Alexander & Baldwin Inc (ALEX) Reports Mixed Results for Q4 and Full-Year 2023

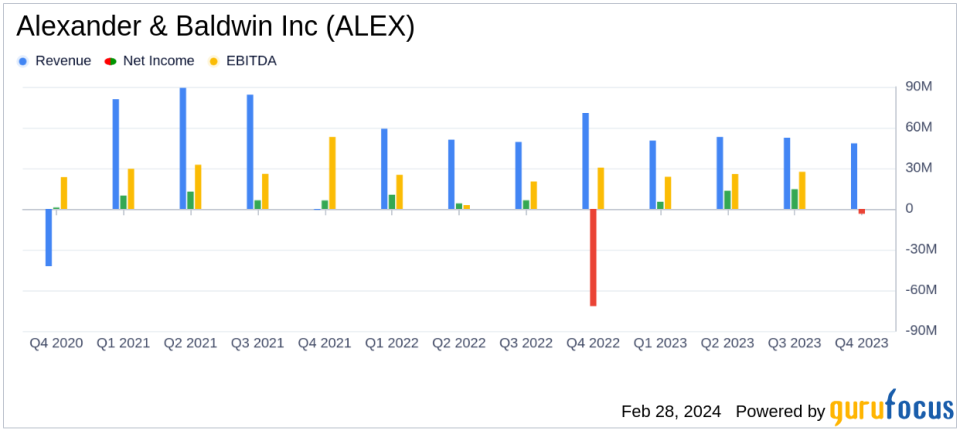

Net Loss in Q4: ALEX reported a net loss of $3.5 million, or $0.05 per diluted share, in Q4 2023.

Annual Net Income: For the full year, net income reached $29.7 million, or $0.41 per diluted share.

CRE Operating Profit: CRE segment reported operating profits of $17.0 million in Q4 and $81.2 million for the year.

FFO and Core FFO: Q4 FFO stood at $19.9 million, with Core FFO at $21.0 million. Annual FFO was $79.4 million, with Core FFO at $85.3 million.

Same-Store NOI Growth: CRE Same-Store NOI grew by 4.3% in Q4 and 4.3% for the full year.

Leasing Activity: Leased occupancy was 94.7% at year-end, with significant leasing activity reported.

Balance Sheet Strength: Equity market capitalization of $1.4 billion with total debt at $464.0 million as of December 31, 2023.

On February 28, 2024, Alexander & Baldwin Inc (NYSE:ALEX) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The company, a prominent player in the real estate sector, operates primarily through its Commercial Real Estate and Land Operations segments, with a significant presence in Hawaii.

Performance and Challenges

Despite a net loss in the fourth quarter, ALEX's full-year performance showcased resilience with a net income of $29.7 million. The Commercial Real Estate segment continued to be a strong contributor, with a 4.3% growth in Same-Store Net Operating Income (NOI) for both the quarter and the year. However, the net loss in Q4 indicates potential challenges ahead, particularly as the company navigates a complex real estate market.

Financial Achievements

The company's financial achievements, particularly in the Commercial Real Estate segment, underscore its strategic focus and operational efficiency. The growth in Same-Store NOI and the successful leasing activities reflect ALEX's ability to attract and retain tenants, which is crucial for stability and growth in the REIT industry.

Income Statement and Balance Sheet Highlights

Key financial metrics from the income statement include a flat CRE operating revenue for Q4 at $48.4 million, while the full-year saw an increase to $194.0 million. The balance sheet shows a robust equity market capitalization and a manageable debt level, with a debt-to-total market capitalization of 25.2%.

Management Commentary

"In the fourth quarter, our commercial real estate portfolio continued to perform well. CRE Same-Store NOI increased by 4.3%, and total leased occupancy ticked up from last quarter to 94.7%. Importantly, we continue to see leasing demand for our high-quality retail and industrial properties," said Lance Parker, president and chief executive officer.

Analysis of Company's Performance

The sale of Grace Pacific LLC marks a strategic shift for ALEX, allowing the company to focus more intently on its core commercial real estate operations in Hawaii. The company's ability to maintain a high occupancy rate and achieve positive leasing spreads indicates a strong market position and effective asset management. However, the net loss in the fourth quarter suggests that there are areas where the company must improve efficiency or address market challenges.

Looking ahead, ALEX has provided guidance for 2024, projecting CRE Same-Store NOI growth percentages and FFO per diluted share, indicating a cautious but optimistic outlook for the year ahead.

For more detailed information and to view the complete financial tables, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Alexander & Baldwin Inc for further details.

This article first appeared on GuruFocus.