Alamo Group Inc. Just Recorded A 35% EPS Beat: Here's What Analysts Are Forecasting Next

Alamo Group Inc. (NYSE:ALG) just released its latest third-quarter results and things are looking bullish. It was overall a positive result, with revenues beating expectations by 7.6% to hit US$292m. Alamo Group also reported a statutory profit of US$1.69, which was an impressive 35% above what the analysts had forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Alamo Group

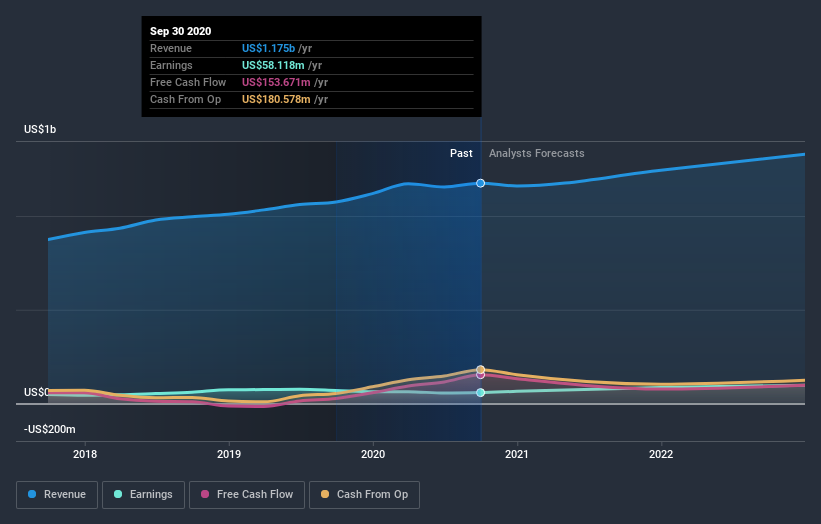

Taking into account the latest results, the current consensus from Alamo Group's three analysts is for revenues of US$1.24b in 2021, which would reflect a credible 5.9% increase on its sales over the past 12 months. Statutory earnings per share are predicted to leap 46% to US$7.22. In the lead-up to this report, the analysts had been modelling revenues of US$1.24b and earnings per share (EPS) of US$6.88 in 2021. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 7.5% to US$139. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Alamo Group analyst has a price target of US$148 per share, while the most pessimistic values it at US$133. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Alamo Group's past performance and to peers in the same industry. Next year brings more of the same, according to the analysts, with revenue forecast to grow 5.9%, in line with its 7.1% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 7.4% per year. So although Alamo Group is expected to maintain its revenue growth rate, it's forecast to grow slower than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Alamo Group following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Alamo Group's revenues are expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Alamo Group going out to 2022, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 2 warning signs for Alamo Group that you need to be mindful of.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.