Alector (ALEC) Up 7% on Finishing Enrolment in Alzheimer Study

Shares of Alector ALEC rose 6.8% on Thursday after management announced that it achieved the enrolment target in the phase II INVOKE-2 study on its Alzheimer’s disease (“AD”) candidate, AL002. The candidate is being co-developed with AbbVie ABBV.

Alector expects data from the study before this year’s end.

Based on this study's results, management will decide whether to advance the candidate to pivotal late-stage development.

The INVOKE-2 study is evaluating the safety and efficacy of AL002 in slowing disease progression in individuals with early AD. The study participants are randomized to receive either AL002 or a placebo administered intravenously every four weeks for a treatment period lasting up to 96 weeks.

The primary endpoint of the INVOKE-2 study is disease progression, as measured by the Clinical Dementia Rating Sum of Boxes (“CDR-SB”) scale. The CDR-SB is a numerical scale that measures the severity of AD indication. In addition, the study will also assess microglial activation and Alzheimer’s pathophysiology using cerebrospinal fluid and plasma biomarkers.

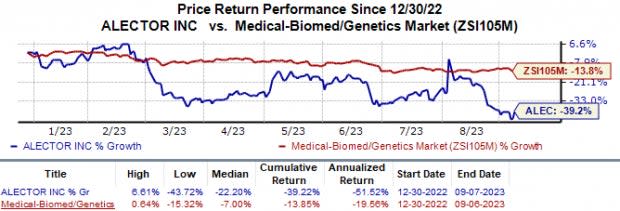

In the year so far, shares of Alector have lost 39.2% compared with the industry’s 13.8% fall.

Image Source: Zacks Investment Research

A humanized monoclonal antibody, AL002 targets triggering receptor expressed on myeloid cells 2 (“TREM2”) to improve cell survival and microglia activity.

Alector signed a global strategic collaboration with AbbVie in 2017 to co-develop and market therapeutics targeting AD and other neurodegenerative indications. Per the terms of the partnership, Alector granted AbbVie an exclusive option for global rights to the development and commercialization of AL002. If AbbVie exercises its option for the program, Alector would be eligible to receive milestone payments of up to $487.5 million. Both companies will share the development costs and profits equally post regulatory approvals.

The AD target market is highly competitive as several other pharma companies like Biogen BIIB and Eli Lilly LLY have their drugs targeting the AD indication. The Alzheimer’s drugs of these companies have either recently been approved for use or are under regulatory review development.

This July, the FDA granted full approval to Biogen’s AD drug Leqembi (lecanemab). Following approval, the Biogen drug is the first and only approved anti-amyloid antibody treatment shown to reduce the rate of disease progression and slow cognitive impairment in the early and mild dementia stages of AD indication. Since Biogen’s Leqembi received full/standard approval from the FDA, it is also eligible for broader Medicare coverage. Such coverage is crucial for a wider rollout of treatment.

Eli Lilly developed donanemab, its antibody therapy for AD. In June, Lilly reported positive data from the phase III TRAILBLAZER-ALZ 2 study that showed that treatment with donanemab significantly slowed cognitive and functional decline in people with early symptomatic AD. Based on this result, Eli Lilly has submitted regulatory applications with the FDA and EMA for the drug to treat AD. A final decision in the United States is expected before year-end.

With no marketed drugs, Alector is solely dependent on its pipeline development for growth, Apart from AL002, Alector is also developing its lead pipeline candidate AL001 in a late-stage study for frontotemporal dementia (FTD) with progranulin mutation (FTD-GRN). The candidate is being developed in collaboration with GSK. AL002 is also being developed in an early-stage study for AD indication.

The successful development of these pipeline candidates will likely boost Alector’s prospects. The company’s partnerships with pharma big-wigs like AbbVie and GSK are also a positive as compared to Alector, these companies already have years of drug-development experience and well-established drug distribution and supply chain.

Alector, Inc. Price

Alector, Inc. price | Alector, Inc. Quote

Zacks Rank

Alector sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Alector, Inc. (ALEC) : Free Stock Analysis Report