Al Gore's Generation Investment Management Highlights Trimble Inc as a New Addition in Q3 2023

Insight into the Investment Moves of Al Gore (Trades, Portfolio)'s Firm with a Focus on Sustainable Development

Al Gore (Trades, Portfolio)'s investment firm, Generation Investment Management, has released its 13F report for the third quarter of 2023, revealing strategic moves that underscore the firm's commitment to sustainability and long-term value creation. Co-founded by the former Vice President of the United States and David Blood in 2004, the London-based firm integrates sustainability research into its investment decisions, catering to a diverse clientele that includes pension plans and charitable organizations. With a global reach and a team fluent in over 25 languages, Generation Investment Management is at the forefront of addressing key global challenges through its investment strategy.

New Portfolio Addition

Al Gore (Trades, Portfolio)'s firm has made a notable new investment in the third quarter of 2023:

Trimble Inc (NASDAQ:TRMB) stands out as a significant addition with 6,474,410 shares, representing 1.84% of the portfolio and a total value of $348.71 million.

Key Position Increases

Al Gore (Trades, Portfolio)'s firm has also bolstered its stakes in several companies:

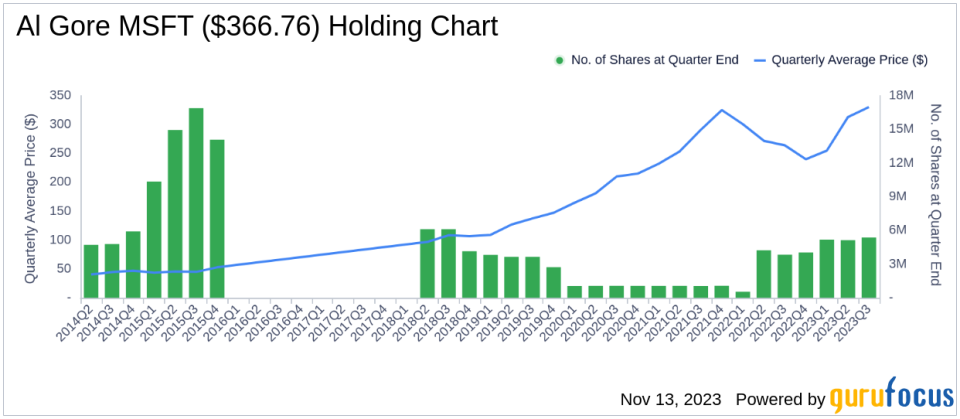

Microsoft Corp (NASDAQ:MSFT) saw an additional 242,896 shares, bringing the total to 5,380,798 shares. This represents a 4.73% increase in share count and a 0.4% impact on the current portfolio, with a total value of $1.69 billion.

Waters Corp (NYSE:WAT) experienced a 14.37% increase in share count with an additional 209,585 shares, bringing the total to 1,668,414 shares, valued at $457.49 million.

Complete Exits

During the same period, Al Gore (Trades, Portfolio)'s firm exited positions in two companies:

PTC Inc (NASDAQ:PTC) was sold off completely, with 466,012 shares liquidated, impacting the portfolio by -0.32%.

Proterra Inc (PTRAQ) also saw a complete exit with 5,183,736 shares sold, resulting in a -0.03% portfolio impact.

Significant Position Reductions

Noteworthy reductions were made in several holdings:

Palo Alto Networks Inc (NASDAQ:PANW) was reduced by 1,231,518 shares, a -48.06% decrease, impacting the portfolio by -1.52%. The stock traded at an average price of $236.67 during the quarter and has seen a 17.55% return over the past three months and an 83.62% year-to-date return.

Analog Devices Inc (NASDAQ:ADI) saw a reduction of 766,235 shares, a -14.77% decrease, with a -0.72% impact on the portfolio. The stock's average trading price was $184.4 during the quarter, with a -6.04% return over the past three months and a 5.94% year-to-date return.

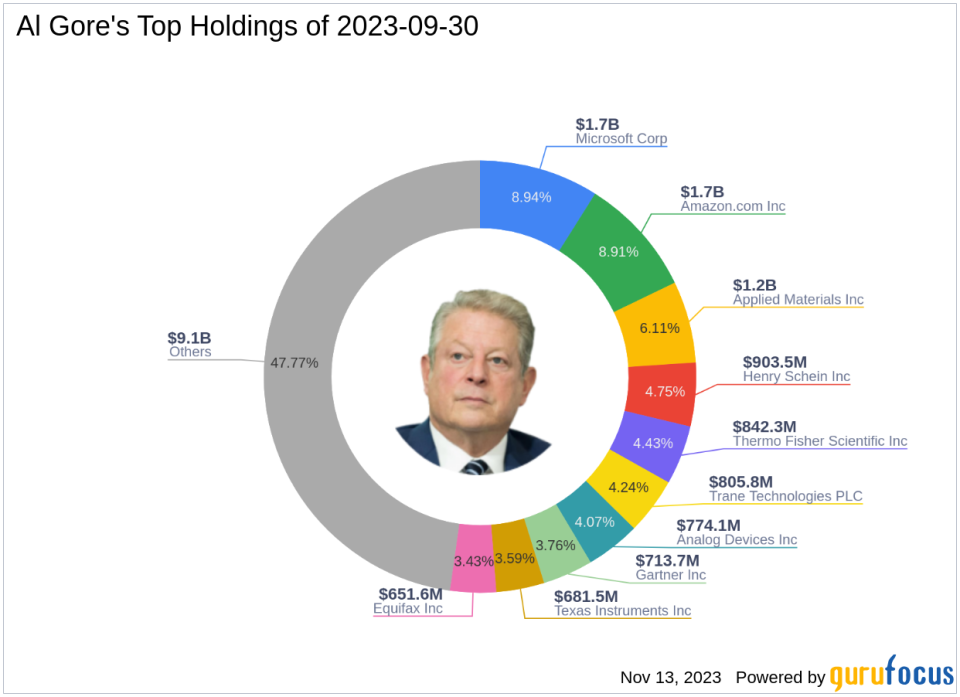

Portfolio Overview

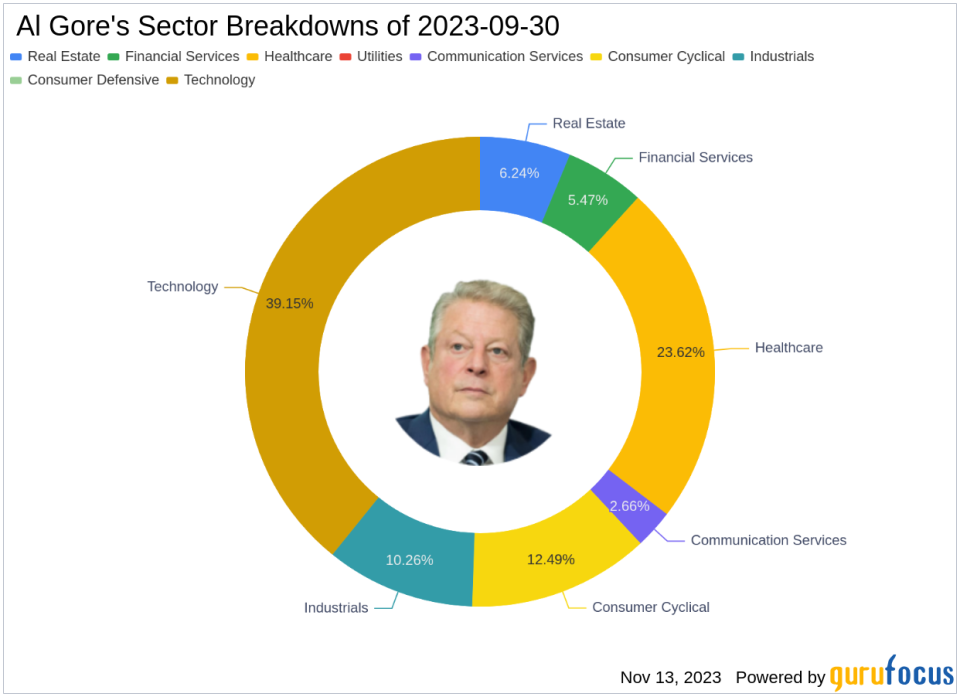

As of the third quarter of 2023, Al Gore (Trades, Portfolio)'s portfolio comprised 44 stocks, with top holdings including 8.94% in Microsoft Corp (NASDAQ:MSFT), 8.91% in Amazon.com Inc (NASDAQ:AMZN), 6.11% in Applied Materials Inc (NASDAQ:AMAT), 4.75% in Henry Schein Inc (NASDAQ:HSIC), and 4.43% in Thermo Fisher Scientific Inc (NYSE:TMO). The investments are primarily concentrated across seven industries: Technology, Healthcare, Consumer Cyclical, Industrials, Real Estate, Financial Services, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.