Alcon (ALC) Business Hurt by Macroeconomic Woes, Competition

Alcon’s ALC business is dented by a challenging international market with subdued demand for ophthalmological products. Also, a tough competitive landscape is a threat. The stock carries a Zacks Rank #4 (Sell).

Alcon is experiencing inflationary pressure in electronic components, freight, labor, resins and plastics, impacting the company’s margins. The company is also encountering supply chain challenges in certain components, including microchips, resins and plastics, metals and filters. The company expects these inflationary pressures and supply chain challenges to continue in 2024. The cost of net sales in the third quarter of 2023 was up 6.7% year over year.

The ophthalmology industry is highly competitive, and in both surgical and vision care businesses, Alcon faces intense competition. In the surgical business, Alcon faces a mixture of competitors, ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of specialized products. The company also faces competition from providers of alternative medical therapies, such as pharmaceutical companies that have the potential to disrupt core elements of its business.

In the vision care business, Alcon operates in a highly competitive environment. In contact lenses, increased product entries from contact lens manufacturers in Asia are posing a massive threat. The market for contact lenses is intensely competitive and is characterized by declining sales volumes for older and reusable product lines and growing demand for daily lenses and advanced materials lenses.

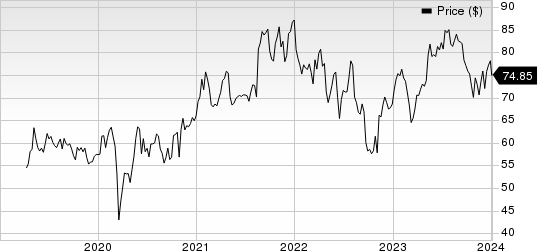

Alcon Price

Alcon price | Alcon Quote

On a positive note, Alcon’s Surgical business continues to gain from the company’s diverse portfolio and incremental innovation. In terms of the latest developments within Implantables, Alcon’s technology continues to lead the market. Globally, one out of every three intraocular lens (IOL) implanted is done with an Alcon lens. In premium lenses, the statistic is even more impressive, with one out of two ATIOLs (Advanced Technology Intraocular Lenses) being an Alcon product. The company’s flagship lenses, Vivity and PanOptix, continue to lead the category in the United States and around the world. The company continues to expand in areas where it has significant opportunities to grow share, such as China.

Within Vision Care, Alcon is registering solid growth, banking on strong sales of its contact lenses and ocular health products. In contact lenses, the company is successfully executing its strategy of investing in fast-growing market segments where it has significant share opportunities. As a result of this, Alcon is outpacing market growth in every category where it has launched new products.

Over the past year, shares of ALC have gained 6.5% compared with the industry's 1.7 rise.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have remained constant at $1.91 in the past 30 days. Shares of the company have dropped 26.3% in the past year against the industry’s rise of 3.7%.

PODD’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Shares of Haemonetics have gained 8.7% in the past year. Earnings estimates for Haemoneticshave remained constant at $3.89 for 2023 and at $4.15 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.43 to $1.44 in the past 30 days. Shares of the company have gained 9.6% in the past year compared with the industry’s 3.8% rise.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report