Alibaba Gets Big Boost From China's Central Bank

Alibaba Group Holding Limited (NYSE:BABA) is a leading Chinese e-commerce company that also has significant operations in technology, retail and the internet. The stock price performance has not impressive with year-to-date gains of about 5% following years of underperformance. The company has faced regulatory issues that have been rehashed time and again in the news and have mostly been resolved now, but that still leaves the problem of weak sales growth. Fortunately for Alibaba, both macroeconomic and company-specific factors mean the stock could be set for a rebound in the second half of 2023 in my opinion.

Chinas central bank stimulus efforts are a key catalyst

Earlier this week, according to CNBC, The Peoples Bank of China lowered the rate on 237 billion Chinese yuan ($33 billion) of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points." This brings the rate from 2.75% to 2.65%.

This move represents a cut to a key policy rate for the first time in 10 months. This suggests that China's central bank is aiming to boost economic growth and support a sustainable post-Covid recovery. It could be the beginning of further interest rate cuts to support demand, consumption and higher retail sales, which would all likely lead to higher economic growth measured by gross domestic product. The cost of borrowing will be cheaper, which will help businesses and homebuyers spend more.

As they say, a rising tide lifts all boats, so this development should help Alibaba achieve higher revenue over the coming quarters.

Alibaba's growth strategy

Alibaba also has a strategic growth plan to expand internationally, especially in Europe. Alibaba has decided to make Europe a top priority for business growth and diversification, aiming to serve local brands and local customers in local markets starting with Spain first and then focusing on the remaining countries of Europe. This could be a game-changer as Europe is a very large economy with a variety of consumer trends to explore and benefit from adding incremental revenue.

Back in March 2023, Alibaba announced its decision to split into six separate business units, namely Cloud Intelligence, Taobao Tmall Commerce, Local Services, Cainiao Smart Logistics, Global Digital Commerce and lastly Digital Media and Entertainment.

The reasoning is that each business unit will have the dynamics to pursue an IPO and is a signal that Alibaba believes it could get a higher valuation for each business as a standalone. This should also help decrease regulatory pressures.

Weak sales growth

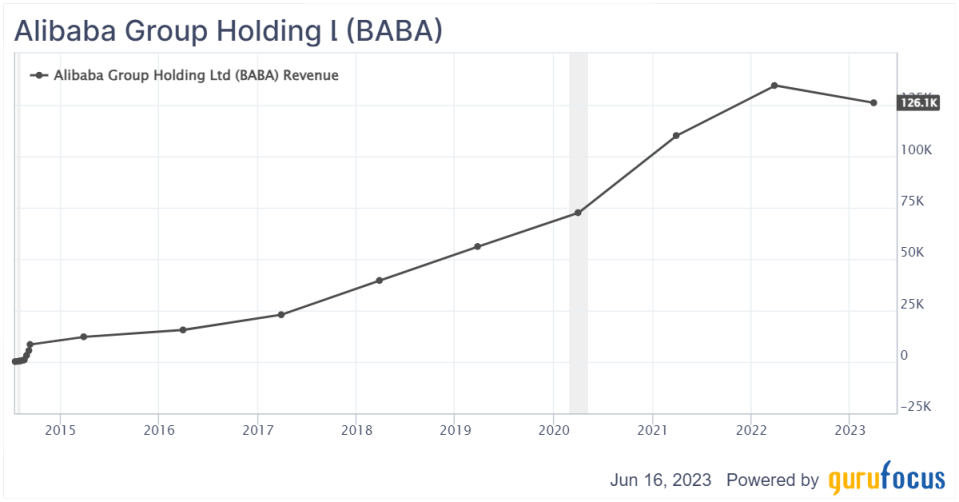

Alibaba has had weak sales growth in recent years, which it needs to turn around before investor enthusiasm can return.

BABA Data by GuruFocus

In the latest earnings report in May 2023, revenue of $29.59 billion missed analysts' expectations by $512.56 million. However, GAAP earnings per share of $1.28 beat estimates by $0.56.

Overall Alibaba has very positive key metrics, like high financial strength of 7 out of 10 with a debt-to-equity ratio of 0.16, a high profitability rank of 9 out 10 and growth in free cash flow. During the past three years, the average free cash flow per share growth rate was 15.00% per year.

Alibaba has several business model advantages

Alibaba is one of the world's largest e-commerce companies, so it has several advantages in its business model. To name a few, the company has a vast market reach, a dynamic ecosystem, diversified revenue streams and a strong brand reputation.

Alibaba operates in China, the world's most populous country, and has a strong presence in the international market as well. This gives the company access to a massive customer base, providing ample opportunities for growth and revenue generation.

Alibaba has invested heavily in developing its logistics network, known as Cainiao. It utilizes advanced technologies like big data analytics, artificial intelligence and robotics to streamline operations and provide efficient delivery services. This robust logistics infrastructure enables Alibaba to offer fast and reliable shipping options, enhancing the customer experience.

Alibaba leverages the vast amount of data generated through its platforms and services. By analyzing user behavior, preferences and trends, Alibaba can provide personalized recommendations and targeted advertising and improve its overall service offerings. This data-driven approach enables the company to stay ahead of the competition and adapt to evolving customer needs.

Alibaba generates revenue from various sources, including commissions on transactions, advertising, cloud computing services and financial services. This diversification reduces dependency on a single revenue stream and provides stability and resilience to the business.

Alibaba has a strong focus on innovation and invests heavily in research and development. The company pioneers new technologies and explores emerging trends like artificial intelligence, blockchain and the Internet of Things (IoT). This commitment to innovation helps Alibaba stay at the forefront of the industry and drive its future growth.

Valuation

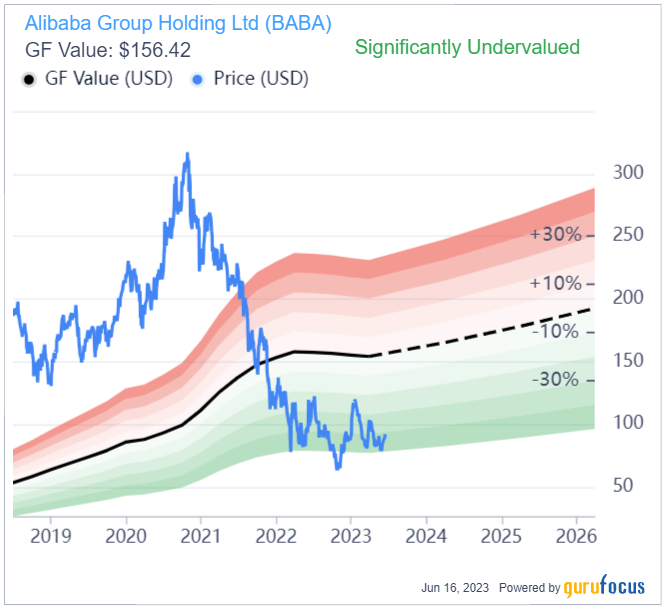

The stock seems to be significantly undervalued based on a GF Value of $156.42.

Thus, while the company has a problem with weak revenue over the past few years, the macroeconomic environment in China signals a major shift could be in store. Overall, I think the outlook is very positive for Alibaba.

This article first appeared on GuruFocus.