Alico Inc (ALCO) Reports Significant Net Income Growth in Q1 2024 Following Land Sale

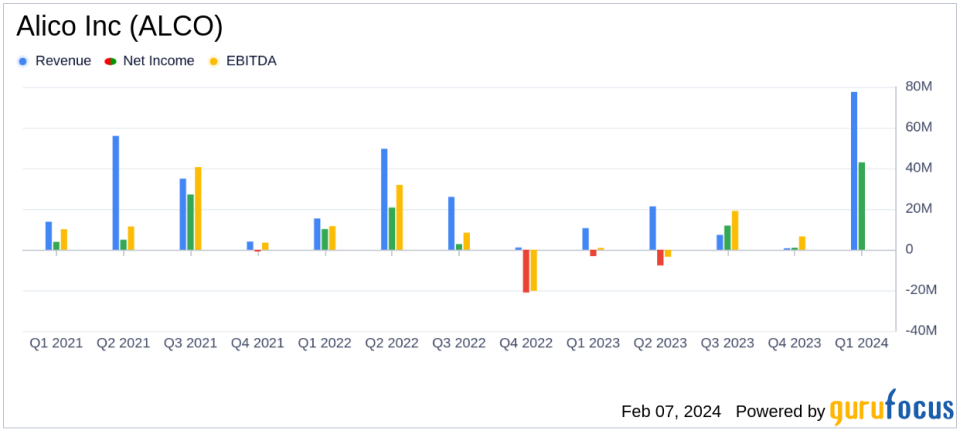

Net Income: Alico Inc (NASDAQ:ALCO) reports a net income of $42.9 million for Q1 2024, a substantial increase from a net loss of $3.2 million in Q1 2023.

EBITDA: EBITDA stands at $63.8 million, with Adjusted EBITDA at $(2.3) million after certain adjustments.

Debt Reduction: The company repaid all outstanding borrowings on its working capital line of credit and $19.1 million on its Met Life Variable-Rate Term loans.

Balance Sheet: Alico maintains a strong balance sheet with a working capital ratio of 2.52 to 1.00 and a debt ratio of 0.19 to 1.00.

Operational Challenges: Lower than anticipated box production for the Early and Mid-Season Harvest due to Hurricane Ian, resulting in a $10.8 million inventory write-down.

Dividend: A quarterly cash dividend of $0.05 per share was paid on January 12, 2024.

On February 7, 2024, Alico Inc (NASDAQ:ALCO) released its 8-K filing, announcing financial results for the first fiscal quarter ended December 31, 2023. Alico Inc, a leading agribusiness and land management company in Florida, primarily focuses on citrus production and grove conservation. The company operates through Alico Citrus and Land Management and Other Operations, with Alico Citrus being the primary revenue generator.

The company's financial performance in the first quarter was significantly influenced by the sale of 17,229 acres of the Alico Ranch to the State of Florida for $77.6 million in gross proceeds. This strategic move allowed Alico to repay high-interest debt and strengthen its balance sheet. Despite the challenges posed by Hurricane Ian, which led to lower box production and an inventory write-down, Alico's financial achievements, including a robust net income and EBITDA, are critical for the company's stability and future growth within the Consumer Packaged Goods industry.

Financial Highlights and Management Commentary

Alico's financial results reflect the seasonal nature of its business, with the majority of citrus crop harvests and related gross profit and cash flows occurring in the second and third fiscal quarters. The company reported earnings of $5.64 per diluted common share for Q1 2024, compared to a loss of $0.41 per diluted common share for the same period in the previous year. Total operating expenses increased to $28.2 million, up from $14.4 million in Q1 2023, primarily due to the inventory adjustment and increased harvest and haul costs.

President and CEO John Kiernan provided insights into the company's operations, expressing cautious optimism for the upcoming Valencia crop harvest. Kiernan also highlighted Alico's financial strength, noting the significant reduction in total and net debt following the land sale. The company's balance sheet shows a working capital of $43.3 million and a solid debt ratio improvement from 0.30 to 1.00 in Q1 2023 to 0.19 to 1.00 in Q1 2024.

"We believe that our balance sheet remains one of our greatest strengths as we continue to operate in a challenging citrus industry," said John Kiernan, President and CEO of Alico Inc.

General and administrative expenses for Q1 2024 were $3.3 million, an increase from $2.5 million in Q1 2023, primarily due to higher salaries, wages, and consulting fees. Other income, net, for Q1 2024 was $75.5 million, a significant increase from $2.0 million in Q1 2023, mainly due to the land sale.

Looking Ahead

While Alico Inc faces operational challenges due to weather impacts, its strategic decisions and strong balance sheet position the company for resilience and potential growth. The company's focus on sustainability and environmental stewardship, as outlined in its 2023 Annual Sustainability Report, further underscores its commitment to long-term value creation.

Investors and stakeholders can find more detailed financial information and the full earnings release on Alico Inc's website or through the SEC filing. Alico Inc remains focused on navigating the complexities of the citrus market and leveraging its financial strength to enhance shareholder value.

Explore the complete 8-K earnings release (here) from Alico Inc for further details.

This article first appeared on GuruFocus.