Align (ALGN) Gains From New Launches, Strategic Partnerships

Align Technology’s ALGN robust product line, balanced growth across all channels and consistent focus on international markets to drive growth bolster our confidence in the stock. The stock carries a Zacks Rank #2 (Buy).

Over the past couple of years, Align Technology has successfully launched its first subscription-based clear aligner program, Doctor Subscription Program (DSP), worldwide. The company introduced DSP in the United States and Canada in 2021 and expanded it to Spain and the Nordic countries in the second quarter of 2023. Further, Align Technology has plans to launch DSP in France and the United Kingdom in the second half of 2023.

Further, in the second quarter of 2023, the company successfully continued to roll out the Invisalign Comprehensive Three and Three product in APAC. It is now available in Hong Kong, Korea, Taiwan and India. It also has plans to launch Invisalign Three and Three product in China in the third quarter of 2023.

According to the company, Invisalign Comprehensive Three and Three product will allow Align Technology to recognize deferred revenues over a shorter period of time compared to the traditional Invisalign comprehensive product.

In 2022, in terms of new products, the company continued its launch of the Invis is Drama Free, targeted at teens, and Invis When Everything Clicks, targeted at adults.

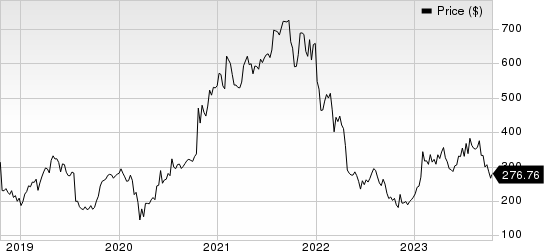

Align Technology, Inc. Price

Align Technology, Inc. price | Align Technology, Inc. Quote

The company also launched ClinCheck Live Update software, Invisalign Practice App, Invisalign Personal Plan, Invisalign Smile Architect, the Invisalign Outcome Simulator Pro with in-face visualization, Cone Beam Computed Tomography with ClinCheck software Invisalign, Virtual AI software and iTero-exocad Connector.

Align Technology's slew of strategic alliances looks impressive. The company has well-established relationships with many DSOs, especially in the United States, and is continuously exploring collaboration with others that drive the adoption of digital dentistry.

In 2023, in the Americas, Align Technology is focused on reaching young adults, teens, and their parents through influencer and creator-centric campaigns partnering with leading smile squad creators, including Marshall Martin, Rally Shaw and Jeremy Lin. Each of these creators shared their personal experiences with Invisalign treatment and why they chose to transform their smile with Invisalign aligners.

Align Technology’s iTero intraoral scanners, the preferred scanning technology for digital dental scans, and its exocad CAD/CAM software, the dental restorative solution of choice for dental labs, are successfully expanding its foothold in the niche market globally. According to the company, intraoral scanning is a rapidly evolving technology that substantially impacts dentistry. Beginning patient care with the early usage of the iTero intraoral scanners and combining the results with digital workflows help visualize and evaluate various treatment options with detailed imagery and CAD/CAM solutions.

Over the past year, shares of Align Technology have risen 35% compared with a 21.5% rise of the industry.

On the flip side, although Align Technology is gradually coming out of the impact of the two-and-a-half-year-long healthcare crisis, staffing shortages and supply chain-related hazards are denting growth. Deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor cost as well as freight charges, and rising interest rate have put the dental treatment space (which is highly-elective) in a tight spot.

Added to this, Align Technology is also concerned about the military conflict between Russia and Ukraine that is likely to continue.

Foreign exchange is a major headwind for Align Technology due to a considerable percentage of its revenues coming from outside the United States (in 2022, 44% of the company’s consolidated revenues came from international regions). Through the first half of 2023, the strengthening of the U.S. dollar against nearly every other major currency hampered Align Technology’s revenues in the international markets. This was mainly due to Fed’s 10 consecutive aggressive hikes in interest rates to tackle inflation since March 2022.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Cardinal Health CAH, Haemonetics HAE and DaVita Inc. DVA, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health stock has risen 31.1% in the past year. Earnings estimates for the company have increased from $6.65 to $6.66 in 2023 in the past 30 days and from $7.56 to $7.57 for 2024 in the past seven days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.03%. In the last reported quarter, it posted an earnings surprise of 4.73%.

Estimates for Haemonetics’ 2023 earnings per share have remained constant at $3.82 in the past 30 days. Shares of the company have increased 13.1% in the past year against the industry’s decline of 10.3%.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%.

DaVita has gained 25.5% against the industry’s 8.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report