Albemarle Corp (ALB) Reports Mixed Results Amidst Market Challenges

Net Sales: Full-year net sales hit a record $9.6 billion, up 31% year-over-year.

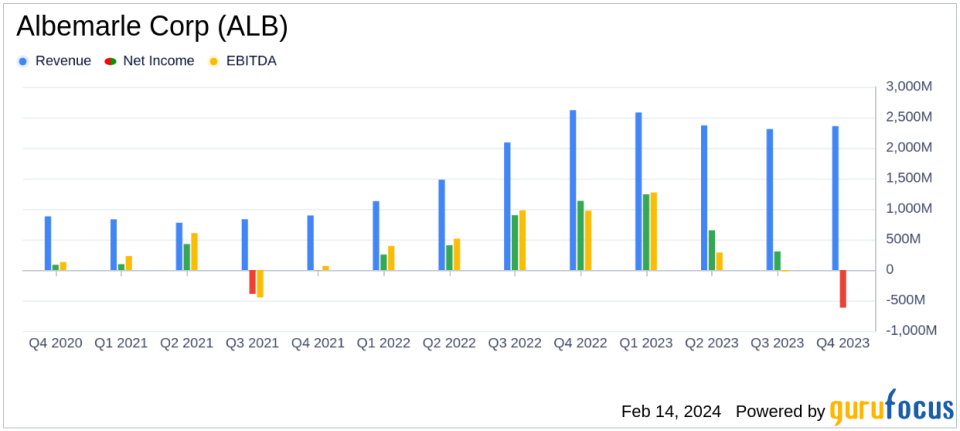

Net Income: Full-year net income reached $1.6 billion, with Q4 facing a net loss of $618 million due to charges.

Adjusted EBITDA: $2.8 billion for the full year, or $3.4 billion excluding specific charges.

Adjusted EPS: $15.22 per share for the full year, or $22.25 excluding charges.

Liquidity: Estimated liquidity of approximately $1.9 billion as of year-end.

Capital Expenditures: Expected to be $1.6 billion to $1.8 billion in 2024, down from $2.1 billion in 2023.

On February 14, 2024, Albemarle Corp (NYSE:ALB) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading lithium producer vital for energy storage in batteries, particularly for electric vehicles, faced a challenging market environment. Despite these challenges, Albemarle achieved a significant increase in full-year net sales, driven by volume growth, particularly in its Energy Storage segment.

Company Overview

Albemarle is a fully integrated lithium producer with upstream resources including salt brine deposits and hard rock mines. It operates lithium refining plants across the globe and is also a global leader in bromine production, used in flame retardants, and a major producer of oil refining catalysts.

Financial Performance and Challenges

Albemarle's full-year net sales reached a historic high of $9.6 billion, a 31% increase from the previous year, with a 21% total volume growth. The Energy Storage sales volumes surged by 35%. However, the fourth quarter saw a net loss of $618 million, or ($5.26) per diluted share, primarily due to a lower of cost or net realizable value (LCM) pre-tax charge and a tax valuation allowance expense in China. Adjusted EBITDA for the quarter was negative at ($315) million, or $289 million excluding the LCM charge. The company's proactive measures are expected to unlock over $750 million of cash flow, including reduced capital expenditures and working capital.

Financial Achievements and Importance

The company's financial achievements, particularly the record net sales, underscore its capacity to drive growth even in a challenging market. The adjusted EBITDA, excluding specific charges, aligns with previous outlooks, indicating effective management strategies to offset lower pricing.

Key Financial Metrics

Albemarle's net income for the full year was the second highest in company history at $1.6 billion, or $13.36 per diluted share. Adjusted diluted EPS was $15.22 per share, or $22.25 excluding the LCM charge and tax valuation allowance expense. The company's liquidity position remains strong, with approximately $1.9 billion in estimated liquidity at year-end. Capital expenditures for 2024 are projected to decrease, reflecting a strategic focus on high-return projects.

"Albemarles full-year 2023 result marks the second highest earnings year in company history, made possible by the disciplined focus of our global teams," said Albemarle CEO Kent Masters. "Looking ahead, we are taking actions to enhance our financial flexibility, while advancing near-term growth and preserving future opportunities to create value."

Analysis of Company Performance

The company's performance in 2023, despite a net loss in the fourth quarter, demonstrates resilience in the face of market headwinds. The proactive measures announced to unlock cash flow and the mechanical completion of the Meishan lithium conversion plant in December 2023 are positive steps towards future growth. Albemarle's strategic investments and focus on high-return projects are expected to sustain its leading position in the lithium market.

Albemarle's outlook for 2024 includes considerations for Energy Storage market price scenarios, with a projected increase in Energy Storage volumes of 10% to 20% compared to 2023. The company's capital allocation priorities remain focused on investing in organic opportunities, maintaining financial flexibility, and funding its dividend.

For a more detailed analysis of Albemarle's financial results and outlook, investors and interested parties are encouraged to review the full earnings presentation and supporting material available on Albemarles website.

Explore the complete 8-K earnings release (here) from Albemarle Corp for further details.

This article first appeared on GuruFocus.