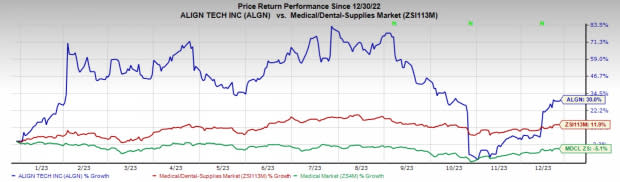

Align Technology (ALGN) Up 30% YTD: Will the Rally Continue?

Align Technology‘s ALGN shares have surged 30% year to date compared with the industry’s growth of 11.9%. The Medical sector has declined 5.1% in the said time frame. The company has a market capitalization of $21.00 billion.

This Zacks Rank #2 (Buy) stock is well-positioned to drive the digital revolution in the dental industry with Invisalign clear aligners, Itero Scanners and the Align digital platform. Its earnings are expected to rise 11.6% in next year.

Will the Upside Continue?

The consensus estimate for 2023 revenues is pegged at $3.86 billion, indicating a year-over-year improvement of 3.3%. ALGN’s ROE for the trailing 12 months was 12.7%, better than the industry average of 10.9%.

Align Technology is strategically capturing the growing malocclusion market, one of the most prevalent clinical dental conditions in the world. According to Align Technology’s May 2023 data, it is currently affecting 60-75% of the global population. Annually, only 21 million people globally elect treatment by orthodontists, suggesting that a large portion of the patient base is unattended.

The company also noticed that 90% of this patient base could be treated with Invisalign Clear Aligner. This represents a significant growth opportunity for Align Technology to increase its share of the existing global market of orthodontic case starts, especially among teens and expand the market for digital orthodontics, especially among adults.

Image Source: Zacks Investment Research

Align Technology is expanding its sales and marketing by reaching new countries and regions, including new areas within Africa and Latin America. By the end of 2022, the company made sales in more than 100 countries directly or through authorized distributors. With the opening of its third clear aligner fabrication facility in Wroclaw, Poland, the company has a manufacturing facility in each of its operating territories — Americas (Mexico), APAC (China) and EMEA (Poland).

The company also performs digital treatment planning and interpretation for restorative cases worldwide — in Costa Rica, China, Germany, Spain, Poland and Japan — among others. Align Technology continues to expand its business in 2023 through investments in resources, infrastructure and initiatives that help drive growth in Invisalign treatment, intraoral scanners and Exocad CAD/CAM software in existing and new international markets. By establishing and expanding its key operational activities in locations closer to customers, it can address local and regional needs in a better way.

Align Technology's slew of strategic alliances looks impressive. The company has well-established relationships with many DSOs, especially in the United States. It is continuously exploring collaboration with others that drive the adoption of digital dentistry.

In 2023, in the Americas, Align Technology is focused on reaching young adults as well as teens and their parents through influencer and creator-centric campaigns partnering with leading smile squad creators, including Marshall Martin, Rally Shaw, and Jeremy Lin. Each of these creators shared their personal experiences with Invisalign treatment and why they chose to transform their smile with Invisalign aligners.

Further, in the United States, the company is working closely with Athletes Over Time, a high school sports social media platform that showcases the benefits of Invisalign treatment. In the EMEA region, the company partnered with new influencers to reach consumers across social media platforms, including TikTok and Meta.

Lately, Align Technology’s Invisalign Palatal Expander System has FDA’s 510(K) clearance for commercial availability in the United States. This development is likely to bolster the company’s performance in the coming months.

Estimate Trends

The Zacks Consensus Estimate for ALGN’s 2023 earnings per share has moved up from $8.41 to $8.42 in the past 60 days, reflecting analysts’ optimism.

Key Picks

Some other top-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2, Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ shares have increased 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report