Albemarle (ALB) Withdraws Offer to Acquire Liontown Resources

Albemarle Corporation ALB declared its decision to forgo the pursuit of a binding agreement to acquire Liontown Resources Limited. The company has officially withdrawn its non-binding offer, which had been extended to Liontown's board of directors.

This move follows the culmination of Albemarle's exclusive due diligence process. Kent Masters, the CEO of Albemarle, expressed gratitude for the productive collaboration with the Liontown team, acknowledging their efforts in the engagement. The company decided that proceeding with the acquisition does not align with Albemarle's best interests.

One of the pivotal factors contributing to this resolution is the increasing complexities associated with the proposed transaction. Albemarle's decision underscores its commitment to a disciplined approach to capital allocation. The company will continue to execute its long-term growth strategy, with ongoing expansions aimed at achieving volumetric growth throughout its global portfolio.

The company’s key capital allocation priorities continue to encompass investments in high-return organic and inorganic growth, the maintenance of financial flexibility, preservation of an investment-grade credit rating and funding dividends.

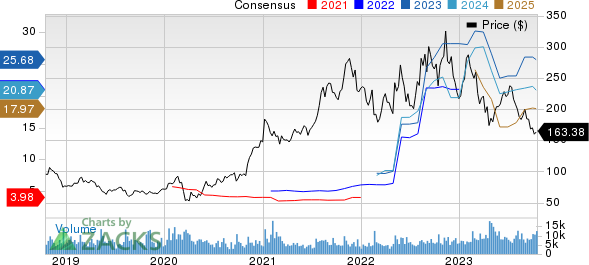

Shares of Albemarle have lost 34.1% in the past year against a 4.2% rise of the industry.

Image Source: Zacks Investment Research

In its second-quarter call, Albemarle raised its 2023 outlook, anticipating a boost from rising lithium market prices and a continued global shift towards electric vehicles. The company now projects net sales in the range of $10.4-$11.5 billion and adjusted EBITDA of $3.8-$4.4 billion for the year, indicating an upward revision from previous estimates. Adjusted earnings per share for 2023 are expected to be in the range of $25.00-$29.50 compared with the earlier forecast of $20.75-$25.75.

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Zacks Rank & Other Key Picks

Albemarle currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the Basic Materials space are WestRock Company WRK, sporting a Zacks Rank #1 (Strong Buy) and Air Products and Chemicals, Inc. APD and Kinross Gold Corporation KGC, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Westrock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 14.1% in the past year.

The consensus estimate for Air Products’ current fiscal year earnings is pegged at $11.47, indicating year-over-year growth of 10.2%. APD beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 1.8%. The company’s shares have surged 20.3% in the past year.

The consensus estimate for Kinross Gold’s current year earnings is pegged at 39 cents, indicating year-over-year growth of 77.3%. KGC beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 31.7%. The Zacks Consensus Estimate for KGC's current-year earnings has been revised 8.3% upward over the past 60 days. KGC shares have rallied around 49.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report