Aligos Therapeutics, Inc.'s (NASDAQ:ALGS) 30% Dip In Price Shows Sentiment Is Matching Revenues

To the annoyance of some shareholders, Aligos Therapeutics, Inc. (NASDAQ:ALGS) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

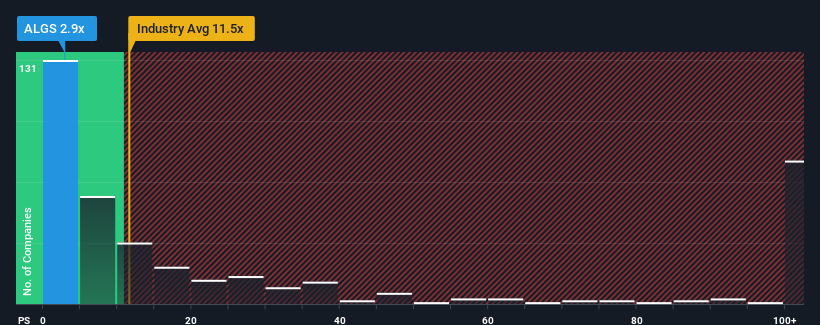

After such a large drop in price, Aligos Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.9x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.5x and even P/S higher than 50x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Aligos Therapeutics

What Does Aligos Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Aligos Therapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Aligos Therapeutics will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Aligos Therapeutics would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 219% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 100% per annum during the coming three years according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 92% per year.

With this information, we are not surprised that Aligos Therapeutics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Aligos Therapeutics' P/S

Aligos Therapeutics' P/S looks about as weak as its stock price lately. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Aligos Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Aligos Therapeutics.

If you're unsure about the strength of Aligos Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here