waters Corp (NYSE:WAT)

Generation Investment Management established a new position in Waters Corp (NYSE:WAT), purchasing 1,458,829 shares, which now represents 1.88% of the equity portfolio. The shares were traded at an average price of $278.8 during the quarter. As of August 15, 2023, Waters Corp had a market cap of $16.86 billion and a stock price of $285.205. Despite a -13.80% return over the past year, GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 10 out of 10. The company's valuation ratios include a P/E ratio of 25.15, a P/B ratio of 21.84, a PEG ratio of 2.19, a EV-to-Ebitda ratio of 19.36, and a P/S ratio of 5.66.

Danaher Corp (NYSE:DHR)

The firm also increased its stake in Danaher Corp (NYSE:DHR) by purchasing an additional 992,593 shares, bringing the total holding to 2,477,437 shares. This trade had a 1.15% impact on the equity portfolio. The stock was traded at an average price of $239 during the quarter. As of August 15, 2023, Danaher Corp had a market cap of $188.80 billion and a stock price of $255.7. Despite a -15.02% return over the past year, GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10. The company's valuation ratios include a P/E ratio of 30.01, a P/B ratio of 3.65, a PEG ratio of 1.21, a EV-to-Ebitda ratio of 20.58, and a P/S ratio of 6.26.

The Cooper Companies Inc (NYSE:COO)

Conversely, Generation Investment Management reduced its investment in The Cooper Companies Inc (NYSE:COO) by 487,546 shares, impacting the equity portfolio by 0.97%. The stock was traded at an average price of $375.08 during the quarter. As of August 15, 2023, The Cooper Companies had a market cap of $18.68 billion and a stock price of $377.36. Despite a 13.27% return over the past year, GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. The company's valuation ratios include a P/E ratio of 65.06, a P/B ratio of 2.53, a PEG ratio of 11.22, a EV-to-Ebitda ratio of 25.88, and a P/S ratio of 5.50.

In conclusion, Generation Investment Management's Q2 2023 portfolio shows a strategic focus on long-term investments with sustainable growth potential. The firm's top trades reflect a balanced approach to risk and reward, with a mix of new positions and reductions in existing holdings.

This article first appeared on GuruFocus.