Alamo Group Inc. Posts Record Earnings in Q4 and Full Year 2023

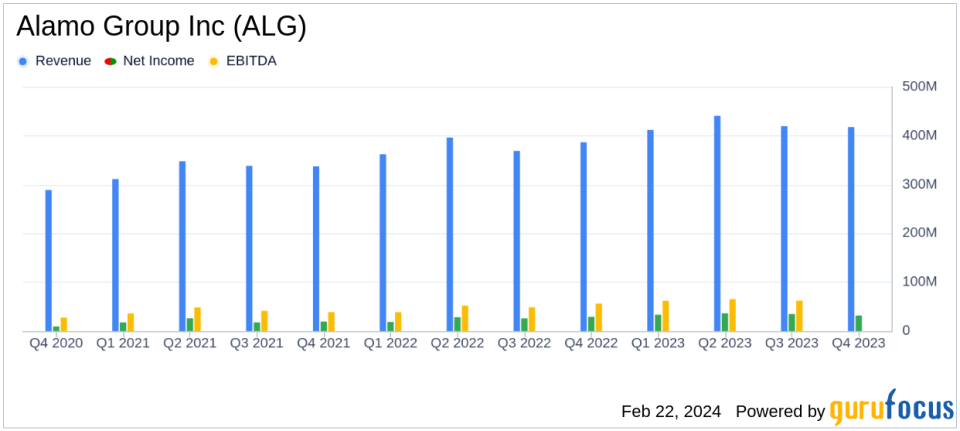

Fourth Quarter Sales: Increased by 8% to $417.5 million.

Full Year Sales: Grew by 12% to $1.69 billion.

Net Income: Rose by 34% to $136.2 million for the full year.

Diluted EPS: Up by 33% to $11.36 for the full year.

EBITDA: Reached a record $246.6 million, a 26% increase.

Backlog: Ended the year at $860 million.

On February 22, 2024, Alamo Group Inc (NYSE:ALG) released its 8-K filing, announcing record-breaking results for both the fourth quarter and the full year ended December 31, 2023. The company, a leading manufacturer of agricultural and infrastructure maintenance equipment, reported its ninth consecutive quarter of record sales and earnings, highlighting its operational resilience and market strength.

Company Overview

Alamo Group Inc is engaged in the design, manufacture, and distribution of high-quality equipment for vegetation management and infrastructure maintenance. With a product lineup that includes mowing, street sweeping, snow removal equipment, and more, the company operates primarily through its Vegetation Management and Industrial Equipment segments. Alamo Group's majority revenue is generated within the United States, reflecting its strong domestic market presence.

Financial Highlights and Challenges

The company's fourth quarter saw net sales increase to $417.5 million, an 8% rise from the previous year, while full-year sales climbed to nearly $1.7 billion, marking a 12% improvement. The growth in net income was even more pronounced, with a 34% jump to $136.2 million for the year, translating to a 33% increase in diluted earnings per share (EPS) to $11.36. These achievements underscore Alamo Group's ability to capitalize on market opportunities and optimize its operations amidst various challenges.

Despite these successes, the company faced headwinds in the Vegetation Management Division due to price pressures, slowing demand, and softness in the farm and ranch market. High interest rates also led to elevated channel inventories and cautious dealer ordering. Conversely, the Industrial Equipment Division experienced robust demand, contributing significantly to the quarter's strong performance.

Income Statement and Balance Sheet Analysis

Alamo Group's improved gross margin, which expanded by 80 basis points in the fourth quarter, reflects the company's operational efficiency gains. Selling, general, and administrative expenses increased to $60.1 million, up from $51.3 million in the prior year's quarter, due to higher employee-related administrative expenses. The balance sheet remained solid, with total assets increasing to $1.41 billion from $1.31 billion the previous year, and stockholders' equity growing to $932.8 million from $785.4 million.

Management Commentary

"We are pleased that our fourth quarter results established new records for sales and earnings for the ninth consecutive quarter... The Companys solid performance in the fourth quarter capped a very strong performance in 2023. Full-year sales were up 12% and net income improved by 34% versus the prior year," said Jeff Leonard, Alamo Groups President and CEO.

Outlook and Performance Analysis

Looking ahead, Alamo Group remains confident in its 2024 outlook, anticipating modestly lower interest rates to invigorate dealer demand and a continued strong performance from the Industrial Equipment Division. The company's robust backlog, which stands at nearly $860 million, is indicative of sustained demand and a healthy pipeline for future revenue.

Alamo Group's record EBITDA of $246.6 million, a 26% increase, reflects the company's strong profitability and cash flow generation capabilities, which are critical for ongoing investments and shareholder returns. The company's financial discipline and strategic focus position it well for continued success in the Farm & Heavy Construction Machinery industry.

For more detailed financial information and to listen to the earnings conference call, investors and interested parties can visit Alamo Group's website under the "Investor Relations" section.

Alamo Group Inc's performance in 2023 exemplifies the company's resilience and strategic execution, setting a positive tone for the year ahead. Value investors and potential GuruFocus.com members interested in the Farm & Heavy Construction Machinery sector may find Alamo Group's consistent growth and robust financial health to be a compelling investment narrative.

Explore the complete 8-K earnings release (here) from Alamo Group Inc for further details.

This article first appeared on GuruFocus.