Alaska Air Group Inc (ALK) Posts Mixed Q4 Results; Full Year Revenue Hits Record $10.4 Billion

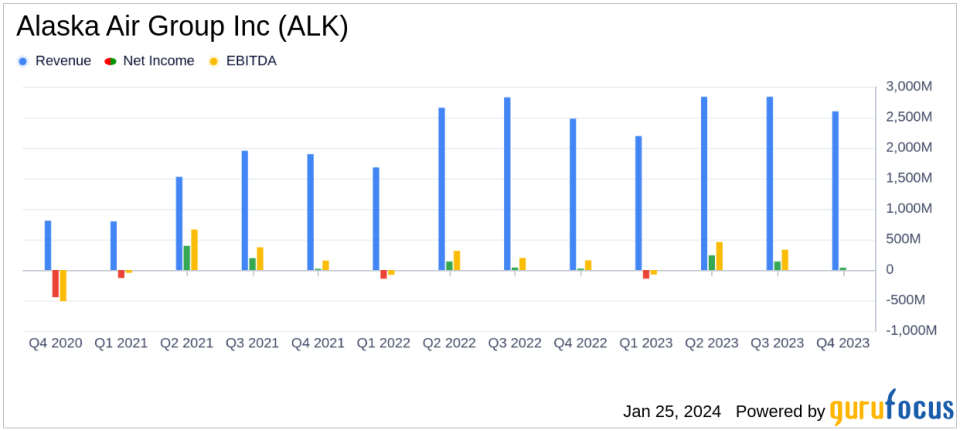

Net Income: ALK reported a net loss of $2 million for Q4 but a full year net income of $235 million.

Revenue: Record annual operating revenue of $10.4 billion, with Q4 revenue at $2.6 billion.

Earnings Per Share (EPS): Full year adjusted EPS at $4.53, compared to $4.35 in 2022.

Debt-to-Capitalization Ratio: Ended the year with a healthy ratio of 46%, within the target range.

Stock Repurchase: Repurchased approximately 3.5 million shares for $145 million in 2023.

Operational Milestones: Announced significant route expansions and introduced industry-first inflight contactless payment.

Environmental, Social, and Governance: Partnered with CHOOOSE to offer sustainable aviation fuel credits and received a perfect score on the Corporate Equity Index for LGBTQ+ workplace equality.

On January 25, 2024, Alaska Air Group Inc (NYSE:ALK) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. Despite a net loss in Q4, ALK achieved a record annual operating revenue of $10.4 billion and announced a significant agreement to acquire Hawaiian Airlines, signaling strategic growth and expansion.

Company Overview

Alaska Air Group Inc operates Alaska and Horizon airlines, serving passengers and cargo with a fleet of Boeing and Airbus jet aircraft across the U.S., Mexico, and Costa Rica. The company's revenue streams include passenger tickets, ancillary services, and its Mileage Plan passenger revenue. The acquisition of Hawaiian Airlines is set to expand its network and preserve both brand identities, offering customers a broader range of travel options.

Financial Performance and Challenges

ALK's financial achievements in 2023 reflect a resilient business model, with a 7.5% adjusted pretax margin, one of the highest in the industry. The company's focus on cost control led to a 6.6% reduction in CASM excluding fuel and special items in Q4 and a 2.6% reduction for the full year. However, the net loss in Q4 indicates potential challenges ahead, including the integration of Hawaiian Airlines and the ongoing inspections of the 737-9 MAX aircraft.

Income Statement and Balance Sheet Highlights

The company's income statement reveals a 3% increase in Q4 operating revenue year-over-year and an 8% increase for the full year. Operating expenses also saw a 3% rise in Q4, with significant investments in wages, benefits, and aircraft maintenance. The balance sheet shows a solid liquidity position, with $1.79 billion in cash and marketable securities, and a commitment to reducing debt, as evidenced by the $282 million in debt payments made in 2023.

"Air Group's 2023 accomplishments were significant," said CEO Ben Minicucci. "I want to thank our people for delivering a reliable operation, industry-leading cost performance, and a strong 7.5% adjusted pretax margin."

Analysis of ALK's Performance

ALK's performance in 2023 demonstrates a strategic balance between growth and operational efficiency. The acquisition of Hawaiian Airlines is a bold move that could significantly enhance the company's market presence. The record operating revenue underscores the company's ability to generate income amidst industry challenges. However, the Q4 net loss and the ongoing MAX aircraft inspections suggest that ALK must navigate operational hurdles to maintain its trajectory of success.

Value investors may find ALK's stock repurchase program and debt management strategy appealing, as these actions reflect a commitment to shareholder value and financial stability. The company's operational updates, including new routes and enhanced partnerships, position it well for future growth, making ALK an interesting prospect for potential GuruFocus.com members interested in the transportation industry.

For a more detailed breakdown of Alaska Air Group Inc's financials and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Alaska Air Group Inc for further details.

This article first appeared on GuruFocus.