Align Technology (ALGN): A Hidden Gem in the Market? A Comprehensive Analysis of Its Valuation

Align Technology Inc (NASDAQ:ALGN) experienced a slight daily gain of 0.05%, but over the past three months, the stock has seen a loss of -9.94%. Despite this, the company's Earnings Per Share (EPS) stands at 4.07. This analysis will explore whether the stock is significantly undervalued and provide a comprehensive valuation analysis.

Company Introduction

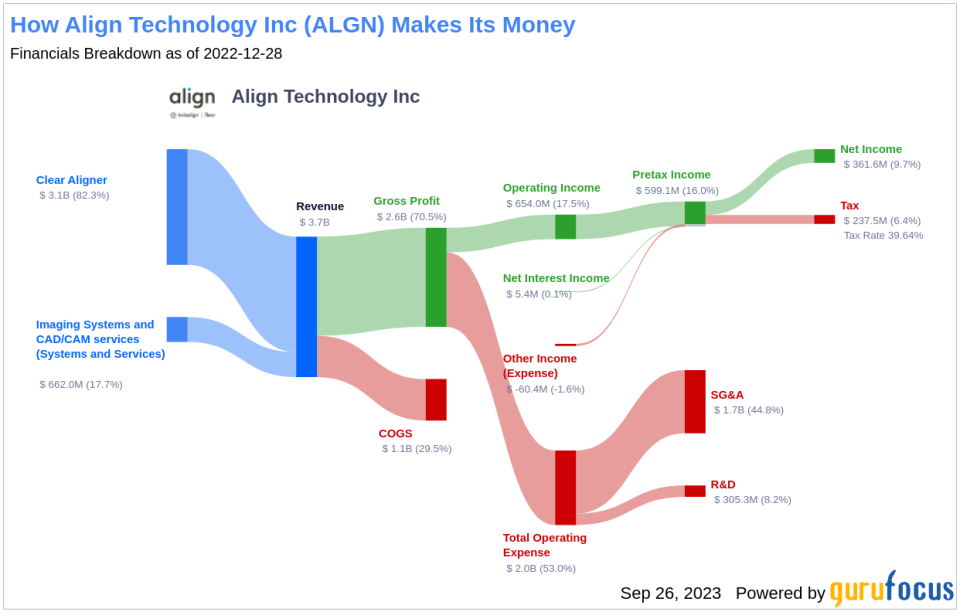

Align Technology is the leading manufacturer of clear aligners, controlling over 90% of the market with its main product, Invisalign. Approved by the FDA in 1998, Invisalign can treat roughly 90% of all malocclusion cases (misaligned teeth). The company has over 230,000 Invisalign-trained dentists and orthodontists. In 2022, Invisalign treated over 2 million cases, which is roughly 10% of all orthodontic cases for the year. Since its launch, it has treated over 14 million patients. Align also sells intraoral scanners under the brand iTero, which captures digital impressions of patients' teeth and illustrates treatment plans.

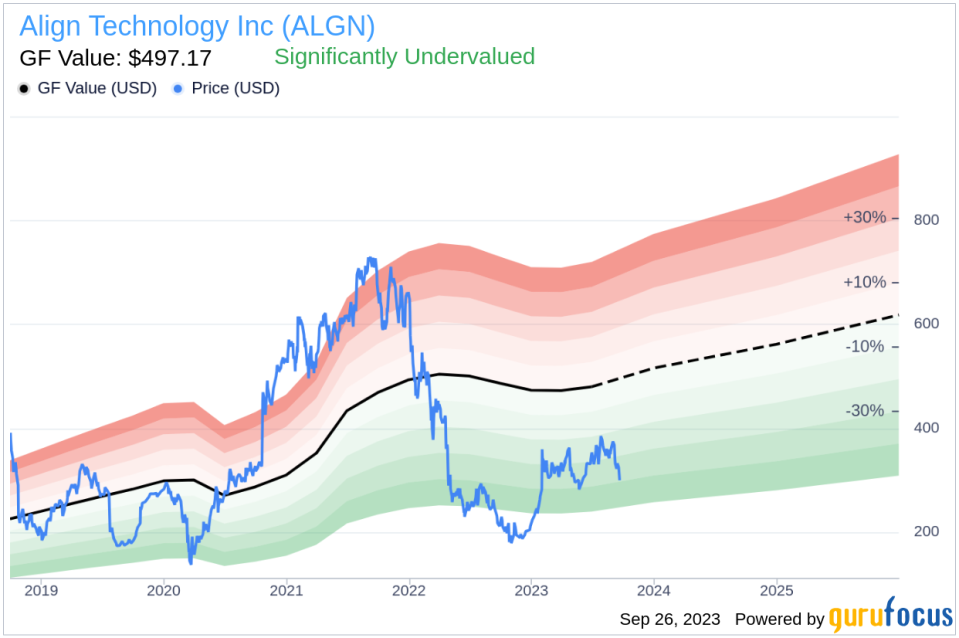

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value. It is derived from historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should be traded.

Align Technology (NASDAQ:ALGN) appears to be significantly undervalued based on the GF Value. The current share price of $298.17 is significantly below the GF Value Line, indicating that the stock may be undervalued and have higher future returns. As a result, the long-term return of Align Technology's stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

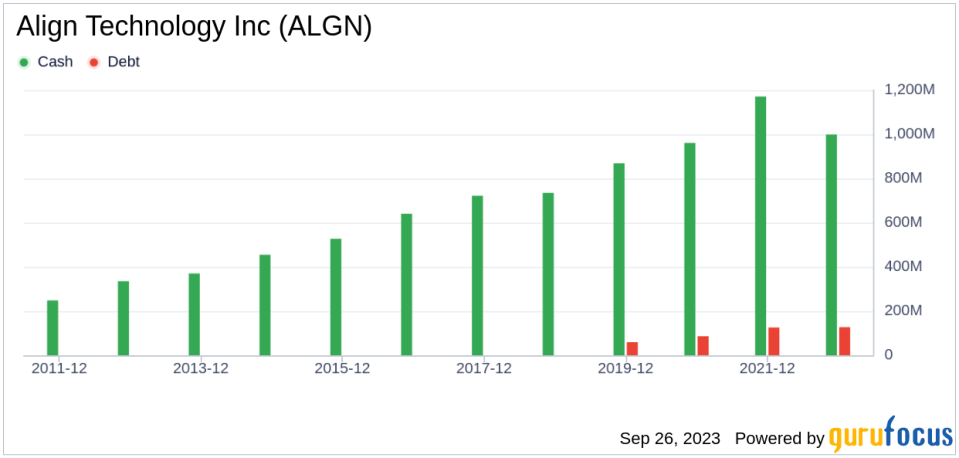

Financial Strength

Companies with poor financial strength offer investors a high risk of permanent capital loss. To avoid this, it's important to review a company's financial strength before deciding to purchase shares. A good way to understand its financial strength is by looking at its cash-to-debt ratio and interest coverage. Align Technology has a cash-to-debt ratio of 7.55, ranking better than 66.23% of 841 companies in the Medical Devices & Instruments industry. Overall, Align Technology's financial strength is strong, with a rating of 8 out of 10.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. Align Technology has been profitable 10 years over the past 10 years. Over the past twelve months, the company had a revenue of $3.70 billion and Earnings Per Share (EPS) of $4.07. Its operating margin is 15.34%, which ranks better than 75.96% of 836 companies in the Medical Devices & Instruments industry. Overall, Align Technology's profitability is strong, with a rating of 10 out of 10.

Growth is a crucial factor in a company's valuation. Align Technology's 3-year average annual revenue growth is 16.6%, ranking better than 70.86% of 731 companies in the Medical Devices & Instruments industry. The 3-year average EBITDA growth rate is 10.3%, which ranks better than 53.52% of 738 companies in the same industry.

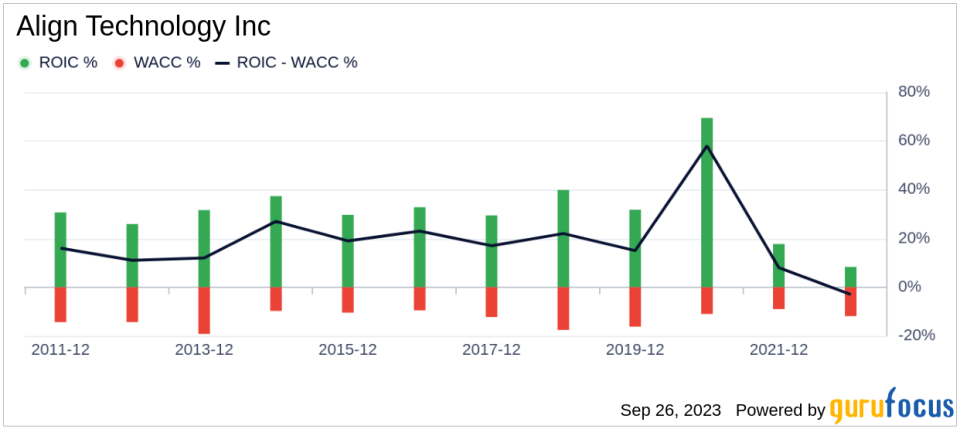

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) with its weighted average cost of capital (WACC). For the past 12 months, Align Technology's ROIC is 6.78, and its cost of capital is 12.55.

Conclusion

In conclusion, Align Technology (NASDAQ:ALGN) stock appears to be significantly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 53.52% of 738 companies in the Medical Devices & Instruments industry. To learn more about Align Technology stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.