Align Technology (ALGN): A Significantly Undervalued Gem in the Market?

Align Technology Inc (NASDAQ:ALGN) has experienced a daily loss of 6.98% and a 3-month gain of 13.19%. With an Earnings Per Share (EPS) (EPS) of 4.07, the question arises - is the stock significantly undervalued? This article seeks to answer this question through a comprehensive valuation analysis. Read on for a deep dive into the financials of Align Technology (NASDAQ:ALGN).

Company Introduction

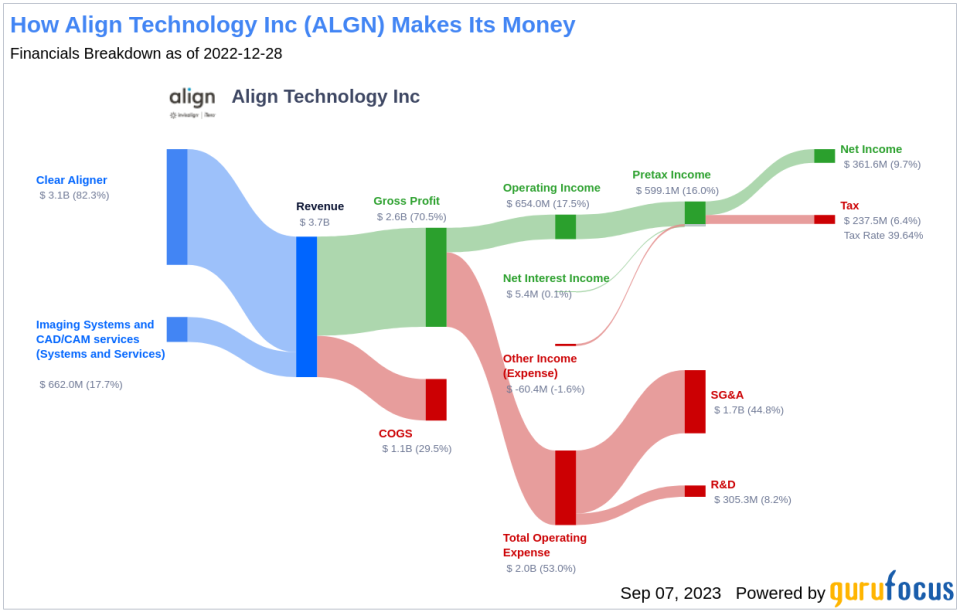

Align Technology is the industry leader in manufacturing clear aligners. Its primary product, Invisalign, has been dominating the market since its FDA approval in 1998. With over 230,000 Invisalign-trained dentists and orthodontists, the company has treated over 14 million patients and continues to grow. The company also sells intraoral scanners under the brand iTero, further enhancing its market presence.

Align Technology's current stock price is $343.89, and with a market cap of $26.30 billion, it appears significantly undervalued when compared to its GF Value of $493.48. The following analysis will delve deeper into the company's value, integrating financial assessment with essential company details.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock. It considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value that the stock should ideally be traded at.

Align Technology (NASDAQ:ALGN) stock appears to be significantly undervalued based on the GF Value calculation. If the price of a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher. Considering Align Technology's current price, the stock seems to be significantly undervalued.

As Align Technology is significantly undervalued, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

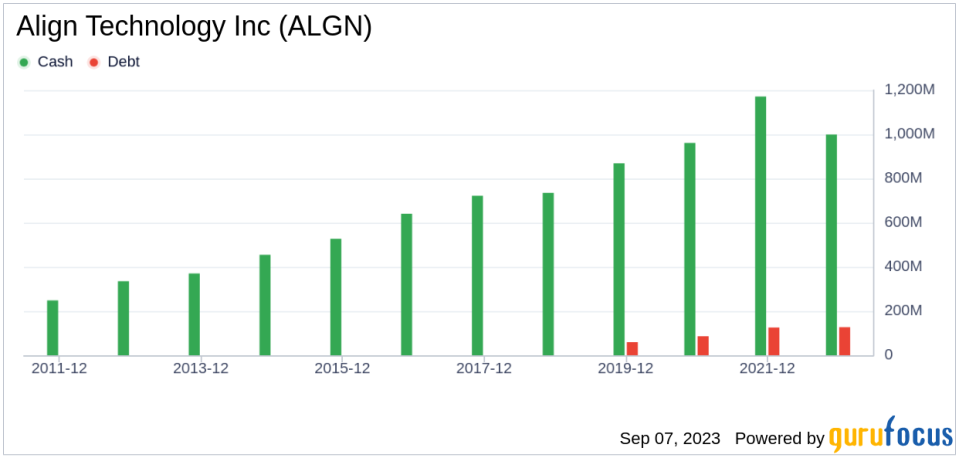

Investing in companies with poor financial strength poses a higher risk of permanent capital loss. Thus, reviewing the financial strength of a company is crucial before deciding to buy its stock. Align Technology's cash-to-debt ratio of 7.55 is better than 65.99% of the companies in the Medical Devices & Instruments industry. This indicates that the financial strength of Align Technology is robust.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Align Technology has been profitable 10 times over the past 10 years. With an operating margin of 15.34%, it ranks better than 75.91% of the companies in the Medical Devices & Instruments industry. This indicates strong profitability.

Growth is a critical factor in the valuation of a company. The 3-year average annual revenue growth of Align Technology is 16.6%, which ranks better than 70.86% of the companies in the Medical Devices & Instruments industry. This suggests strong growth.

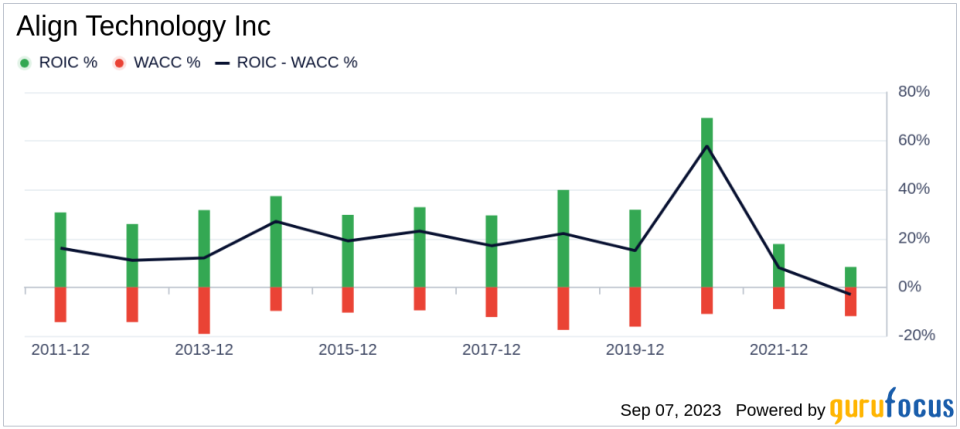

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. During the past 12 months, Align Technology's ROIC was 6.78 while its WACC was 12.34.

Conclusion

In summary, the stock of Align Technology (NASDAQ:ALGN) is believed to be significantly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 53.22% of the companies in the Medical Devices & Instruments industry. To learn more about Align Technology stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.