Align Technology (ALGN) Gains From Innovation, Macro Issues Ail

Align Technology’s ALGN robust product line, balanced growth across all channels and consistent focus on international markets to drive growth to bolster our confidence in the stock. Yet, we are concerned about the current economic uncertainty that continues to cast a negative impact on Align Technology’s dental procedures. The stock carries a Zacks Rank #3 (Hold).

Align Technology is strategically capturing the growing malocclusion market, one of the most prevalent clinical dental conditions in the world. According to Align Technology’s May 2023 data, it is currently affecting approximately 60% to 75% of the global population. The company estimates that there are approximately 500 million people globally with malocclusion.

This represents a significant growth opportunity for Align Technology to increase its share of the existing global market of orthodontic case starts, especially among teens, and expand the market for digital orthodontics, especially among adults. Till the end of 2023, the company achieved several major milestones, including 17 million Invisalign patients treated with 4.7 million teens. Total Invisalign Clear Aligner shipments for teens and younger patients reached a total of 809,000 cases, up 8% compared to 2022 and made up 34% of total Clear Aligner shipments.

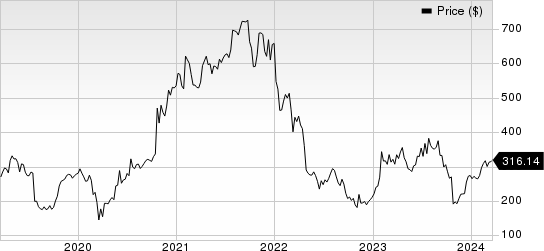

Align Technology, Inc. Price

Align Technology, Inc. price | Align Technology, Inc. Quote

In terms of innovation, over the past couple of years, Align Technology has successfully launched its first subscription-based clear aligner program, the Doctor Subscription Program (DSP), worldwide. The company introduced DSP in the United States and Canada in 2021. DSP currently continues to be well received by its customers and is currently available in the Iberia and Nordics and most recently, the U.K.

Meanwhile, in the fourth quarter of 2023, Align Technology got FDA clearance for its Invisalign Palatal Expander System (IPE). The FDA 510(k)clearance is for broad patient applicability, including growing children, teens and adults. IPE is currently available on a limited basis in Canada and the United States, and the company recently received regulatory clearance in Australia and New Zealand, where commercialization is expected in the second quarter of 2024.

The company is also in the process of launching the ClinCheck smile video, the next generation of In-Face digitalization with AI-assisted video that is expected to be available to all doctors who use the Invisalign Practice App and ClinCheck treatment planning software. Align Technology currently expects the roll out the ClinCheck smile video in the first quarter of 2024 in North America and EMEA, followed by APAC later in the year.

On the flip side, although Align Technology is gradually coming out of the impact of the two-and-a-half-year-long healthcare crisis, the ongoing industry-wide trend of staffing shortages and supply chain-related hazards is denting growth. Deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, all have put the dental treatment space (which is highly elective) in a tight spot.

Added to this, Align Technology is also concerned about the military conflict between Russia and Ukraine that is likely to continue in the upcoming period as well. The company noted earlier that while it continues to employ research and development personnel in Russia as well as limited post-sales support and administrative personnel, its total number of employees in Russia was materially reduced in 2022. Align Technology anticipates increasing headwinds from macroeconomic uncertainty and potential supply issues related to the war in the Middle East in the upcoming period.

Further, foreign exchange is a major headwind for Align Technology due to a considerable percentage of its revenues coming from outside the United States (in 2023, 44% of the company’s consolidated revenues came from international regions). In 2023, the strengthening of the U.S. dollar against nearly every other major currency hampered Align Technology’s revenues in the international markets. This was mainly due to the Fed’s 10 consecutive aggressive hikes in interest rates to tackle inflation since March 2022.

During the fourth quarter, the unfavorable effect of foreign exchange reduced revenues and margins significantly for Align Technology. In the fourth quarter, clear aligner revenues witnessed an unfavorable foreign exchange impact of approximately $12.8 million, or approximately 1.3% sequentially. Systems and services revenues were unfavorably impacted by approximately $2.1 million, or approximately 1.2% sequentially.

Key Picks

Some better-ranked stocks from the broader medical space are Stryker Corporation SYK, Cencora, Inc. COR and Cardinal Health CAH. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker, carrying a Zacks Rank #2, reported a fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported a first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Cardinal Health, carrying a Zacks Rank #2, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report