Albemarle (ALB) to Post Q3 Earnings: What's in the Offing?

Albemarle Corporation ALB will release third-quarter 2023 results after the closing bell on Nov 1.

The company beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters. In this timeframe, it delivered an earnings surprise of 18.6%, on average. It posted an earnings surprise of 48.9% in the last reported quarter. The company is likely to have benefited from higher lithium volumes and its cost-reduction actions in the third quarter amid demand headwinds in specialties.

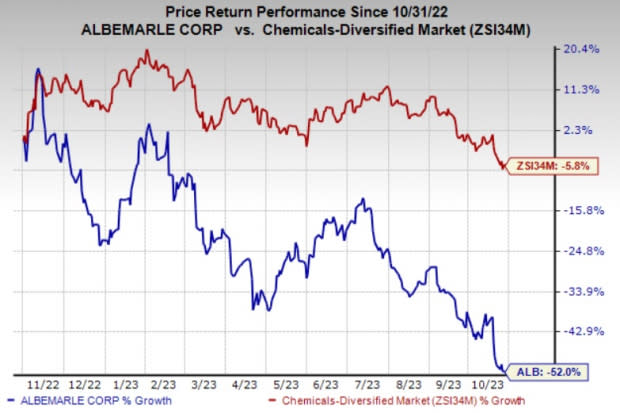

Albemarle’s shares have lost 52% over a year compared with a 5.8% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Albemarle this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP: Earnings ESP for Albemarle is +5.73%. The Zacks Consensus Estimate for the third quarter is currently pegged at $3.70. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Albemarle currently carries a Zacks Rank #3.

What do the Estimates Say?

The Zacks Consensus Estimate for revenues for Albemarle for the to-be-reported quarter stands at $2,393.1 million, reflecting an increase of around 14.4% from the year-ago quarter.

The consensus estimate for net sales for the Energy Storage unit for the third quarter is pegged at $1,723 million, reflecting a sequential decline of 2.3%.

The Zacks Consensus Estimate for net sale for the Specialties unit is pegged at $385 million, suggesting a sequential growth of 3.8%.

The Zacks Consensus Estimate for net sales for the Ketjen unit for the third quarter stands at $278 million, indicating a sequential rise of 17.8%.

Some Factors to Watch For

Albemarle is likely to have benefited from higher volumes in its lithium business in the third quarter. Higher customer demand, capacity expansion and plant productivity improvements are expected to have supported volumes. The La Negra III/IV expansion in Chile and the processing plant in Qinzhou, China also likely to have contributed to volumes.

Benefits of the company’s cost-saving, pricing and productivity initiatives are also expected to get reflected in the quarter to be reported. Its cost and productivity actions are expected to have supported margins in the September quarter.

However, the company’s Specialties unit is likely to have faced headwinds from demand weakness. The segment faces demand headwinds in consumer and industrial electronics and elastomers markets. The demand weakness is expected to have continued in the third quarter.

Albemarle Corporation Price and EPS Surprise

Albemarle Corporation price-eps-surprise | Albemarle Corporation Quote

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they too have the right combination of elements to post an earnings beat this quarter:

Axalta Coating Systems Ltd. AXTA, scheduled to release earnings on Nov 1, has an Earnings ESP of +5.39% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s earnings for the third quarter is currently pegged at 38 cents.

CF Industries Holdings, Inc. CF, slated to release earnings on Nov 1, has an Earnings ESP of +4.79% and carries a Zacks Rank #3 at present.

The consensus mark for CF’s third-quarter earnings is currently pegged at 94 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +2.96%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 10 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report