Aldeyra (ALDX) Plummets on Dry Eye Disease Drug's Setback

Shares of Aldeyra Therapeutics, Inc. ALDX plunged 66.3% after the company received a setback with its new drug application (“NDA”) for reproxalap for the treatment of the signs and symptoms of dry eye disease.

Aldeyra received minutes from a late-cycle review meeting with the FDA, which identified substantive review issues in connection with the NDA for reproxalap.

In the meeting, the regulatory body stated that the NDA lacks data to support reproxalap’s efficacy for the sought indication. The FDA has also requested certain chemistry, manufacturing and controls (“CMC”) details.

Aldeyra then submitted its responses to the FDA, which it believed was sufficient to mitigate the identified review issues and CMC requests. However, the FDA has not directly given an opinion on the sufficiency of the information submitted and has indicated Aldeyra to conduct an additional clinical study to satisfy efficacy requirements.

Aldeyra submitted its NDA for reproxalap for treating the signs and symptoms of dry eye disease in December 2022. In February 2023, the FDA accepted the reproxalap NDA for filing and set a target action date of Nov 23, 2023.

Given the details of the minutes released by Aldeyra, it is unlikely that the FDA will be able to approve the NDA for reproxalap on or about the target action date or even afterward.

The regulatory body might issue a Complete Response Letter (“CRL”) instead and ask Aldeyra to conduct additional CMC studies or clinical studies and submit the results before the application is reconsidered.

An additional study equals extra capital outlay and a delay in approval, significantly denting Aldeyra's growth prospects. Investors are disappointed with the setback.

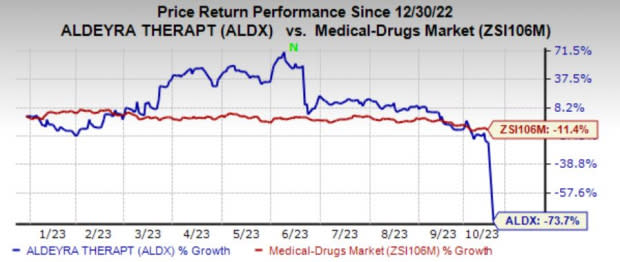

Shares of Aldeyra have plummeted 73.7% year to date compared with the industry’s 11.4% decline.

Image Source: Zacks Investment Research

Other candidates in Aldeyra’s pipeline include ADX-629, a novel orally administered reactive aldehyde species (“RASP”) modulator in development for atopic dermatitis, idiopathic nephrotic syndrome, moderate alcohol-associated hepatitis, chronic cough and Sjögren-Larsson syndrome.

The preclinical RASP platform includes ADX-246, ADX-248 and other drug candidates in development for systemic inflammatory diseases and geographic atrophy.

ADX-2191 is in clinical development for the treatment of proliferative vitreoretinopathy and retinitis pigmentosa, two rare retinal diseases characterized by inflammation and vision loss.

Aldeyra Therapeutics, Inc. Price, Consensus and EPS Surprise

Aldeyra Therapeutics, Inc. price-consensus-eps-surprise-chart | Aldeyra Therapeutics, Inc. Quote

However, in June 2023, the company received a CRL from the FDA for the NDA for ADX-2191 (methotrexate for injection) for treating primary vitreoretinal lymphoma (PVRL).

The FDA stated that there was a “lack of substantial evidence of effectiveness” due to “a lack of adequate and well-controlled investigations” in the literature-based NDA submission. Any safety or manufacturing issues with ADX-2191 were not identified, though. Based on prior discussions with the FDA, Aldeyra did not conduct any clinical trials of ADX-2191 in PVRL.

Bausch + Lomb Corporation BLCO recently acquired Xiidra (lifitegrast ophthalmic solution) 5% and certain other ophthalmology assets from Novartis NVS.

Xiidra is a non-steroid eye drop specifically approved to treat the signs and symptoms of dry eye disease. BLCO made an upfront payment of $1.75 billion in cash to Novartis. The deal includes potential milestone obligations of up to $750 million based on sales thresholds and pipeline commercialization.

Zacks Rank and Stock to Consider

Aldeyra currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare industry is Acadia Pharmaceuticals ACAD, currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for Acadia for 2023 have narrowed to 37 cents from 41 cents in the past 60 days, while earnings estimates for 2024 are pegged at 67 cents per share. Acadia’s shares have gained 49.3% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Aldeyra Therapeutics, Inc. (ALDX) : Free Stock Analysis Report

Bausch + Lomb Corporation (BLCO) : Free Stock Analysis Report