Alarm.com (NASDAQ:ALRM) Reports Q4 In Line With Expectations, Outlook For Next Year Is Optimistic

Home security and automation software provider Alarm.com (NASDAQ:ALRM) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 8.7% year on year to $226.2 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $923 million at the midpoint. It made a GAAP profit of $0.58 per share, improving from its profit of $0.52 per share in the same quarter last year.

Is now the time to buy Alarm.com? Find out by accessing our full research report, it's free.

Alarm.com (ALRM) Q4 FY2023 Highlights:

Revenue: $226.2 million vs analyst estimates of $224.9 million (small beat)

EPS: $0.58 vs analyst estimates of $0.21 (173% beat)

Management's revenue guidance for the upcoming financial year 2024 is $923 million at the midpoint, in line with analyst expectations and implying 4.7% growth (vs 4.7% in FY2023)

Management's adjusted EBITDA guidance for the upcoming financial year 2024 is $162 million at the midpoint, above analyst expectations of $151 million

Free Cash Flow of $37.7 million, down 38.1% from the previous quarter

Gross Margin (GAAP): 64.1%, up from 61.8% in the same quarter last year

Market Capitalization: $3.45 billion

“We are pleased to report solid results for the quarter and the year,” said Steve Trundle, CEO of Alarm.com.

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

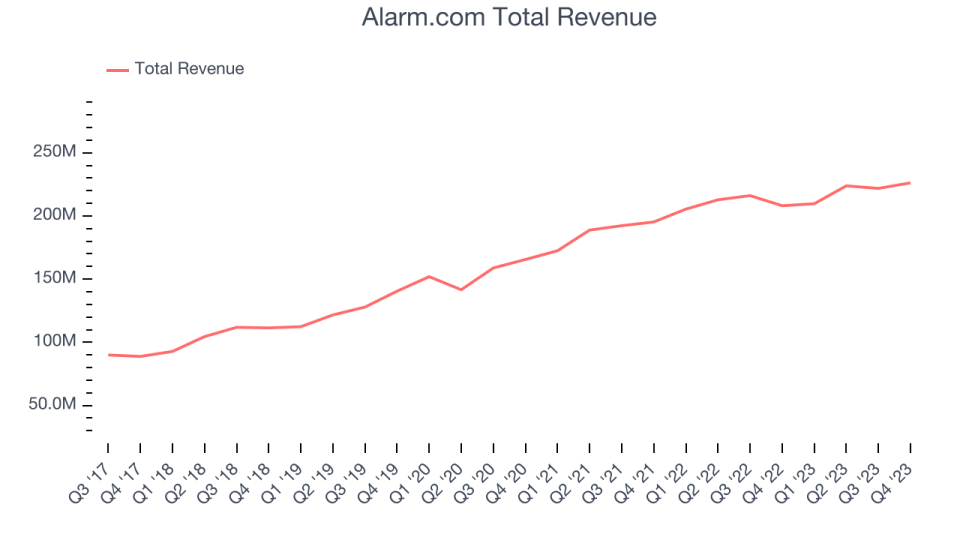

As you can see below, Alarm.com's revenue growth has been unremarkable over the last two years, growing from $195.3 million in Q4 FY2021 to $226.2 million this quarter.

Alarm.com's quarterly revenue was only up 8.7% year on year, which might disappoint some shareholders. However, its revenue increased $4.38 million quarter on quarter, a strong improvement from the $2.02 million decrease in Q3 2023. This is a sign of acceleration of growth and very nice to see indeed.

For the upcoming financial year, management expects revenue to be $923 million at the midpoint, growing 4.7% year on year compared to the 4.6% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

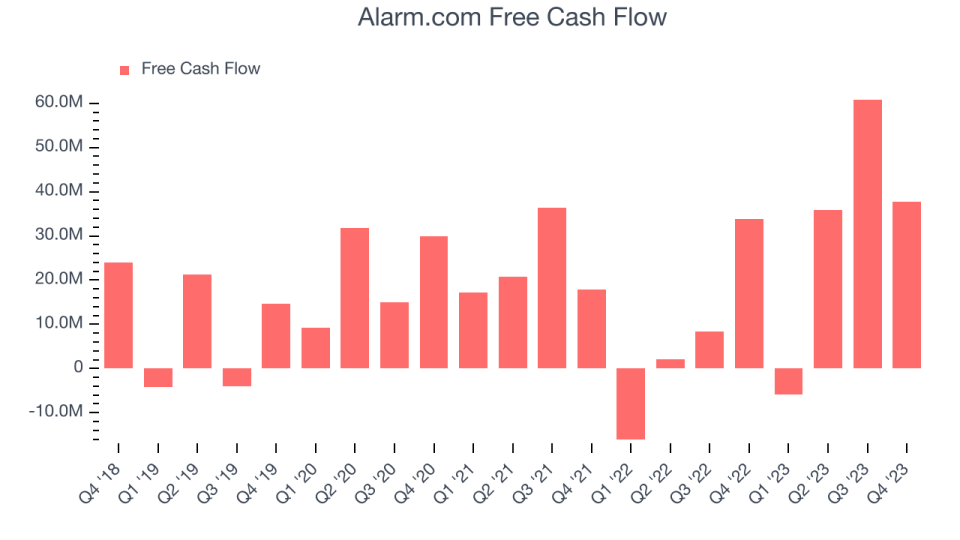

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Alarm.com's free cash flow came in at $37.7 million in Q4, up 11.3% year on year.

Alarm.com has generated $128.4 million in free cash flow over the last 12 months, a decent 14.6% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Alarm.com's Q4 Results

This was a solid quarter, with revenue and profits beating expectations. Looking forward, while revenue for next quarter is in line with expectations, adjusted EBITDA guidance was better. Zooming out, we think that the company is staying on target. The stock is up 3.3% after reporting and currently trades at $72.1 per share.

So should you invest in Alarm.com right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.