Alarm.com Holdings Inc (ALRM) Reports Strong Earnings Growth in Q4 and Full Year 2023

SaaS and License Revenue: Q4 increased to $148.3 million; Full year rose to $569.2 million.

GAAP Net Income: Q4 grew to $31.3 million; Full year climbed to $81.0 million.

Non-GAAP Adjusted EBITDA: Reached $45.6 million in Q4; $154.0 million for the full year.

Cash Flow: Operating cash flow for the year was $136.0 million, with non-GAAP free cash flow at $128.4 million.

Balance Sheet: Total cash and cash equivalents stood at $697.0 million as of December 31, 2023.

2024 Outlook: SaaS and license revenue expected to be between $622.5 million and $623.5 million.

Alarm.com Holdings Inc (NASDAQ:ALRM) released its 8-K filing on February 22, 2024, revealing a strong performance for both the fourth quarter and the full year of 2023. The company, which operates a leading platform for intelligently connected properties, has reported significant growth in its SaaS and license revenue, a key driver of its business model.

Alarm.com's platform enables home and business owners to secure and automate their properties, with a majority of revenue generated in the United States and Canada. The company's revenue primarily comes from SaaS and license fees paid by service providers who resell Alarm.com's services.

Financial Performance and Achievements

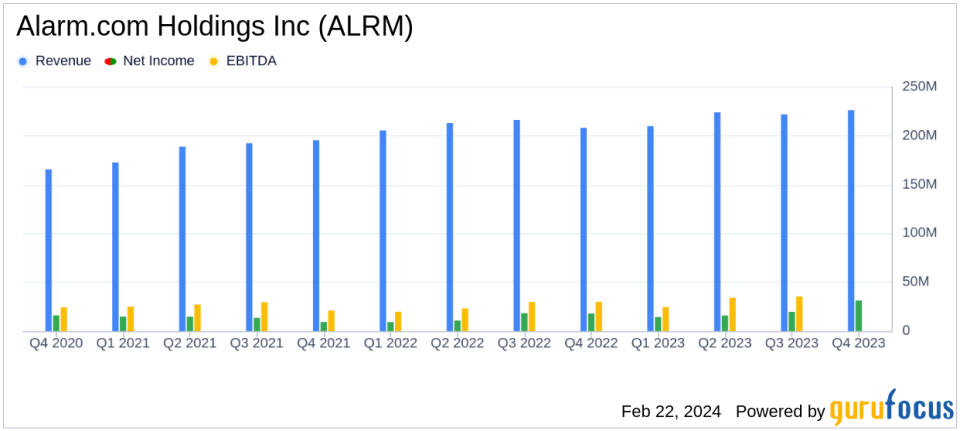

The fourth quarter saw SaaS and license revenue increase by 10.3% to $148.3 million, while total revenue for the quarter rose by 8.7% to $226.2 million. The full year echoed this positive trend, with SaaS and license revenue up by 9.4% to $569.2 million and total revenue increasing by 4.6% to $881.7 million.

GAAP net income attributable to common stockholders for the fourth quarter increased significantly to $31.3 million, or $0.58 per diluted share, compared to $18.1 million, or $0.34 per diluted share, in the same quarter of the previous year. For the full year, GAAP net income rose to $81.0 million, or $1.53 per diluted share, from $56.3 million, or $1.07 per diluted share, in 2022.

Non-GAAP adjusted EBITDA for the fourth quarter increased to $45.6 million from $39.0 million, and for the full year, it grew to $154.0 million from $146.8 million. Non-GAAP adjusted net income attributable to common stockholders for the full year was $113.2 million, or $2.07 per diluted share, up from $106.9 million, or $1.95 per diluted share.

Balance Sheet and Cash Flow

Alarm.com's balance sheet remains robust, with total cash and cash equivalents ending the year at $697.0 million. The company also repurchased shares of its common stock, reflecting confidence in its financial position and future prospects.

Operating cash flow for the year was strong at $136.0 million, and non-GAAP free cash flow was even more impressive at $128.4 million, demonstrating the company's ability to generate cash and fund operations effectively.

2024 Financial Outlook

Looking ahead, Alarm.com provided an optimistic financial outlook for 2024, with SaaS and license revenue expected to be between $622.5 million and $623.5 million. Total revenue is projected to be in the range of $912.5 million to $933.5 million, which includes anticipated hardware and other revenue.

Non-GAAP adjusted EBITDA is expected to be between $160.0 million and $164.0 million, and non-GAAP adjusted net income attributable to common stockholders is forecasted to be between $116.0 million and $118.1 million, based on an estimated tax rate of 21.0%.

Conclusion

Alarm.com's strong financial performance in 2023, highlighted by growth in SaaS and license revenue and net income, positions the company well for continued success in 2024. The company's strategic focus on expanding its suite of connected property solutions and its efficient execution of long-term growth initiatives are key factors contributing to its positive outlook.

Investors and potential GuruFocus.com members interested in the software industry and connected property solutions should consider the promising financial trajectory of Alarm.com Holdings Inc (NASDAQ:ALRM) as a noteworthy opportunity.

Explore the complete 8-K earnings release (here) from Alarm.com Holdings Inc for further details.

This article first appeared on GuruFocus.