Alignment Healthcare (NASDAQ:ALHC investor one-year losses grow to 12% as the stock sheds US$122m this past week

It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. Over the year the Alignment Healthcare, Inc. (NASDAQ:ALHC) share price fell 12%. However, that's better than the market's overall decline of 21%. We wouldn't rush to judgement on Alignment Healthcare because we don't have a long term history to look at.

After losing 5.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Alignment Healthcare

Given that Alignment Healthcare didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Alignment Healthcare increased its revenue by 23%. We think that is pretty nice growth. While the share price drop of 12% over twelve months certainly won't delight holders, it's not bad in a weak market. It's likely that the revenue growth encouraged some shareholders to hold firm. So growth investors might like to put this one on the watchlist to see if revenue keeps trending in the right direction.

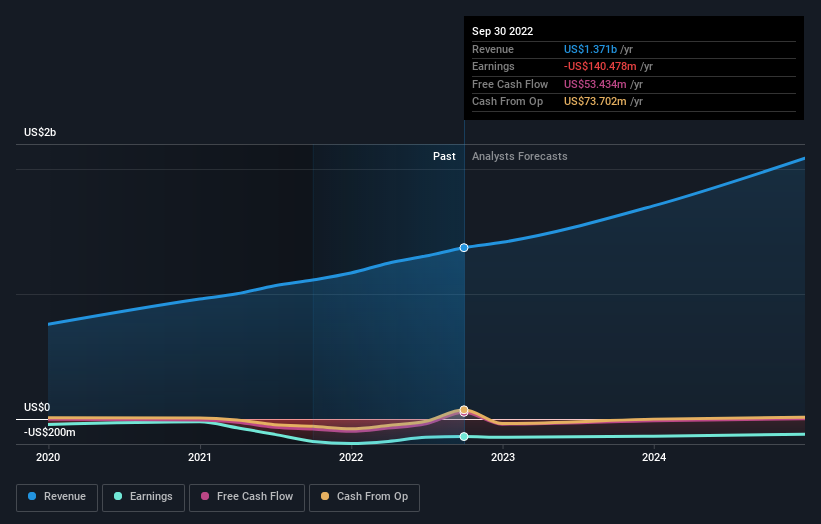

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Alignment Healthcare's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the broader market dropped 21% over the year, the fact that Alignment Healthcare shareholders were down 12% isn't so bad. Unfortunately for shareholders, the share price momentum hasn't improved much with the stock down 7.8% in around 90 days. This doesn't look great to us, but it is possible that the market is over-reacting to prior disappointment. It's always interesting to track share price performance over the longer term. But to understand Alignment Healthcare better, we need to consider many other factors. Take risks, for example - Alignment Healthcare has 1 warning sign we think you should be aware of.

We will like Alignment Healthcare better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here