Albemarle (ALB) Accelerates Lithium Growth With $1.75B Offering

Albemarle Corporation ALB announced the commencement of an offering of $1.75 billion in depositary shares. Each depositary share represents a 1/20th interest in a share of Series A Mandatory Convertible Preferred Stock of the company in an underwritten registered public offering. Additionally, Albemarle anticipates granting the underwriters a 30-day option to purchase up to an additional $262.5 million of depositary shares, subject to market and other conditions.

The net proceeds from the offering will be utilized for general corporate purposes, including funding growth capital expenditures such as the construction and expansion of lithium operations in Australia and China, which are significantly progressed or near completion. The funds will also contribute to repaying ALB’s outstanding commercial paper.

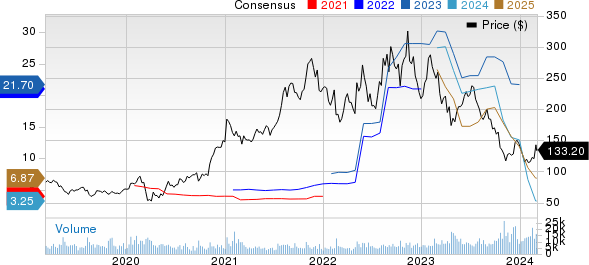

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Holders of the depositary shares will enjoy a proportional fractional interest in the rights and preferences of the Preferred Stock, including conversion, dividend, liquidation, and voting rights, under the provisions of a deposit agreement. Each share of the Preferred Stock will automatically convert on or around Mar 1, 2027, into a predetermined number of shares of common stock of the company, with a par value of 1 cent per share, based on the applicable conversion rate. Similarly, each Depositary Share will automatically convert into a proportionate fractional interest in shares of common stock. The conversion rates, dividend rate and other terms of the Preferred Stock will be determined at the time of pricing of the offering. Currently, there is no public market for the Depositary Shares or the Preferred Stock. Albemarle plans to apply to list the Depositary Shares on the NYSE under the symbol ‘ALB PR A.’

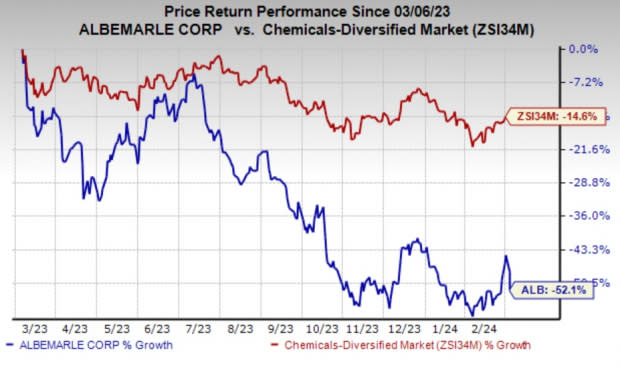

Shares of Albemarle have lost 52.1% in the past year compared with a 14.6% fall of the industry.

Image Source: Zacks Investment Research

Albemarle, in its fourth-quarter call, predicted a 10-20% increase in Energy Storage volumes for 2024 from 2023 levels. The company anticipates net sales for its Specialties segment to be in the range of $1.3-$1.5 billion, with an EBITDA of $270-$300 million. In the Ketjen segment, net sales are expected to be $1-$1.2 billion, with an EBITDA of $130-$150 million.

Zacks Rank & Key Picks

ALB currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the Basic Materials space are Ecolab Inc. ECL, sporting a Zacks Rank #1 (Strong Buy), and Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ecolab has a projected earnings growth rate of 22.65%% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 6.5% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 40.3% in the past year.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $3.97 per share, indicating a year-over-year surge of 248.3%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have 30% in the past year.

The consensus estimate for HWKN’s current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 4.3% in the past 30 days. HWKN beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 70.6%. The company’s shares have surged 73.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report