Alcoa Corp (AA) Faces Headwinds Despite Operational Progress in Q4 and FY 2023

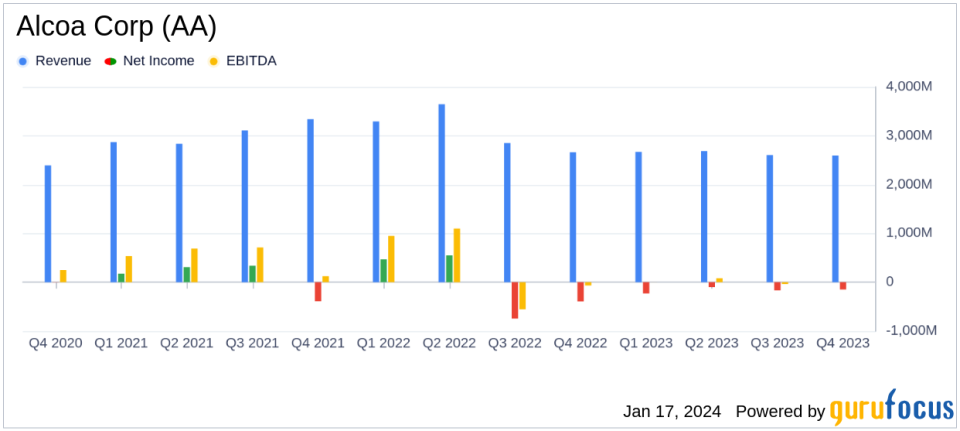

Revenue: Q4 revenue remained flat at $2.60 billion, with FY 2023 revenue decreasing 15% to $10.6 billion.

Net Loss: Q4 net loss improved slightly to $150 million, while FY 2023 net loss widened to $651 million.

Adjusted EBITDA: Q4 Adjusted EBITDA rose to $89 million, yet FY 2023 saw a significant drop to $536 million.

Production and Shipments: Aluminum production increased by 5% annually, with records set in Canadian and Norwegian smelters.

Strategic Actions: Alcoa Corp (NYSE:AA) initiated several strategic actions, including mine approvals and operational adjustments.

Working Capital: Improved working capital management with a decrease in days working capital.

Outlook: Alcoa Corp (NYSE:AA) provides production and shipment outlook for 2024, with expected increases in aluminum production.

On January 17, 2024, Alcoa Corp (NYSE:AA) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The vertically integrated aluminum company, known for its large-scale bauxite mining, alumina refining, and primary aluminum manufacturing, faced a challenging year with its profits heavily influenced by the volatile commodity prices in the aluminum supply chain.

Financial Performance Overview

Alcoa Corp (NYSE:AA) reported a flat revenue of $2.60 billion in Q4 2023 compared to the previous quarter, while the full-year revenue saw a 15% decline to $10.6 billion from the previous year. The net loss for Q4 improved slightly to $150 million from $168 million in Q3, but the full-year net loss widened significantly to $651 million from $123 million in FY 2022. Adjusted EBITDA for Q4 increased to $89 million from $70 million in Q3, yet experienced a sharp decrease from $2.224 billion in FY 2022 to $536 million in FY 2023.

Operational Highlights and Challenges

Alcoa Corp (NYSE:AA) made operational progress by increasing aluminum production by 5% sequentially and setting annual production records in its Canadian and Norwegian smelters. However, the company faced challenges with alumina production decreasing 13% annually due to lower grade bauxite and partial curtailments. The company also returned cash to stockholders through $72 million in quarterly dividend payments.

Strategic Actions and Outlook

The company took several strategic actions, including receiving approval for bauxite mining in Western Australia and initiating engagement with Spanish stakeholders for the San Ciprian complex. Looking ahead to 2024, Alcoa Corp (NYSE:AA) expects alumina production to range between 9.8 and 10.0 million metric tons and aluminum shipments to be between 2.5 million and 2.6 million metric tons.

Financial Tables and Metrics

Key financial metrics such as net loss per share improved from $(0.94) in Q3 to $(0.84) in Q4, while the full-year net loss per share worsened from $(0.68) in FY 2022 to $(3.65) in FY 2023. The company ended the quarter with a cash balance of $944 million, and free cash flow was $10 million for Q4 and negative $440 million for the full year.

Analysis of Alcoa Corp (NYSE:AA)'s Performance

Alcoa Corp (NYSE:AA) has demonstrated resilience in a challenging market environment by improving operational efficiencies and managing its portfolio. However, the significant decline in full-year revenue and Adjusted EBITDA highlights the impact of lower commodity prices and higher production costs. The company's strategic actions, including cost-saving initiatives and adjustments to its credit facility, indicate a focus on improving profitability and competitiveness in the coming year.

Alcoa Corp (NYSE:AA) will hold a conference call to discuss these results and provide further insights into its business strategies and market conditions. Investors and stakeholders are looking forward to understanding how the company plans to navigate the ongoing challenges in the aluminum industry and capitalize on potential opportunities.

For a detailed analysis of Alcoa Corp (NYSE:AA)'s financial results and strategic outlook, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Alcoa Corp for further details.

This article first appeared on GuruFocus.