Align Technology Inc (ALGN) Posts Mixed Q4 and Full-Year 2023 Financial Results

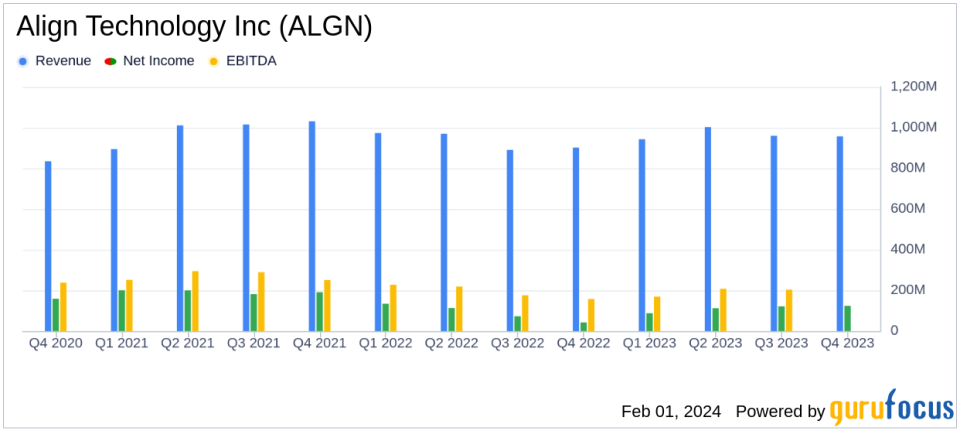

Q4 Revenue: $956.7 million, a 0.4% decrease sequentially but a 6.1% increase year-over-year.

Full-Year Revenue: $3.9 billion, up 3.4% from the previous year.

Net Income: Q4 net income of $124.0 million, with full-year net income rising 23.1% to $445.1 million.

Earnings Per Share (EPS): Q4 EPS at $1.64, with non-GAAP EPS at $2.42; full-year EPS at $5.81, with non-GAAP EPS at $8.61.

Clear Aligner Shipments: Slight increase of 0.4% year-over-year, totaling 2,408,520 shipments.

Stock Repurchases: $600 million of common stock repurchased in 2023.

Foreign Exchange Impact: Negative impact on 2023 revenues by approximately $36.3 million compared to 2022.

On January 31, 2024, Align Technology Inc (NASDAQ:ALGN) released its 8-K filing, announcing financial results for the fourth quarter and full fiscal year of 2023. Align Technology, the leading manufacturer of clear aligners, reported a slight sequential dip in Q4 revenue but saw an overall increase for the year. The company, known for its Invisalign product, continues to dominate the clear aligner market, with over 17 million patients treated to date.

Financial Performance and Challenges

Align Technology's Q4 revenue was marginally lower than the previous quarter, mainly due to foreign exchange headwinds. However, the year-over-year increase in Q4 and full-year revenues highlights the company's resilience in a challenging economic environment. The company's operating margin for 2023 stood at 16.7%, with a non-GAAP operating margin of 21.4%. Despite the unfavorable impact of foreign exchange rates, Align Technology managed to post a significant increase in net income, demonstrating its ability to maintain profitability.

Strategic Achievements and Innovations

Align Technology's financial achievements are crucial for sustaining its leadership in the Medical Devices & Instruments industry. The company's continued investment in innovation is exemplified by the unveiling of the next-generation iTero Lumina Intraoral Scanner, which promises to enhance practice efficiency with faster scanning and higher accuracy. This innovation is expected to solidify Align's competitive edge and drive future growth.

Income Statement and Balance Sheet Highlights

For the fiscal year 2023, Align Technology reported total revenues of $3.9 billion, with clear aligner revenues accounting for $3.2 billion. The company's balance sheet remains strong, with $937.4 million in cash and cash equivalents as of December 31, 2023. The total assets were reported at $6.08 billion, with total liabilities at $2.45 billion, resulting in a solid equity position.

"I am pleased to report fourth quarter results with better-than-expected revenues and earnings," said Align Technology President and CEO Joe Hogan. "Our continued focus on innovation and execution has driven growth across our key markets and product lines."

Analysis of Company's Performance

Align Technology's performance in 2023 reflects its ability to navigate economic headwinds and maintain growth through strategic initiatives and product innovation. The company's repurchase of $600 million in common stock underscores its commitment to delivering shareholder value. Looking ahead, Align Technology's focus on expanding its product offerings and capitalizing on the untapped orthodontic market presents a promising growth trajectory.

For more detailed information on Align Technology Inc (NASDAQ:ALGN)'s financial results, including the full income statement, balance sheet, and cash flow statement, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Align Technology Inc for further details.

This article first appeared on GuruFocus.