Alerus Financial Corp (ALRS) Reports Q4 Loss and Balance Sheet Repositioning

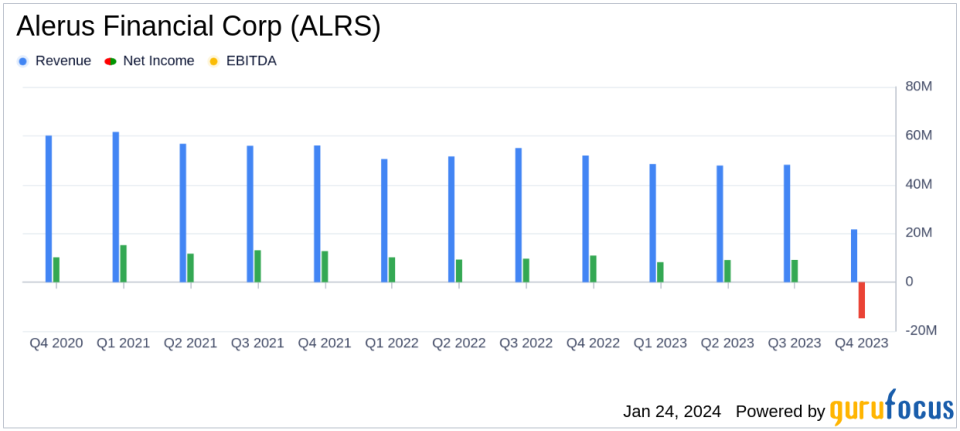

Net Loss: Reported a net loss of $14.8 million for Q4 2023, a stark contrast to the net income of $9.2 million in Q3 2023 and $10.9 million in Q4 2022.

Balance Sheet Repositioning: Sold $172.3 million of AFS securities, resulting in a one-time pre-tax net loss of $24.6 million, but reinvested in loans and reduced borrowings.

Adjusted Pre-Provision Net Revenue: Slightly increased to $9.0 million from $8.9 million in Q3 2023, indicating resilience in core operations.

Net Interest Margin: Improved to 2.37% in Q4 2023 from 2.27% in Q3 2023, despite a year-over-year decrease from 3.09% in Q4 2022.

Noninterest Income: Experienced a significant decrease to $0.8 million in Q4 2023 due to the loss on sale of investment securities.

Loan Growth: Total loans increased by 12.8% year-over-year to $2.8 billion as of December 31, 2023.

Capital Strength: Tangible book value per common share grew to $15.46, and the company returned over $5.8 million to shareholders through dividends and share buybacks.

Alerus Financial Corp (NASDAQ:ALRS) released its 8-K filing on January 24, 2024, disclosing a challenging fourth quarter for the year 2023. The company, a diversified financial services entity operating across banking, retirement & benefit services, wealth management, and mortgage sectors, faced a net loss of $14.8 million, or ($0.73) per diluted common share. This performance marks a downturn from both the previous quarter's net income of $9.2 million and the prior year's Q4 net income of $10.9 million.

The loss was primarily due to a strategic balance sheet repositioning, where Alerus sold $172.3 million in available-for-sale securities, incurring a one-time pre-tax net loss of $24.6 million. Despite this, the company's adjusted pre-provision net revenue saw a marginal increase to $9.0 million from $8.9 million in the third quarter of 2023, suggesting underlying operational strength.

Performance Amidst Repositioning

President and CEO Katie Lorenson highlighted the year's challenges and opportunities, noting the transformation of the commercial wealth bank, exceptional deposit growth, and quality loan growth. The balance sheet repositioning in December is set to bolster financial performance into 2024. Alerus's net interest margin saw an improvement, and fee income continued to be a strong contributor, accounting for 54% of total revenues. The company remains focused on returning to top-tier profitability levels and maintaining prudent credit quality management.

Financial Highlights and Asset Quality

Net interest income for Q4 2023 increased by 5.7% from the previous quarter, although it decreased by 20.1% from Q4 2022. The net interest margin also improved by 10 basis points quarter-over-quarter but declined year-over-year. Noninterest income took a significant hit due to the securities sale, while wealth management and retirement services showed revenue growth. Noninterest expense saw a slight increase due to inflationary pressures and higher professional fees.

On the balance sheet, total assets grew by 3.1% year-over-year to $3.9 billion. Loans increased notably by 12.8% to $2.8 billion, driven by growth in commercial and residential real estate loans. Deposits also grew by 6.2%, with a shift from noninterest-bearing to interest-bearing accounts. Nonperforming assets increased, primarily due to one loan, but the allowance for credit losses remained robust at 1.30% of total loans.

Capital and Shareholder Value

Stockholders' equity increased by $12.3 million from the previous year, with a notable decrease in accumulated other comprehensive loss. The company's tangible book value per share improved, reflecting a stronger capital position. Alerus also continued to deliver value to shareholders, repurchasing $2.1 million of its stock and maintaining a robust dividend payout.

The company's strategic decisions, including balance sheet repositioning and a focus on loan growth, are aimed at strengthening its financial foundation and positioning for future growth. While the fourth quarter presented challenges, Alerus Financial Corp (NASDAQ:ALRS) is poised to leverage its diversified business model to navigate the evolving financial landscape and create value for shareholders.

For a detailed discussion on Alerus Financial Corp's financial results, interested parties can join the conference call scheduled for January 25, 2024, or access the transcript and recording on the company's investor relations website post-call.

Explore the complete 8-K earnings release (here) from Alerus Financial Corp for further details.

This article first appeared on GuruFocus.