Albemarle (ALB) Gains on Strong Lithium Demand, Expansion Moves

Albemarle Corporation ALB is benefiting from higher lithium volumes on strong demand, capacity expansion and productivity actions amid challenges from the softness in the specialties unit.

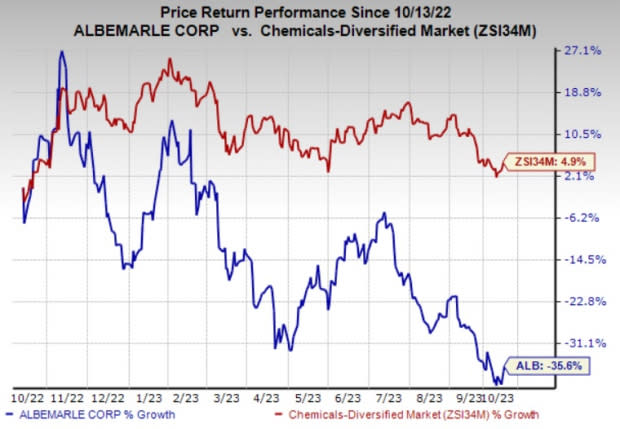

The North Carolina-based company’s shares are down 35.6% over a year compared with a 4.9% rise of the industry.

Image Source: Zacks Investment Research

Albemarle is well-placed to gain from the long-term growth in the battery-grade lithium market. The company is strategically executing its projects aimed at boosting its global lithium conversion capacity. It remains focused on investing in high-return projects to drive productivity.

The company’s Kemerton I lithium hydroxide conversion plant in Western Australia achieved first product in July 2022. Kemerton II is also progressing through the commissioning phase. Kemerton III and IV projects have also been moved into execution. Moreover, the Qinzhou plant in China will also boost the growth of conversion capacity and drive lithium volumes. Mechanical completion of the Meishan facility is also expected in early 2024. The Salar yield improvement project has also moved into the commissioning phase.

Albemarle, last month, secured a $90-million grant from the U.S. Department of Defense to support the expansion of domestic mining and lithium production for the nation's battery supply chain. The grant will be instrumental in acquiring a fleet of mining equipment, a crucial component of Albemarle's strategy to reopen its lithium mine in Kings Mountain, NC. ALB sees that the Kings Mountain mine will become operational as early as late 2026, subject to permitting processes.

Increased customer demand, capacity expansion and improvements in plant productivity are contributing to higher volumes in the company’s lithium business. It saw higher volumes in the Energy Storage unit in the second quarter of 2023, primarily driven by the expansion of La Negra III/IV in Chile and a surge in tolling volumes to meet the growing demand from customers. Production from the processing plant in Qinzhou, China also contributed to the volume growth.

Albemarle is also benefiting from cost-saving and productivity initiatives. It sees $250 million in productivity benefits over 2023 and 2024 through operational discipline. The company’s cost actions are expected to support its margins in 2023.

However, ALB’s specialties unit is exposed to headwinds from demand weakness. Sales from the segment tumbled around 20% year over year in the second quarter, hurt by lower volumes and pricing related to weakness in certain end markets.

The segment faces demand headwinds in consumer and industrial electronics and elastomers markets. The demand weakness is expected to continue in the third quarter of 2023. Albemarle has reduced its adjusted EBITDA outlook for the segment for 2023 factoring in the demand softness.

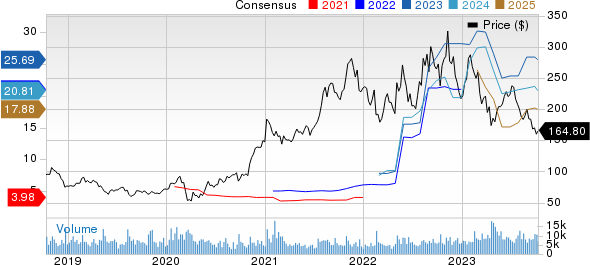

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Koppers Holdings Inc. KOP, Carpenter Technology Corporation CRS and The Andersons Inc. ANDE.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers has a trailing four-quarter earnings surprise of roughly 21.7%, on average. KOP shares have surged around 77% in a year.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #2.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 101% over the past year.

Andersons currently carries a Zacks Rank #2. The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days.

Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 50% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report